How to Learn Credit Repair in 2026 and Get Results Faster

Short answer: You learn credit repair in 2026 by understanding how credit data is reported, applying compliant dispute methods, using modern systems, and combining repair with rebuilding. This approach works whether you are fixing your own credit or helping clients professionally.

Credit repair has changed. What worked years ago no longer produces consistent results. Credit bureaus respond differently, consumers are more informed, and lenders are stricter. Yet demand for credit repair keeps growing as more people struggle with approvals, funding, and rising costs.

Credit repair in 2026 will no longer be about sending generic dispute letters or hoping something gets deleted. Credit bureaus are stricter, lenders verify more deeply, and consumers are far more informed than they were a few years ago. What used to work inconsistently now fails outright without structure, accuracy, and compliance.

At the same time, demand for credit repair continues to grow. More people are denied approvals, struggle with funding, or face higher costs because of credit report issues they do not understand how to fix. That gap between demand and clarity is why learning credit repair properly still matters.

This guide breaks down how to learn credit repair in 2026 the right way, what skills actually produce results today, and how to shorten the learning curve by using systems instead of outdated trial-and-error methods.

What Learning Credit Repair Really Means in 2026

Learning credit repair today is no longer about disputing everything on a report or copying templates from the internet and hoping something sticks. Credit bureaus now verify data more closely, and lenders look beyond surface-level changes when making decisions.

In 2026, credit repair means understanding how information actually flows onto a credit report and why certain items stay while others can be challenged. It involves knowing which errors are legally removable, which negative items must be corrected rather than deleted, and how bureaus are required to respond when disputes are submitted properly.

Modern credit repair also requires compliant dispute processes. Random or excessive disputes often slow progress instead of improving results. Targeted, accurate disputes supported by documentation are far more effective.

Beyond removals, learning credit repair includes fixing personal information issues such as incorrect addresses, mixed files, and outdated details that quietly block approvals. Just as important is guiding rebuilding alongside removals, because deleting negatives without adding positive history leads to weak or temporary improvement.

Whether you are an individual fixing your own credit or a professional offering credit repair as a service, the foundation is the same. Accuracy, structure, and consistency now matter far more than dispute volume or speed.

Read Also: 6 Simple Ways to Delete Old Addresses From Your Credit Report Fast

Who Should Learn Credit Repair in 2026

People learning credit repair today usually fall into two main groups. While their goals may differ, the core knowledge they need is the same.

Individuals and Consumers

Many people choose to learn credit repair because they want more control over their financial future. Common reasons include fixing their own credit, improving approval chances, or preparing for funding, housing, or major purchases like a car or home.

Others want to understand the process so they can avoid paying for poor-quality services or falling for misleading promises. Learning credit repair empowers individuals to make informed decisions instead of relying on guesswork.

Professionals and Business Owners

Others learn credit repair to apply it professionally. This includes people who want to offer credit repair as a standalone service, support funding or lending businesses, or add credit repair to an existing client base.

For many, it also becomes a way to create recurring revenue while providing real value to clients who already need help. The process of learning credit repair is the same for both groups. The difference is how the knowledge is applied, either for personal improvement or as part of a professional service.

Discover: New Dual-Service Model Turning Credit Clients Into Funding Wins (From One Contact Stream)

The Core Skills You Must Learn to Get Results Faster

To learn credit repair properly in 2026, you must master a few core areas. These skills determine whether your efforts lead to real improvements or stalled results.

Understanding Credit Reports

You need to know how to read Experian, Equifax, and TransUnion reports accurately. This goes beyond checking the score. It includes spotting errors, duplicate accounts, outdated negative items, mixed files, and inconsistencies between bureaus. Many delays in credit repair happen simply because people misread what is actually being reported.

Credit Laws and Consumer Rights

Effective credit repair is built on consumer protection laws. A working understanding of the Fair Credit Reporting Act (FCRA), Fair Debt Collection Practices Act, and Fair Credit Billing Act is essential. These laws define what information must be accurate, how disputes are handled, and when items must be corrected or removed. Without this knowledge, disputes often fail or get ignored.

Strategic Disputing

Learning credit repair is not about disputing everything on a report. It is about disputing with purpose. Targeting information that is inaccurate, unverifiable, incomplete, or outdated produces far better outcomes than mass disputes. Strategy matters more than volume, especially in 2026, when bureaus are stricter.

Credit Rebuilding

Repair alone is not enough. Without rebuilding, any gains are fragile. Learning how credit utilization, payment history, account age, and account mix affect scores is critical.

Strong rebuilding habits ensure that once negative items are corrected or removed, the credit profile continues to improve instead of slipping back. Mastering these skills is what allows people to get results faster and maintain them long term.

Check Out: What is Revolving Utilization and How to Fix It From Hurting Your Credit

Common Ways People Try to Learn Credit Repair and Why They Struggle

Many people attempt to learn credit repair through scattered sources, including random videos, free templates, outdated blog posts, and trial and error. Initially, this feels productive because information is easily accessible. In reality, it creates confusion and inconsistent results.

The main issue with these methods is the lack of structure. They rarely explain how disputes are actually verified by credit bureaus or why some disputes succeed while others fail. Most skip over how to manage three different credit reports at once, how timelines work, or how to track progress properly.

These approaches also ignore communication and compliance. People are not taught how to explain the process clearly, respond to bureau requests, or stay within legal boundaries. As a result, disputes stall, reports remain unchanged, and many give up thinking credit repair does not work.

Without a clear system, effort is wasted. This is why so many people try credit repair but never see consistent, repeatable results.

See Also: Does Credit Repair Really Work? The Honest Truth Most Sites Avoid

The Right Way to Learn Credit Repair in 2026

People who get results faster usually follow a structured approach instead of experimenting blindly. Credit repair works best when learning is intentional and organized.

Learn the System Before the Tactics

Understanding how credit data moves from lenders to credit bureaus helps you avoid wasted disputes. When you know how reporting, verification, and updates actually happen, you focus only on actions that can produce results.

Practice With Real Credit Reports

Hands-on experience matters more than theory. Reviewing real Experian, Equifax, and TransUnion reports teaches you how errors appear, how accounts differ between bureaus, and what can realistically be challenged.

Use a Credit Repair System

Modern credit repair relies on systems, not spreadsheets or memory. Effective systems help you:

- Track disputes and responses

- Organize multiple reports

- Manage timelines and follow-ups

- Reduce manual mistakes that slow progress

Learn How to Explain the Process Clearly

Whether you are fixing your own credit or working with clients, clear explanations build confidence. When people understand what is happening, how long it takes, and what comes next, results become easier to manage and repeat.

This structured approach is what separates frustration from steady progress in 2026.

How Long Does It Take to Learn Credit Repair

Learning credit repair is not instant, but it is also not endless when done correctly. Progress depends on how structured your approach is and whether you are learning with real reports instead of theory alone.

Most realistic timelines look like this:

- First 30 days: You understand the fundamentals, including how credit reports are structured, what common errors look like, and which items are legally disputable.

- 60 to 90 days: You can apply disputes confidently, track responses, and adjust your approach based on how bureaus and lenders reply.

- 3 to 6 months: You can manage full credit repair cases from start to finish, including disputes, follow-ups, and rebuilding steps.

People who use structured systems and guided workflows learn much faster than those relying on trial and error. The clearer the system, the shorter the learning curve and the more consistent the results.

Can You Learn Credit Repair Without Starting a Business

Yes.

Many people learn credit repair to:

- Improve personal credit

- Support family members

- Increase funding approvals

- Add value to existing services

Learning credit repair is a practical life skill, not only a business move.

What to Look for in Credit Repair Training in 2026

If you are choosing how to learn credit repair, focus on programs that include:

- Updated laws and bureau behavior

- Real dispute workflows

- Rebuilding strategies

- System-based learning

Avoid promises of instant deletions or guaranteed outcomes.

How CreditVeto Supports Learning Credit Repair Faster

Credit Veto was built to remove confusion from credit repair learning.

For individuals, it provides:

- Clear steps to fix personal credit

- Guidance on disputes and rebuilding

- Tools to monitor progress

For professionals, CreditVeto supports:

- Organized credit repair workflows

- Client tracking and follow-up

- A system that scales without manual stress

This allows both consumers and professionals to learn credit repair with structure, not guesswork.

Final Thoughts

Learning credit repair in 2026 is about doing things correctly, not quickly. When you understand the rules, apply disputes strategically, and rebuild credit the right way, results follow faster and last longer.

Whether your goal is personal credit improvement or professional growth, learning credit repair with the right system saves time, reduces mistakes, and builds confidence.

If you want a structured way to learn and apply credit repair, Credit Veto gives you the tools to move forward with clarity and consistency. Get started today and stay 88% ahead of others learning credit repair.

Frequently Asked Questions (FAQs)

Is credit repair hard to learn?

No, but it requires structure. Most people struggle without a clear system.

Can I learn credit repair on my own?

Yes, but guided systems like Credit Veto reduce mistakes and speed up results.

Will credit repair still be effective in 2026?

Yes, when done correctly and combined with rebuilding.

Do professionals and consumers learn credit repair differently?

The foundation is the same. The application is what changes.

How a Credit Repair Course Can Improve Your Credit Score and Business Faster

How a Credit Repair Course Can Improve Your Credit Score and Business Faster  How Fast Will a Car Loan Raise My Credit Score? 2026 Real Timeline

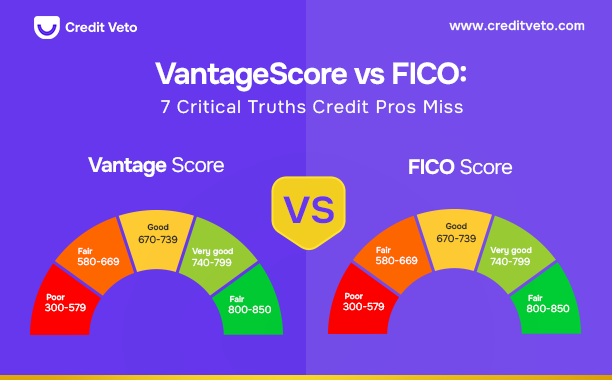

How Fast Will a Car Loan Raise My Credit Score? 2026 Real Timeline  Vantage Score vs FICO: 7 Critical Truths Credit Pros Miss

Vantage Score vs FICO: 7 Critical Truths Credit Pros Miss  What Credit Score Is Needed to Buy a UTV? (Real Limits)

What Credit Score Is Needed to Buy a UTV? (Real Limits)  Does a DUI Affect Your Credit Score? 5 Ways to Protect It

Does a DUI Affect Your Credit Score? 5 Ways to Protect It  How to Remove a Closed Account from Your Credit Report: 3 Best Steps

How to Remove a Closed Account from Your Credit Report: 3 Best Steps  How Long Do Late Payments Stay on Your Credit Report? 2026 Update

How Long Do Late Payments Stay on Your Credit Report? 2026 Update  How Many Credit Cards Should I Have? Avoid These 4 Mistakes

How Many Credit Cards Should I Have? Avoid These 4 Mistakes  How to Check Personal Credit Report: 7 Easy Steps

How to Check Personal Credit Report: 7 Easy Steps