How to Become a Certified Credit Repair Specialist (Even If You’re Starting from Scratch)

Short Answer: Anyone can become a certified credit repair specialist by learning how credit works, taking a simple online credit repair class, and getting trained to start serving clients using Credit Veto’s webinar, automation, and lead-matching tools needed to serve clients confidently.

Are you looking to enter the world of credit repair? With millions of people struggling to maintain a good credit score, there’s never been a better time to become a credit repair specialist.

In fact, becoming a certified credit repair expert can not only allow you to help individuals fix their financial futures but can also help you generate a steady income.

The credit-repair-service market grew from USD 4.68 billion in 2024 to USD 5.29 billion in 2025. It is expected to continue growing at a CAGR of 13.33%, reaching USD 9.92 billion by 2030.

In this post, we’ll walk you through what a credit repair specialist is, why you should consider becoming one, and how you can get certified with Credit Veto, the most effective way to grow your career and business.

Who is a Credit Repair Specialist?

A credit repair specialist is a professional who helps individuals improve their default credit scores by disputing inaccuracies on credit reports, negotiating with creditors, and educating clients on best financial practices. They are experts in identifying negative marks like late payments, collections, and inaccuracies that affect your credit score.

Credit repair specialists work with credit reports, guiding clients on how to dispute errors, resolve debts, and implement strategies to boost their credit scores.

A credit repair specialist doesn’t just help people fix errors on their credit reports, improve their credit scores, and regain financial freedom.

Why Credit Repair Business is a Smart Career

Right now, millions of people are struggling with low credit scores. Some cannot rent apartments, buy cars, or even qualify for simple loans. That problem has created a huge demand for people who know how to fix credit the right way.

Becoming a credit repair specialist is one of the smartest moves you can make. It is a career where you help people take back control of their money while building a business that gives you flexibility and freedom. You do not need a college degree or years of experience to start. You only need the right training, tools, and a system that helps you stay compliant and confident.

Credit repair is more than just removing errors from reports. It is about helping families feel less stressed and more stable. Every credit file you fix gives someone a second chance at life, and that is what makes this career so rewarding.

Read also: How to scale credit repair business the right way

What a Credit Repair Specialist Actually Does

A credit repair specialist helps people find and fix mistakes on their credit reports. Many credit reports contain errors like wrong account details, duplicate records, or debts that should have been removed years ago. These small mistakes can drop someone’s credit score and block them from getting approved for loans or housing.

A specialist’s job is to read credit reports, spot problems like mixed credit file errors, and write dispute letters to the credit bureaus. They also teach clients how to build better financial habits, like paying on time and keeping balances low.

In simple terms, a credit repair specialist is both a coach and a problem solver. You help people understand what went wrong with their credit, guide them through fixing it, and show them how to rebuild stronger credit for the future.

Why the Credit Repair Industry Keeps Growing

The demand for credit repair specialists keeps rising every year. Many people lost good credit after medical bills, student loans, or job changes. Others simply do not understand how credit scores work.

This problem has become even more common as more people use credit for everyday life. From rent to car insurance, credit scores affect almost everything. That means there will always be people who need your help.

Credit repair is also one of the few industries where you can start small, work from home, and grow fast. Whether you want to earn extra income or build a full-time business, it gives you the power to serve others while improving your own financial life.

How to Become a Credit Repair Specialist Step-by-Step

Below are 5 pivotal steps to becoming a credit repair specialist.

Step 1: Learn the Basics of Credit Repair

Before you start helping others, you need to understand how credit works. This includes knowing how credit scores are calculated, how reports are built, and what affects them the most. Learn about payment history, debt levels, credit age, types of credit, and inquiries.

You can start by studying the three major credit bureaus: Experian, Equifax, and TransUnion. Get familiar with how they collect and report data. Once you understand this, you will be ready to help clients fix errors with confidence.

Step 2: Join a Credit Repair Class or Program

Taking a credit repair class is the fastest way to learn what works. A good credit repair program teaches both the technical and legal sides of credit. It helps you understand laws like the Fair Credit Reporting Act (FCRA) and the Credit Repair Organizations Act (CROA).

These laws protect both you and your clients. They guide what you can and cannot do in the credit repair business.

Credit veto pro offers an easy and clear path for beginners. You get lessons that explain each step of the repair process, templates for letters, and real examples of how to serve clients without guesswork.

Step 3: Get Certified with a Compliance-Ready System

Certification gives you trust and credibility. When clients see that you are certified, they feel safe working with you. Getting certified also teaches you the right ethics, communication skills, and business practices.

Through credit veto ’s certification, you do not only learn how to repair credit but also how to build a real business. The system includes training, automation tools, and ready-to-use templates that save you time and keep you compliant with industry standards.

Step 4: Build Your Own Credit Repair Business

Once you have your certification, you can start your business. The good news is that you do not need a large budget. Many credit repair specialists start from home using their laptops or phones.

Register your business name, get a simple website, and create an email for professional use. Make sure you open a business bank account to keep your finances organized.

Then, start reaching out to people who already trust you. Friends, family, and past coworkers are often your first clients. You can grow from there by building referrals and using social media to share tips about improving credit.

Step 5: Use the Right Tools and Automation

Doing credit repair manually can take a lot of time. That is why successful specialists use systems that handle the heavy lifting. Credit Veto gives you software that helps you manage clients, automate letters, and track their progress all in one place.

This means less paperwork, fewer mistakes, and more time to grow your business. With automation, you can serve more clients while maintaining quality. That is how small operations turn into strong, growing companies.

Why Become a Credit Repair Specialist?

The credit repair industry is booming, and with over 68% of Americans facing credit struggles, the demand for professionals in this field is higher than ever. Becoming a certified credit repair specialist is not only an opportunity to provide essential services, but it also opens the door to a potentially lucrative business.

Here’s why pursuing this career is a smart choice:

High Demand for Services

Millions of individuals across the U.S. are facing credit challenges that hinder their ability to secure loans, mortgages, and even jobs. With such a significant portion of the population dealing with poor credit, the demand for credit repair specialists is consistently rising.

This is a growing market, and businesses in the credit repair space are benefiting from the increasing number of clients in need of financial guidance and assistance.

As a credit repair specialist, you’ll be stepping into a role where there is a constant flow of potential clients who need help navigating and improving their credit scores.

Low Startup Costs

One of the biggest advantages of becoming a credit repair specialist is the low barrier to entry. Unlike traditional businesses that require expensive inventory or office space, starting a credit repair business can be done with minimal investment.

You can launch your credit repair services for as little as $500 or even less, which makes it an accessible option for anyone looking to start a side hustle or a full-fledged business. The cost-effective nature of the industry means you can keep overheads low while growing your client base and income.

Work from Anywhere

The flexibility that comes with being a credit repair specialist is one of its biggest appeals. Whether you prefer working from the comfort of your home, a coffee shop, or while traveling, you can manage your business remotely. With the right tools and software, credit repair work can be done from virtually anywhere with an internet connection.

This provides you with the freedom to create your own schedule, which is especially appealing for those looking for work-life balance or seeking a flexible side income. Plus, the digital nature of the business means that you can scale it without the limitations of a traditional brick-and-mortar office.

Make a Difference

Credit repair specialists don’t just fix numbers—they change lives. Helping clients improve their credit can have a profound impact on their future financial well-being. Whether it’s enabling a young couple to buy their first home or helping someone secure financing for a car loan, the work you do will have a real, tangible impact.

By assisting individuals in raising their credit scores, you empower them to achieve their financial goals. The satisfaction of knowing you’re directly contributing to someone’s success is incredibly rewarding and adds a sense of purpose to your work.

Earn a Great Income

For those committed to the craft, credit repair specialists can earn a substantial income. Many top credit repair specialists can make between $5K to $25K per month, depending on the number of clients they serve and the services they offer. As you build a reputation and establish a loyal client base, your income potential increases, making credit repair not only a fulfilling profession but also a financially rewarding one. Whether you’re offering one-time consultations or monthly credit monitoring and repair services, the financial opportunities in this field are considerable.

With these compelling reasons in mind, it’s clear that becoming a credit repair specialist is not only an opportunity to help others but also to build a sustainable and profitable business that can thrive in the years to come.

How to Learn Credit Repair Without Feeling Overwhelmed

Learning credit repair can feel confusing at first, but it becomes simple once you follow the right process. Focus on one area at a time. Start with how credit scores work, then move to reports, then to dispute methods.

Credit Vero ’s program breaks everything into small, easy lessons. Each topic builds on the last, so you understand not just what to do, but why it matters. You do not need to be good with numbers or finance. You only need patience and the desire to help people.

Choosing the Right Credit Repair Class

Not all credit repair classes are created equal. When choosing where to learn, look for a program that offers:

- Step-by-step lessons you can actually follow

- Legal compliance training

- Real tools for managing clients

- Templates for letters and reports

- Ongoing support or community access

Credit veto combines all of these features. You get practical training, automation tools, and mentorship that guide you from beginner to professional. It’s not just about learning theory; it’s about learning how to help real people with real results.

What Makes Credit Veto Different

Most programs only teach you how to fix credit. Credit Veto teaches you how to fix credit and build a business at the same time. The platform is designed to help you learn, launch, and grow faster.

It comes with compliance-based training, client management dashboards, and built-in partnerships with funding networks. That means once your clients fix their credit, you can also help them access business or personal funding.

Credit veto focuses on creating real professionals who follow the rules, use smart tools, and grow ethically. It is a full system, not just a class. Sign up on our FREE webinar today to get started.

Conclusion

Becoming a credit repair specialist is not only a smart career choice, it is a chance to change lives. You do not need a background in finance. You only need the right system, the right mindset, and the right training.

Credit veto makes the process simple. It gives you everything you need to learn, practice, and grow while helping others fix their credit and rebuild confidence.

If you have been searching for a flexible, meaningful, and profitable path, this is it. Start your journey today. Learn how to become a certified credit repair specialist from scratch.

Frequently Asked Questions (FAQ)

Q1: How do I become a credit repair specialist?

Start by learning how credit reports and scores work. Take a credit repair class, get certified, and set up your business with proper tools. Credit veto offers a complete system for beginners. Launch here.

Q2: Do I need a degree to start?

No, you do not need a degree. Anyone can become a credit repair specialist with proper training and a willingness to help others.

Q3: How long does it take to learn credit repair?

Most people can learn the basics in a few weeks and start serving clients within a few months. credit veto ’s online system lets you learn at your own pace but a much faster one.

Q4: What skills do I need to become successful?

You need patience, communication skills, and a desire to solve problems. The rest can be learned through proper training and practice. But Credit Veto offers you a done for you system.

Q5: Is credit repair legal?

Yes. Credit repair is legal in all 50 states when done under the Credit Repair Organizations Act (CROA). That is why it’s important to get certified through a compliance-first program like credit veto .

How a Credit Repair Course Can Improve Your Credit Score and Business Faster

How a Credit Repair Course Can Improve Your Credit Score and Business Faster  How Fast Will a Car Loan Raise My Credit Score? 2026 Real Timeline

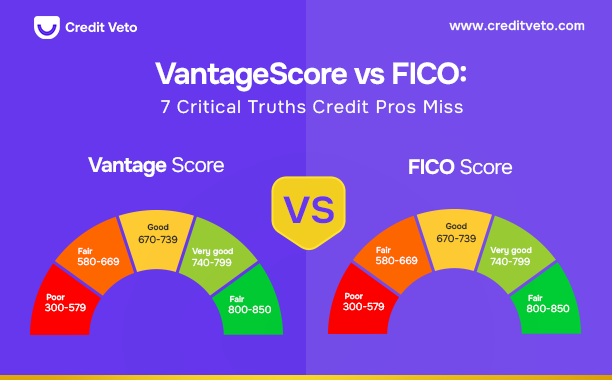

How Fast Will a Car Loan Raise My Credit Score? 2026 Real Timeline  Vantage Score vs FICO: 7 Critical Truths Credit Pros Miss

Vantage Score vs FICO: 7 Critical Truths Credit Pros Miss  What Credit Score Is Needed to Buy a UTV? (Real Limits)

What Credit Score Is Needed to Buy a UTV? (Real Limits)  Does a DUI Affect Your Credit Score? 5 Ways to Protect It

Does a DUI Affect Your Credit Score? 5 Ways to Protect It  How to Remove a Closed Account from Your Credit Report: 3 Best Steps

How to Remove a Closed Account from Your Credit Report: 3 Best Steps  How Long Do Late Payments Stay on Your Credit Report? 2026 Update

How Long Do Late Payments Stay on Your Credit Report? 2026 Update  How Many Credit Cards Should I Have? Avoid These 4 Mistakes

How Many Credit Cards Should I Have? Avoid These 4 Mistakes  How to Check Personal Credit Report: 7 Easy Steps

How to Check Personal Credit Report: 7 Easy Steps