5 Dangerous Myths About Starting a Credit Repair Business

If you’ve ever thought about starting a credit repair business, you’ve probably been haunted by doubts and misinformation. From legal fears to impostor syndrome, these myths don’t just delay your dreams; they rob communities of the solutions they desperately need.

In this blog, we’re going to bust five of the most dangerous myths about the credit repair industry. If you’re wondering how to start a credit repair business, whether you’re qualified, or if this is a real credit repair business opportunity, you’re in the right place.

By the end of this post, you’ll know the truth, feel empowered, and see exactly how Credit Veto is equipping everyday people to launch powerful credit repair businesses, without legal fears, confusion, or tech overwhelm.

Starting a credit repair business might seem like a leap into the unknown, but often, the real barriers are internal, not external. Fear of failure, lack of confidence, and misinformation are some of the biggest obstacles stopping people from taking that first step.

You might be asking yourself: What if I’m not qualified? Or can I compete with the big players? But here’s the truth: most successful credit repair entrepreneurs started with zero experience.

They simply chose to learn, take action, and stay consistent. You don’t need a finance degree to change lives. You need the willingness to serve and the right tools to support your clients.

Another common fear is legal risk. Yes, compliance matters. But when you get proper credit repair business training and use reliable credit repair business software, you operate ethically and within the law. You’re not running a scam, you’re providing a real, valuable service to people in need.

If you’re still unsure, ask yourself this: Will staying stuck serve you or the people you’re meant to help? Because someone out there is waiting for your solution, and your startup credit repair business might just be the opportunity that transforms their financial future and yours.

Read Also: How to Start a Credit Repair Business That Transforms Lives in Just 6 Weeks

The 5 Dangerous Myths You Should Avoid

Let’s clear the air. A lot of what you’ve heard about starting a credit repair business is based on fear, misinformation, or outdated

1. Credit Repair Is Illegal or Shady

This is one of the biggest fears people have when thinking about starting a credit repair business. Thanks to years of scammy players and horror stories, the phrase “credit repair” can sound like a legal trap. But here’s the truth: credit repair is legal when done ethically and in compliance with federal and state laws.

In fact, the Credit Repair Organizations Act(CROA) was created to protect consumers and guide business owners. The key is transparency, using proper documentation, and avoiding false promises. A legitimate credit repair business software helps you stay compliant and organized.

Credit Veto provides legally compliant templates, training, and tools that ensure you’re running a real, honest, and impactful business, so you can sleep at night and grow with confidence.

2. You’ll Get Sued if You Make a Mistake

Let’s be honest. The fear of lawsuits is a strong reason many never pursue their dreams. However, lawsuits in the credit repair industry typically occur when someone promises what they can’t deliver, ignores regulations, or fails to document their actions.

When you use the right credit repair business training, follow CROA guidelines, and treat clients with respect, you’re unlikely to face legal trouble. Even better? Tools like credit repair software for business help keep records and automate tasks to avoid errors.

With Credit Veto, you don’t walk alone. We give you the legal templates, support, and dispute automation features so your credit repair business runs on structure, not guesswork.

3: You’re Not Qualified to Help People with Credit

You might be thinking, “I don’t have a finance degree,” or “I’ve made money mistakes; who am I to help others?”

But here’s the secret: real experience matters more than formal credentials. Many of the most successful credit repair business owners started by fixing their credit or helping family members.

What you need is training, support, and the willingness to serve. That’s it.

How do I start a credit repair business without experience? You learn, you use the right tools, and you grow.

Credit Veto gives you step-by-step training modules in our comprehensive done-for-you Certified Credit and Funding Consultant (CCFC) course that make it easy to get started in a standard way, even if you’re a complete beginner. Our platform was designed for people just like you who want to make a difference and earn income from it.

4: You Can’t Compete with Big Companies

It’s tempting to believe you need a huge marketing budget or a fancy brand to thrive in this industry. But here’s the truth: most people want personal support and real results, not big corporate energy.

In fact, many clients are leaving the big players because they feel like a number. What they’re looking for is a human being who cares about their situation and will walk with them step by step.

With a strong brand, a great credit repair business name, and consistent results, you can build powerful word-of-mouth, even on a small budget.

Credit Veto helps you build a client-centric business that feels local, real, and deeply trustworthy, plus we teach you how to market yourself with confidence.

See Also: From Beginner to Pro: Credit Repair Business Training That Boosts Profits

5. What If My Clients Don’t Get Results?

Let’s face it, no one wants to disappoint their clients. But expecting perfection in an imperfect system is unrealistic. The truth is, credit repair is a process, and while some things can be done quickly, many results take time and consistency.

The key is managing expectations and empowering clients with education. You’re not just removing errors; you’re showing them how to maintain a healthier credit life.

And here’s the beauty of it: results compound. Even small wins can lead to massive life changes for your clients; qualifying for a home, getting a car loan, or lowering their interest rate.

With the right credit repair business software and client education tools, you can create a business that delivers real impact,even if progress is gradual.

Credit Veto includes templates and coaching to help you deliver results, track progress, and retain clients longer.

The Truth About the Credit Repair Business Opportunity

If you’ve been waiting for a sign to get started, this is it.

The credit repair business opportunity isn’t just about money. It’s about giving people hope and reclaiming their power. It’s about serving communities that’ve been shut out of fair credit access. It’s about you becoming a trusted guide who turns financial stress into peace of mind.

Here’s what you really need:

- A step-by-step blueprint

- Software that automates and simplifies

- A community of people on the same path

- Confidence to start small and scale smart

Ready to Start Your Own Credit Repair Business?

Whether you’re still asking, “How do I start a credit repair business?” Or you’re ready to turn your knowledge into income, Credit Veto Pro is here to guide you every step of the way.

With us, you get:

- Access to the Certified Credit & Funding Consultant™ (CCFC) Accreditation which elevates trust and standards in America’s Credit Repair and Funding Industry

- Pre-built credit repair business software

- Legal dispute templates and compliance tools

- Step-by-step credit repair business training

- Tools to help you name your business and position your brand

- A ready-to-launch system that scales with you

This is more than a startup credit repair business. It’s your chance to turn personal purpose into lasting profit while helping others win.

Final Thoughts

Don’t let myths and misinformation block your purpose. The credit repair industry is ready for ethical leaders who care. With the right mindset, tools, and training, you can change your life and others’ in less than six months.

Let’s get you started.

Sign up with Credit Veto now to kickstart your blueprint for success even with no prior experience.

Frequently Asked Questions (FAQs)

1. Is credit repair really legal?

Many people believe that credit repair is illegal or shady, but that’s not true. As long as you follow the Credit Repair Organizations Act (CROA) and maintain transparency with your clients, credit repair is a completely legal service. With proper training and the right tools, you can start your credit repair business and operate ethically while helping people improve their financial situations.

2. Do I need a finance degree to start a credit repair business?

No, you don’t need a finance degree to start a credit repair business. Many successful business owners started with no experience. What matters is your willingness to learn, the right training, and using the right tools to guide your clients toward better credit. The ability to connect with people and solve their credit issues is far more valuable than formal credentials.

3. How can I compete with big credit repair companies?

You don’t need a huge marketing budget to succeed in the credit repair industry. Clients often prefer the personal touch that smaller businesses offer, and word-of-mouth is one of the best marketing strategies. By providing exceptional customer service, focusing on delivering real results, and marketing yourself confidently, you can compete with larger companies in a meaningful way.

4. What happens if my credit repair clients don’t see results?

Results in credit repair can take time, and not every client will see immediate improvement. However, managing expectations and educating your clients on the process is key. With the right tools and a systematic approach like that of Credit Veto, you can help clients see long-term improvements, and even small wins can have a significant impact on their financial future. Clients who understand the process are more likely to stay committed to your services.

5. What should I do if I’m afraid of legal risks in credit repair?

The fear of lawsuits is common, but it’s avoidable with the right preparation. Ensure you have the proper credit repair business training, use reliable software to stay compliant, and make transparency a priority in your services. By following the law, documenting your work, and using tools like the ones offered by Credit Veto Pro, you can minimize legal risks and run your credit repair business with confidence.

How a Credit Repair Course Can Improve Your Credit Score and Business Faster

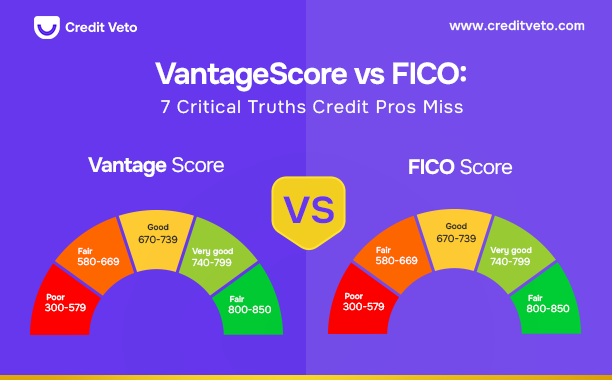

How a Credit Repair Course Can Improve Your Credit Score and Business Faster  Vantage Score vs FICO: 7 Critical Truths Credit Pros Miss

Vantage Score vs FICO: 7 Critical Truths Credit Pros Miss  How to Start a Credit Repair Business from Home in 2026

How to Start a Credit Repair Business from Home in 2026  Can I Hire a Lawyer to Fix My Credit? What Actually Works in 2026

Can I Hire a Lawyer to Fix My Credit? What Actually Works in 2026  How to Generate Credit Repair Leads in 2026: Top Tips for New & Experienced Agents

How to Generate Credit Repair Leads in 2026: Top Tips for New & Experienced Agents  How to Become a Credit Repair Agent and Succeed in 2026

How to Become a Credit Repair Agent and Succeed in 2026  How Long Do Late Payments Stay on Your Credit Report? 2026 Update

How Long Do Late Payments Stay on Your Credit Report? 2026 Update  How Many Credit Cards Should I Have? Avoid These 4 Mistakes

How Many Credit Cards Should I Have? Avoid These 4 Mistakes  How to Check Personal Credit Report: 7 Easy Steps

How to Check Personal Credit Report: 7 Easy Steps