How to Read a Business Credit Report: 5 Key Tips for Success

Short Answer: Understanding how to read a business credit report is crucial for managing your company’s finances. By knowing the key components of your report, you can improve your credit score, secure financing, and make informed decisions for your business’s future.

Running or starting a business like a credit repair business requires you to have a deep understanding of your finances, and one of the most important documents you’ll need to assess regularly is your business credit report.

For business owners, reading a business credit report is a vital skill. Whether you’re applying for a loan, seeking investment, or simply reviewing your financial health, your credit report plays a central role in every decision. Understanding what’s inside can help you spot areas for improvement, prevent financial setbacks, and ultimately boost your business’s credibility.

But if you’re new to reading business credit reports, it can feel overwhelming. In this post, we will break down everything you need to know about how to read a business credit report in the USA and what the key components mean for your business success.

What is a Business Credit Report?

A business credit report is a detailed overview of your company’s financial health. Similar to a personal credit report, a business credit report provides valuable insight into how your company manages debt, pays its bills, and handles financial obligations. This report is essential for lenders, suppliers, and other business partners to assess the risks associated with doing business with you.

Unlike a personal default credit score, which is based on an individual’s financial history, a business credit score reflects the financial status of the company as a whole. This score is critical for securing financing, negotiating better terms, and building long-lasting relationships with vendors and partners. In fact, a good business credit report can be the difference between getting approved for a loan with favorable terms or being turned down.

Why Is It Important to Read a Business Credit Report?

Understanding your business credit report isn’t just about keeping track of your financial health; it’s about strategically managing your business’s growth. Reading and monitoring your business credit report helps you:

- Secure funding: Lenders use it to determine whether you’re a low-risk borrower, which affects your chances of approval and interest rates.

- Negotiate better terms: A solid credit report can help you secure favorable terms from suppliers, such as lower payment requirements and extended payment periods.

- Protect your reputation: Monitoring your report helps identify any discrepancies or fraudulent activity, allowing you to act quickly and protect your company’s reputation.

By learning how to read and interpret your business credit report, you are empowering yourself with valuable insights that can directly impact your business’s financial success.

How to Read Your Business Credit Report: Key Components to Look For

A business credit report typically includes several key components that lenders and suppliers evaluate before extending credit or forming partnerships. Here are the 5 most important elements you’ll find in a business credit report:

1. Business Credit Score

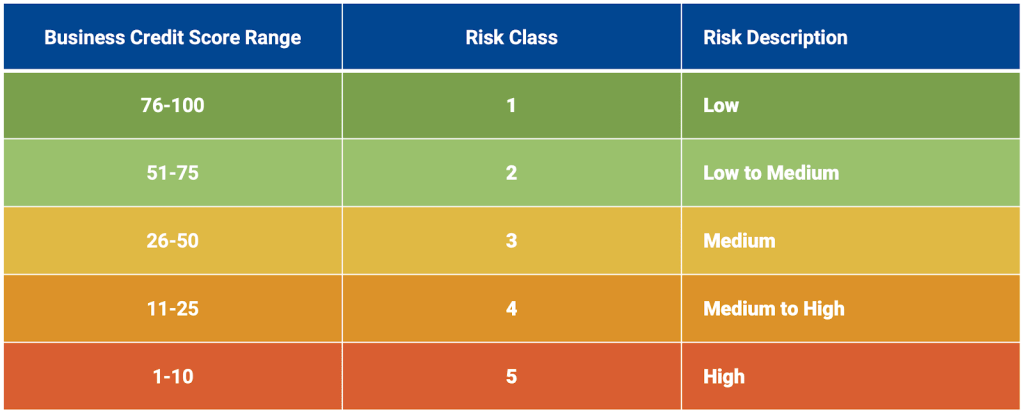

This is the numeric score that reflects your business’s creditworthiness. It’s based on factors like payment history, credit utilization, and outstanding debt. A higher score signals lower risk to lenders and partners.

Your business credit score ranges from 0 to 100 and reflects your company’s creditworthiness. The higher the score, the more trustworthy your business is perceived to be by lenders and suppliers.

- Good score (80+): This indicates that your business is reliable, and lenders will consider you low-risk, granting you access to better rates.

- Fair score (50–79): You’re in an average range but may need to work on improving your score for better terms.

- Poor score (below 50): This score signals high risk for lenders and could result in higher interest rates, stricter terms, or denial of financing altogether.

2. Payment History

This section shows how consistently your business has paid its bills and debts. It shows if payments to creditors, suppliers, and other parties are made on time, which can directly impact your ability to secure future financing.

Lenders and suppliers will use this information to assess your reliability. A solid history of on-time payments will boost your credit score, while missed or late payments can severely damage it.

3. Credit Utilization

Credit utilization refers to how much of your available credit you’re using at any given time, being used compared to the total amount available. If you’re using a large portion of your credit, it may indicate financial instability, potentially lowering your score.

For example, a credit utilization ratio of 30% or less is considered healthy, while higher utilization could raise red flags for lenders.

4. Public Records

This section includes any legal actions against your business, such as bankruptcies, tax liens, or judgments. These can significantly impact your creditworthiness and should be monitored closely. It’s important to address any public records issues promptly.

These records are a red flag to lenders and suppliers and can significantly hurt your business credit score.

5. Credit Inquiries

Every time you or a third party checks your credit report, it generates an inquiry. There are two types of inquiries:

- Hard inquiries: These occur when you apply for a loan or credit. Multiple hard inquiries in a short period can negatively affect your score.

- Soft inquiries: These occur when you check your own credit or when a supplier checks your credit for a background check. These don’t affect your score.

Understanding these components will help you interpret your business credit report and take the necessary steps to improve your financial standing, allowing you to qualify for better loans, lower interest rates, and more favorable business relationships.

How to Improve Your Business Credit Report

Now that you understand the key components of your business credit report, here are some steps you can take to improve it:

- Pay Your Bills on Time: Timely payments are the foundation of a good business credit report. Set up reminders or automatic payments to ensure that you never miss a due date.

- Reduce Credit Utilization: Aim to use no more than 30% of your available credit limit. Pay down existing debts and avoid accumulating new ones.

- Monitor Your Credit Report: Regularly review your report to ensure that all information is accurate. If you spot any discrepancies or errors, dispute them with the credit bureaus immediately or allow AI powered softwares like Credit Veto to help you do the instant monitoring.

- Establish Strong Business Relationships: Build positive relationships with vendors and suppliers by paying on time and keeping lines of communication open. A positive relationship can lead to better credit terms.

- Avoid Unnecessary Inquiries: Every inquiry affects your credit score. Be strategic about applying for credit and avoid unnecessary checks.

Conclusion: Taking Control of Your Business Credit

Your business credit report is one of the most important tools for managing your financial future. By regularly monitoring and understanding it, you can take proactive steps to improve your score and increase your chances of securing favorable financing. Whether you’re looking to expand, secure loans, or simply build stronger relationships with vendors, understanding your business credit report is crucial.

If you’re looking to improve your credit report and take your business to the next level, Credit Veto can help you streamline the process; monitor your credit, dispute any inaccuracies, and improve your score with the right tools and guidance.

Our platform offers the tools you need to monitor your credit, dispute errors, and take charge of your business’s financial health.

Ready to take control of your personal and business’s credit? Sign up today and let your financial future thank you.

Frequently Asked Questions (FAQs)

1. What is a business credit score?

A business credit score reflects your company’s ability to repay debts. The higher the score, the more trustworthy your business is in the eyes of lenders and suppliers.

2. How often should I check my business credit report?

It’s a good idea to check your business credit report at least once a year. If you’re preparing for financing or expecting changes in your business, check it more frequently.

3. Can I improve my business credit report?

Yes! By paying bills on time, reducing your credit utilization, and maintaining a positive payment history, and using advanced credit repair and monitoring platforms like Credit Veto, you can steadily improve your business credit score over time.

How to Read a TransUnion Credit Report (Your Complete Guide)

How to Read a TransUnion Credit Report (Your Complete Guide)  Does a DUI Affect Your Credit Score? 5 Ways to Protect It

Does a DUI Affect Your Credit Score? 5 Ways to Protect It  How to Remove a Closed Account from Your Credit Report: 3 Best Steps

How to Remove a Closed Account from Your Credit Report: 3 Best Steps  How Midland Credit Management Can Affect Your Credit Score

How Midland Credit Management Can Affect Your Credit Score  Can I Lease a Car with a 500 Credit Score? What to Expect

Can I Lease a Car with a 500 Credit Score? What to Expect  Minimum Credit Score for a USDA Home Loan: Don’t Miss These Requirements!

Minimum Credit Score for a USDA Home Loan: Don’t Miss These Requirements!  How to Read a Business Credit Report: 5 Key Tips for Success

How to Read a Business Credit Report: 5 Key Tips for Success  What Credit Score Is Needed to Buy a UTV? (Real Limits)

What Credit Score Is Needed to Buy a UTV? (Real Limits)