Can I Hire a Lawyer to Fix My Credit? What Actually Works in 2026

Short Answer: Yes, you can hire a lawyer to fix credit, but most credit problems do not require a lawyer. In many cases, a structured credit repair system is faster, more affordable, and more effective. Lawyers are best used for legal disputes or lawsuits, not everyday credit report corrections, rebuilding, or funding preparation.

When credit problems start blocking loans, housing, or funding, many people ask the same question: Can I hire a lawyer to fix my credit? It sounds logical. Lawyers deal with laws, disputes, and paperwork, so hiring one feels like the safest option.

But credit repair does not work the way most people think. In this guide, we explain when a credit lawyer actually helps, when they do not, and why most credit issues are solved faster and more affordably through a structured credit repair system instead of legal representation.

We will also show how modern credit repair companies handle disputes, rebuilding, and funding support in ways lawyers typically do not. This will help you decide the smartest path forward for your credit, before you spend money in the wrong place.

Why Credit Problems Make People Look for Lawyers First

Credit problems rarely start as legal questions.

They start as roadblocks.

A mortgage is delayed.

A loan application stalls.

Advice online contradicts itself.

A collection account refuses to disappear.

When credit issues begin blocking real plans, people naturally assume the solution must be legal. That is when the question comes up, “Can I hire a lawyer to fix my credit?”

The confusion is understandable. Credit reports involve laws, disputes, and formal processes. But credit repair and legal action are not the same thing, even though they sometimes overlap.

Most credit issues are administrative, not legal. They come down to reporting accuracy, verification, timelines, and how information is handled by credit bureaus. Lawyers step in only when those processes break down or rights are violated.

Understanding this difference early can save you time, money, and unnecessary stress, and help you choose the right solution instead of the most expensive one.

Read Also: Does Credit Repair Really Work? The Honest Truth Most Sites Avoid

What a Credit Repair Lawyer Actually Does

A lawyer can help with credit issues only in specific situations.

A credit repair lawyer is useful when:

- You are suing a creditor or bureau for violations

- Your rights under the Fair Credit Reporting Act were ignored

- A creditor refuses to correct proven errors

- You are dealing with identity theft, fraud, or serious legal harm

In these cases, legal pressure may be required.

However, most negative credit items are not legal disputes. They are reporting issues, verification issues, or rebuilding issues. That distinction matters.

See Also: How Can I Dispute a Credit Report? (7 Proven Ways)

What Credit Lawyers Usually Don’t Handle in Credit Repair

Hiring a lawyer feels like a serious step, especially when credit problems start affecting major life decisions. But most people are surprised to learn that legal expertise and credit repair expertise are not the same thing.

In practice, credit lawyers typically do not handle the day-to-day work required to improve a credit profile.

Most lawyers do not:

- Review your entire credit profile across all three bureaus for optimization

- Analyze credit utilization, account structure, or balance strategy

- Manage multiple dispute timelines month after month

- Track verification responses from bureaus and furnishers

- Guide credit rebuilding alongside removals

- Prepare your credit profile for funding, auto loans, or mortgage approval

- Handle ongoing follow-ups and adjustments as reports update

Legal services focus on enforcement and compliance, rather than optimization and progress.

That difference matters.

A lawyer is useful when a creditor breaks the law or ignores formal notice requirements. But most credit issues are not legal disputes. They are reporting issues, verification gaps, timing problems, and structural weaknesses in the credit profile.

This is why many people hire a lawyer, spend thousands of dollars, resolve one narrow issue, and still feel stuck afterward. The legal action ends, but the credit profile is not actually prepared for approvals. Credit repair requires consistent management, not one-time legal intervention.

Credit Repair vs Legal Action: The Real Difference

Here is the simple truth:

Credit repair is a process.

Legal action is a response.

Most credit issues fall into the process category:

- Incorrect balances

- Duplicate accounts

- Mixed files

- Old negative items

- Inconsistent personal data

- Poor utilization structure

These do not require lawsuits. They require accuracy, documentation, timing, and follow-up. That is where structured credit repair systems outperform legal-only approaches.

When Hiring a Lawyer Does Make Sense

You should consider a lawyer if:

- A creditor is knowingly violating your rights

- You have documented proof and no response

- Identity theft caused severe damage

- You need financial compensation, not just correction

In these cases, legal support is appropriate. But even then, legal action usually comes after credit repair attempts, not before.

Why Most People Get Better Results Without a Lawyer

For everyday credit issues, people see better outcomes when they use:

- A structured credit repair workflow

- Clear dispute documentation

- Ongoing bureau monitoring

- Strategic rebuilding alongside removals

This approach:

- Costs less

- Moves faster

- Avoids unnecessary escalation

- Improves approvals, not just reports

Most importantly, it fixes the full credit profile, not just one account.

Where Credit Veto Fits (Without Replacing Lawyers)

Credit Veto was built to handle what lawyers are not designed for.

It helps with:

- Identifying what is fixable vs what is legal

- Managing disputes across bureaus

- Tracking responses and timelines

- Correcting personal information issues

- Rebuilding credit alongside removals

- Preparing profiles for funding and approvals

If a case escalates to legal action, Credit Veto does not replace a lawyer. It prepares the groundwork so legal action is clear, targeted, and justified.

That distinction matters.

Credit Repair Is Not Just About Removal Anymore

One major gap in lawyer-focused articles is this:

Removing items alone is no longer enough.

Lenders look at:

- Structure

- Utilization

- Payment patterns

- Stability

- Timing

Credit Veto supports:

- Credit repair

- Credit rebuilding

- Funding readiness

- Business and personal credit paths

This is why people who rely only on legal fixes often struggle later during approvals.

Credit Repair Lawyer vs Credit Repair System (Clear Comparison)

| Area | Credit Repair Lawyer | Credit Repair System (Credit Veto) |

| Fix reporting errors | Limited | Yes |

| Dispute inaccurate accounts | Only if legal violation | Yes |

| Manage credit reports monthly | No | Yes |

| Improve approval odds | Not designed for this | Yes |

| Optimize utilization & structure | No | Yes |

| Support funding preparation | No | Yes |

| Cost efficiency | High (legal fees) | Lower, scalable |

| Best used for | Lawsuits & violations | Everyday credit repair & growth |

Can I Start a Credit Repair Business Instead of Hiring a Lawyer?

Yes, and many people do. Some people ask this question not just for themselves, but because they want to:

- Help others with credit issues

- Build a service business

- Add funding support

- Create recurring income

In these cases, learning credit repair with a system makes far more sense than outsourcing everything to legal professionals.

Credit Veto supports both:

- Individuals fixing their personal credit

- Professionals building credit repair businesses

- Operators helping clients move from repair to funding

Discover How to Launch a Credit & Funding Business that Prints 6 Figures Monthly

The Smarter Way to Decide

Ask yourself:

- Is this a legal violation or a reporting issue?

- Do I need enforcement or structure?

- Do I want correction only, or long-term improvement?

If the issue is legal, involve a lawyer.

If the issue is structural, use a credit repair system.

If the goal is funding, approvals, or business growth, you need more than legal help, like a more structured automated system like Credit Veto.

The Credit Repair + Funding Reality Most Articles Miss

Here’s the part most lawyer-focused articles ignore:

Fixing credit is no longer the finish line.

People want:

- Loan approvals

- Business funding

- Lower interest rates

- Housing eligibility

- Access to capital

Removing one negative item does not guarantee any of that.

Credit Veto supports the entire journey:

- Repair

- Rebuilding

- Profile stability

- Funding readiness

That is why many people who “fix” credit legally still get denied later.

Final Thoughts

Yes, you can hire a lawyer to fix your credit. But for most people, that is not the fastest or smartest first step. Credit repair today is about accuracy, structure, timing, follow-up, and rebuilding.

Credit Veto was built to support that reality. If legal action becomes necessary, it fits into the process. It does not replace the process. That is the difference most articles never explain. Sign up to get started with your smooth credit repair journey today.

FAQs (Frequently Asked Questions)

Can a lawyer remove items from my credit report?

Only if the item involves a legal violation. Most items are removed through disputes, not lawsuits.

Is hiring a lawyer better than credit repair?

No. They serve different purposes. Credit repair handles structure and accuracy. Lawyers handle enforcement.

How much does a credit repair lawyer cost?

Legal services often cost thousands, while structured credit repair systems cost significantly less.

Can credit repair help me get funding?

Yes. When combined with rebuilding and profile optimization, credit repair improves approval odds.

How Long Do Late Payments Stay on Your Credit Report? 2026 Update

How Long Do Late Payments Stay on Your Credit Report? 2026 Update  How to Check Personal Credit Report: 7 Easy Steps

How to Check Personal Credit Report: 7 Easy Steps  How a Credit Repair Course Can Improve Your Credit Score and Business Faster

How a Credit Repair Course Can Improve Your Credit Score and Business Faster  How Fast Will a Car Loan Raise My Credit Score? 2026 Real Timeline

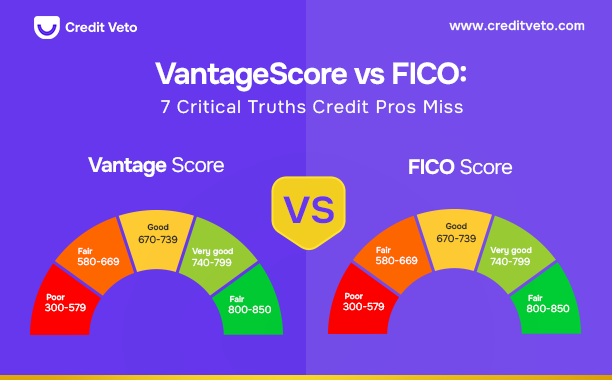

How Fast Will a Car Loan Raise My Credit Score? 2026 Real Timeline  Vantage Score vs FICO: 7 Critical Truths Credit Pros Miss

Vantage Score vs FICO: 7 Critical Truths Credit Pros Miss  How Many Credit Cards Should I Have? Avoid These 4 Mistakes

How Many Credit Cards Should I Have? Avoid These 4 Mistakes