What Is a Bad Credit Score for Buying a Car in 2026? Avoid These Numbers

Short Answer: A bad credit score for buying a car is usually below 620, but approvals are not decided by score alone. Auto lenders look at your entire credit profile, and many buyers with “okay” scores still get denied or overcharged.

If you are planning to buy a car in 2026 or beyond, understanding what lenders consider “bad credit” can save you from rejection, high interest rates, or financing traps.

This guide explains what a bad credit score for buying a car really means, how lenders judge risk, and what to fix before you apply.

Why Auto Lenders Do Not Judge Credit the Way You Expect

Most people assume car approvals are based on a single number. They are not. Auto lenders approve or decline loans based on risk, not just your credit score.

Your credit score is only a summary of what is inside your credit report. The real decision comes from how that score was built and how risky your recent credit behavior appears. That is why two buyers with the same score can have completely different outcomes at the dealership.

When auto lenders evaluate what a bad credit score is for buying a car, they look beyond the number and examine factors such as:

- Recent late payments within the last 12 months

- Open collections or charge-offs that signal unpaid obligations

- Any history of repossession or voluntary surrender

- Credit utilization, especially maxed-out credit cards

- Recent hard inquiries that suggest credit shopping

- Overall stability of your credit profile over time

A credit score that appears “acceptable” can still be considered bad credit if the report indicates instability or unresolved negative items. This is why understanding what a bad credit score for buying a car first requires understanding how the score was built, not just where it falls on a scale.

Auto lenders finance vehicles based on confidence. The cleaner and more stable your credit report looks, the better your approval terms will be, even if your score is not perfect.

Learn More About Default Credit Score: The Surprising Truth & Alternative Scores

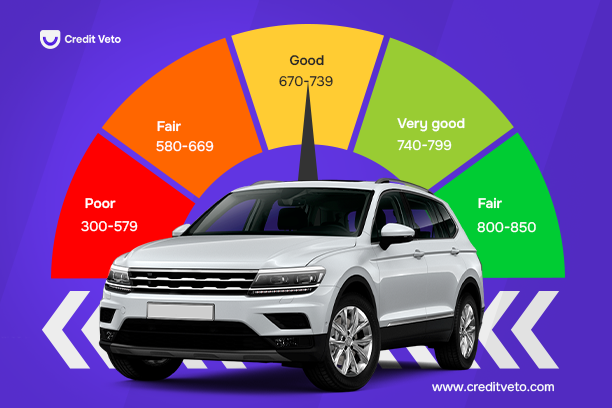

What Credit Score Is Considered Bad for Buying a Car?

When auto lenders evaluate applications, they group borrowers by risk tiers. Here is how most lenders define what is a bad credit score for buying a car.

300–579: Very Bad Credit

At this level, most lenders see extreme risk. Approvals are uncommon and usually come with strict conditions such as:

- Extremely high interest rates

- Large down payments

- A required co-signer

- Buy-here-pay-here (BHPH) car dealerships

Many traditional lenders will decline applications in this range outright, especially if the report includes recent late payments or repossession history.

580–619: Bad Credit

This range is still considered high risk by most auto lenders. You may get approved, but often at a high cost, including:

- Double-digit interest rates

- Shorter loan terms

- Higher monthly payments

- Limited vehicle options

This is where many buyers unknowingly overpay for a car because the approval feels like a win, even though the financing terms are expensive.

620–659: Fair Credit

This range is often viewed as the minimum comfort zone for many lenders. Approvals are more common, but rates can still be higher than necessary if the credit report shows:

- High Credit utilization

- Recent hard inquiries

- Unresolved negative items

Improving the report even slightly in this range can make a noticeable difference in loan terms.

See Also: Is a 635 Credit Score Bad? What It Means and How to Fix It

660 and Above: Good to Excellent Credit

This is where financing becomes easier and cheaper:

- Lower interest rates are available

- More lenders compete for your loan

- Negotiating power improves

- Vehicle options expand

So while many people ask about the lowest credit score to buy a car, the more important question is this:

At what point does bad credit stop costing you thousands in interest and fees? Understanding what is a bad credit score for buying a car helps you decide whether to apply now or fix key issues first to avoid overpaying.

Why a “Not Terrible” Score Can Still Get You Denied

This is where many buyers get confused.

You can have a score above 600 and still be declined.

That happens when your report includes:

- Recent missed payments

- Active collections

- A prior repossession

- High credit card balances

- Too many recent inquiries

- Unverified or incorrect information

Auto lenders are especially sensitive to:

- Recent negatives

- Payment behavior in the last 12 months

- Stability

That is why fixing credit before buying a car is about cleaning the report, not chasing a number.

Learn More: How to Remove Repossession from Credit Report (What Actually Works)

What Actually Makes Credit “Bad” to Auto Lenders

A bad credit score for buying a car is rarely about the number alone. Auto lenders focus on specific risk signals inside your credit report. When these issues appear, your credit is treated as high risk even if your score looks average.

The most common factors that make credit “bad” to auto lenders include:

- Late payments within the last 6 to 12 months

- Collections that are still active or unpaid

- A past repossession or voluntary surrender

- High credit utilization on revolving accounts

- Errors or mixed-file data in the report

- Inconsistent address or personal information

Even one of these issues can outweigh your credit score during underwriting. Recent negatives signal instability, which raises interest rates or leads to denials.

This is why many buyers with “fair” scores still face bad loan terms. The credit score may look acceptable, but unresolved report issues quietly push the deal into a higher-risk category.

Can You Buy a Car With Bad Credit?

Yes, you can buy a car with bad credit. But the more important question is whether you should do it now.

When you buy a car with a bad credit score, lenders usually compensate for risk by increasing costs. That often means:

- Paying thousands more in interest over the life of the loan

- Accepting unfavorable loan terms, you cannot easily change

- Ending up upside down on the vehicle faster than expected

- Struggling to refinance later, even if your credit improves

For many buyers, rushing into an auto loan with bad credit creates a long-term financial drag that lasts years beyond the purchase.

In contrast, fixing key credit issues before applying often leads to:

- Better approval odds with mainstream lenders

- Lower monthly payments

- Less total interest paid over time

- Stronger overall credit health after the purchase

This is why understanding what is a bad credit score for buying a car matters. Timing can be the difference between using a car loan as a stepping stone or turning it into a costly setback.

How to Improve Approval Odds Before Buying a Car

If your credit score is borderline or bad, focus on profile fixes, not shortcuts.

That means:

- Removing incorrect or unauthorized items

- Resolving errors and duplicate accounts

- Lowering credit utilization

- Avoiding new inquiries before applying

- Stabilizing payment history

This is where structured credit repair like that offered by Credit Veto matters.

Common Mistakes Buyers Make With Bad Credit

Many buyers hurt themselves by:

- Applying before cleaning errors

- Accepting the first approval offered

- Using high-interest dealer financing without review

- Ignoring report accuracy

- Focusing only on score apps

Bad credit costs the most when rushed decisions are made.

How Long Does It Take to Fix Bad Credit for a Car Loan?

Timelines depend on your profile, but realistic expectations look like this:

- 30–45 days for dispute responses

- 60–90 days for visible improvement

- 3–6 months for stronger auto approval options

Even small fixes can change loan terms dramatically.

How Credit Veto Helps Buyers Fix Bad Credit Before Auto Financing

CreditVeto helps individuals address the exact issues that cause auto loan denials.

Instead of guessing what lenders want, CreditVeto focuses on:

- Identifying auto-blocking negatives

- Correcting inaccurate data

- Removing unauthorized inquiries

- Cleaning personal information errors

- Guiding rebuilding alongside credit repair

This approach improves approval quality, not just scores. Whether you are buying now or preparing to buy soon, fixing the report first puts you in control of the deal.

Final Thoughts

A bad credit score for buying a car is not just about being below a certain number. It is about risk signals inside your credit report.

Understanding what lenders actually decline gives you leverage. Fixing those issues before applying saves money, stress, and regret.

If you want to clean your credit, improve approval odds, and avoid overpaying on your next car, CreditVeto provides the structure to do it the right way. Sign up today to get started and even get access to the funding that you deserve for your car.

Frequently Asked Questions (FAQ)

What is the lowest credit score needed to buy a car?

There is no universal minimum, but most lenders consider 500 to 580 the lowest range where approval may still happen. At this level, approvals usually come with high interest rates, strict terms, or buy-here-pay-here dealerships.

What is the minimum credit score to apply for a car?

You can technically apply with any score, but realistic approvals typically start around 580 to 620. Below that, many traditional lenders will decline or require a co-signer or large down payment.

Can I finance a car with a 585 credit score?

Yes, a 585 credit score can qualify for financing, but expect higher interest rates and limited offers.

Can a 650 credit score get a car loan?

Yes. A 650 credit score is usually considered fair credit and is enough to get by many lenders. Rates may not be the best, but you will have more negotiating power than buyers with lower

Can I get a car with a 500 credit score?

Yes, but options are limited. Most approvals at 500 come through buy-here-pay-here dealers or subprime lenders with very high interest. Fixing errors or reducing balances first often leads to better outcomes.

How can I raise my credit score 100 points in 30 days?

Raising a score by 100 points in 30 days is possible in some cases, but it depends on what is hurting your credit. The fastest improvements usually come from:

– Removing errors or unauthorized items

– Paying down high credit card balances

– Lowering utilization below 30 percent

– Avoiding new inquiries

Results vary, but addressing the right issues can lead to rapid score movement.

Should I fix my credit before buying a car?

Yes. Cleaning errors and reducing risk improve approval odds and pricing

Can I get a car loan with collections on my credit report?

Yes, but collections reduce approval quality and increase interest rates.

Is 620 a bad credit score for buying a car?

It is considered borderline. Approval is possible, but rates may still be high

What is the lowest credit score to buy a car?

Some lenders approve below 580, but terms are usually unfavorable.

How Long Do Late Payments Stay on Your Credit Report? 2026 Update

How Long Do Late Payments Stay on Your Credit Report? 2026 Update  How Many Credit Cards Should I Have? Avoid These 4 Mistakes

How Many Credit Cards Should I Have? Avoid These 4 Mistakes  How to Check Personal Credit Report: 7 Easy Steps

How to Check Personal Credit Report: 7 Easy Steps  How a Credit Repair Course Can Improve Your Credit Score and Business Faster

How a Credit Repair Course Can Improve Your Credit Score and Business Faster  How Fast Will a Car Loan Raise My Credit Score? 2026 Real Timeline

How Fast Will a Car Loan Raise My Credit Score? 2026 Real Timeline