How to Close a Credit Card Without Hurting Your Score: Real Tips That Work

Learn how to close a credit card without hurting your credit score. Discover safe tips, real Reddit advice, and smarter alternatives to cancellation.

For most people, closing a credit card sounds like a responsible move. But what many don’t realize is that doing it the wrong way can damage your credit score.

Perhaps you’re asking yourself, how do I close my Credit One credit card without ruining my credit? Or how do I cancel my Best Buy credit card safely? What if your credit card company closed your account with a balance, and now your score is suffering? We’ll cover all of it in this guide.

Let’s break down how to close a credit card account properly, how it affects your credit score, and what you can do to protect your financial standing.

Why Closing a Credit Card Affects Your Credit Score

Before canceling any card, it’s important to understand the impact. Your credit score isn’t just based on your spending. It also factors in:

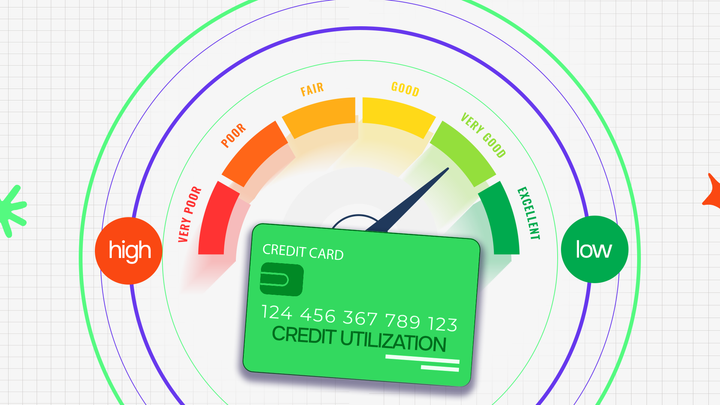

- Credit Utilization Ratio: This is the percentage of credit you’re using compared to your total credit limit. When you close a card, you reduce your total credit limit, which can increase your utilization and lower your score.

- Average Age of Accounts: The longer you keep accounts open, the better. Closing a long-standing card can reduce the average age of your credit, which could slightly hurt your score.

- Credit Mix: Lenders like to see a healthy mix of credit types such as credit cards, loans, etc. If your card is your only form of revolving credit, closing it could reduce your mix.

So, if you’re thinking about closing your Credit One account or deactivating your Doge Federal Credit Card, know that timing and strategy matter.

When It Makes Sense to Cancel a Credit Card

Closing a credit card account isn’t always a bad move. In fact, there are legitimate reasons why canceling a card might actually help you, especially if it’s hurting your financial well-being more than it’s helping.

Here are a few strong reasons to consider canceling:

- You’re paying a high annual fee for benefits you never use. If your credit card comes with a $95 or even $500 annual fee and you’re not redeeming rewards, lounge access, or travel perks, you’re essentially losing money just for keeping the card open.

- You’ve upgraded to better credit cards. Maybe you’ve recently opened a low-interest or no-annual-fee card with better cashback or travel perks. In that case, hanging onto your old card with subpar benefits doesn’t serve much purpose.

- You’re dealing with poor customer service or recurring issues with the issuer. If your bank consistently fails to resolve disputes or overcharges you on fees, it might be time to move on, even if it means canceling a card.

- You’re trying to take control of impulsive spending or break free from credit card addiction. Many users struggling with debt or compulsive spending turn to Reddit and forums asking, “Should I cancel my Credit One card? Should I cancel my Best Buy credit card? I keep paying it off and maxing it out again.”

In fact, one Reddit user put it perfectly:

“Every time I pay off a card, I start using it again. I wish I could just freeze the card instead of canceling it.”

If you’ve had similar thoughts, you’re definitely not alone. And it’s valid; credit cards can become a real source of financial anxiety for some.

However, canceling a card isn’t your only option. You might consider calling your issuer and requesting a temporary freeze, lowering your credit limit, or even switching to a different product with the same bank to maintain your credit age and history.

Before taking that final step, ask yourself:

- Can I trust myself not to use this card unnecessarily?

- Is the annual fee really worth it for what I’m getting?

- Will closing this account significantly affect my credit utilization or credit age?

If you still decide to go ahead, don’t worry, you can close a credit card without hurting your credit if you do it strategically, and we’ll walk you through how in the next section.

Alternatives to Closing a Credit Card

Before rushing to cancel a credit card (especially one you’ve had for a while), it’s worth considering less risky options that can help you maintain your credit score while still controlling your spending or reducing fees.

Here are smart alternatives to explore:

1. Product Change (a.k.a. Downgrade Your Card)

If you’re wondering how to cancel a Best Buy credit card or a Credit One account, stop first and ask, “Can I switch to a no-annual-fee version instead?” Most major credit card companies allow you to do a product change, which means you keep the same account history but get a different card, one with fewer fees or lower interest. This can help you keep your credit age intact while avoiding the downsides of account closure.

2. Lower Your Credit Limit

If your biggest challenge is overspending, one trick is to downgrade the credit limit. Instead of giving yourself access to $5,000, you can ask the issuer to lower your limit to, say, $500. This makes the card less tempting and helps you stay within your budget, without closing the account and hurting your credit utilization.

3. Freeze or Hide the Card

For users who say things like, “I have a spending addiction” or “Every time I pay off the card, I max it out again,” there’s a practical fix.Instead of canceling the card entirely, ask your issuer to temporarily freeze it or simply remove the physical card from your wallet and apps. Some even go as far as locking it in a drawer or deleting it from Apple Pay. Out of sight, out of swipe.

And if your card is from a retailer (like Best Buy or a store-specific Credit One card) you’ll want to be extra cautious. Retail credit cards often have lower credit limits, and closing them can increase your credit utilization percentage quickly. In many cases, downgrading or freezing the card is a safer long-term move than outright cancellation.

These small adjustments can help you avoid the negative credit impact while still regaining control of your finances.

Read Also: Why Maxing Out Your Credit Card Hurts Your Score—and What to Do

How to Close a Credit Card Without Hurting Your Credit

If you’re certain that canceling is the right move, follow these steps to minimize credit score damage:

Step 1: Pay Off the Balance in Full

Don’t cancel a card with a remaining balance. If you do, you’ll still owe the balance, but it could show as “closed with balance” on your report, which is a red flag.

If your credit card company closed your account with a balance, make sure to keep paying it off on time. Missed payments on closed accounts still hurt your score.

Step 2: Redeem Rewards

Before you cancel, make sure to use up any cash back or points. Once the card is closed, you may lose access to those rewards.

Step 3: Contact the Issuer to Cancel

Don’t just cut up the card. Call customer service (or use your online account) and ask to cancel the account formally. If you’re closing a Credit One card or a Best Buy credit card, they may ask why. Be honest.

Request a confirmation email or letter showing the account was closed at your request.

Step 4: Monitor Your Credit Report

Check your credit report after 30 days to make sure the card shows as “closed by consumer” instead of “closed by creditor.”

If you’re seeing changes on your report that don’t make sense, tools like Credit Veto can help you dispute and fix errors.

Should You Pay Off Closed Accounts on Your Credit Report?

This is one of the top questions on Reddit. The answer: Yes.

A closed account with an outstanding balance still affects your credit score. It can:

- Add to your total debt load

- Keep your credit utilization high

- Continue generating interest

- Risk being sent to collections

So if you’re staring at a closed Credit One card with a $600 balance, paying it off is one of the best things you can do for your credit.

Can I Close a Credit Card Temporarily?

Unfortunately, no. Credit cards can’t be “paused” in the traditional sense. But you can:

- Call your issuer to freeze the card (prevents new charges)

- Cut up the physical card while leaving the account open

- Set up spending alerts to help avoid impulsive purchases

This is a great option if you’re recovering from overspending or trying to break a credit card addiction, like the Reddit user mentioned earlier.

Real-Life Example: Redditors Share Their Credit Card Lessons

Many Reddit threads show users shocked by sudden credit score drops after closing a card. One user said their score dropped 21 points after canceling a rarely-used card. Others experienced a 100-point drop because of multiple closures or balances on closed accounts.

The key takeaway? Every situation is different. But with the right approach, you can avoid these pitfalls.

What If the Credit Card Company Closes the Account?

Sometimes, the issuer closes your card without asking. This often happens when:

- You haven’t used the card in a long time

- Your credit risk has increased

- They’re cleaning up inactive accounts

If you had a balance when the card was closed, don’t panic. Just continue making on-time payments. If the closure hurts your utilization, consider requesting a credit limit increase on your other cards.

Final Thoughts: Think Strategy, Not Emotion

Whether it’s Credit One, Best Buy, Doge Federal Credit Union, or a generic Visa, the way you handle closing your credit card matters.

Closing accounts impulsively because you want a clean wallet or are frustrated with spending habits can cost you in the long run. Instead, think of your credit cards as part of your financial strategy, not just tools for spending.

If you’re unsure about the best way to handle it, tools like Credit Veto offer personalized credit repair insights and even help with disputed items.

FAQs: Quick Answers to Your Questions

1. How do I close my Credit One credit card safely?

Call their customer service and request a cancellation. Make sure the balance is fully paid off first and monitor your credit report afterward.

2. Should I pay off closed accounts on my credit report?

Yes. Unpaid closed accounts can still hurt your credit and even go to collections.

3. How can I cancel my Best Buy credit card without hurting my score?

Pay it off, redeem any rewards, then contact the issuer. Ask if there’s a downgrade or no-fee version first.

4. My credit card company closed my account with a balance. What now?

Keep making payments as usual and don’t miss due dates. It still counts toward your score.

5. What’s better: TransUnion or Equifax scores when closing accounts?

Lenders use different bureaus, but if one score drops significantly due to closure, focus on rebuilding through responsible usage.

Need more credit repair help or unsure about your next steps? Sign up for the 5x5 Credit Veto Challenge and start seeing changes in just 5 days.

Don’t just close cards; open up your financial future.

Comments ()