Credit Repair & Business Funding for Realtors

Realtors can convert denied buyers into future closings by pairing evidence-based credit correction with funding readiness in one documented workflow.

Short answer: Many buyers fall out due to credit inaccuracies or a lack of capital. Pairing credit repair for realtors with business funding for real estate inside one documented workflow turns today’s “not yet” into tomorrow’s closing, without hype or guarantees.

Do you know that thousands of real estate agents lose many qualified buyers to credit issues or a lack of capital annually? But then, an education-first, documented approach (credit repair for realtors paired with business funding for real estate) can turn today’s “not yet” into tomorrow’s closing, without hype or guarantees.

This article shows realtors and brokers how to manage credit accuracy and funding readiness in one trackable, audit-ready system.

Why Pair Credit Repair With Business Funding?

A buyer who is denied often needs two things:

- Accurate credit reporting

- A plan to access capital when appropriate.

Treating these as separate, uncoordinated services creates delays and lost trust. A unified workflow lets agents track progress, set expectations, and reengage prospects when they’re truly ready (helping teams scale a credit repair business capability alongside their core practice).

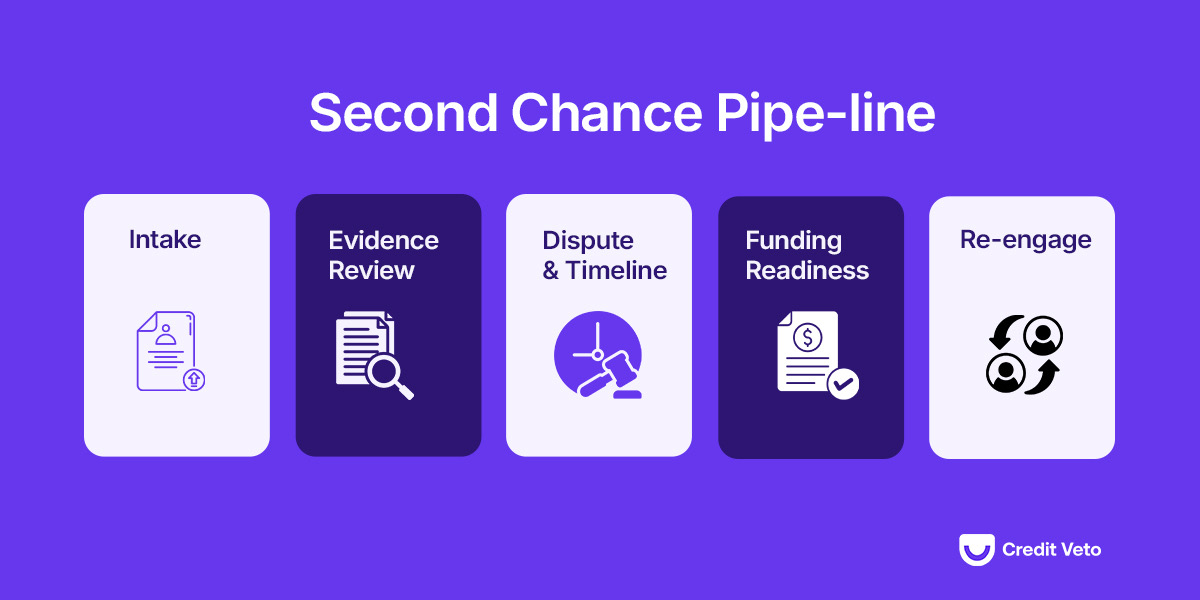

A Second-Chance Framework for Real Estate Agents

In the competitive world of real estate, many potential buyers are lost due to credit issues. But with a clear, easy-to-follow pipeline, you can help these buyers and turn them into clients. By combining credit repair and funding help, you can make sure no opportunity goes to waste.

Here’s how you can set up your second-chance framework:

- Stage 1: Intake & Consent

First, gather the necessary client information and ask for permission to review and help fix their credit. This keeps everything clear and honest right from the start in a clear and honest way.

Add-on detail: Capture consent digitally, confirm identity (KYC), and record the buyer’s objective (home purchase timeline, price band). For real estate agent bad credit cases, validate which issues are inaccurate versus accurate but improvable (e.g., utilization).

- Stage 2: Evidence-Based Credit Review

Next, check the credit report to find any mistakes or things that can be fixed. Identify exactly what needs to be corrected, and make sure everything is clearly written down.

Add-on detail: Tie each dispute item to exhibits (statements, letters, identity docs). Mark the Date of first delinquency (DOFD) and create a round plan. Do not dispute accurate, verifiable data; document it and coach the client on behavior changes (on-time streaks, lowering revolving balances).

- Stage 3: Dispute & Timeline Tracking

Send out the requests for corrections and keep track of when they are due for a response. Make sure to mark the dates when you expect results so you can follow up in time.

Add-on detail: Use SLA timers for bureau reinvestigations, log tracking numbers or e-notary confirmations, and post status in the client portal (“Round started,” “Awaiting responses,” “Results posted”).

- Stage 4: Funding-Readiness Checklist

Once the credit is fixed, gather the documents needed for business funding. Show the client how to get ready for a loan or other financial support by explaining what needs to be done.

Add-on detail: Build a short list by product type, such as bank statements, proof of income, entity docs if applicable, and purchase intent. Route to business funding for real estate options (lines, loans) as appropriate, or coach for mortgage pre-qualification if that is the end goal.

- Stage 5: Re-Engage for the Transaction

Finally, after everything is in order, go back to the client and offer them a chance to move forward. Let them know what’s been fixed and how they can now move toward getting the funding or house they want.

Add-on detail: Share a results one-pager (what changed, what didn’t, next steps). Book the buyer with your lender or your funding partner, and update your pipeline to track contract-ready milestones.

This framework makes it easy for real estate agents to help clients who might have been turned down before. It’s all about providing a clear path that combines credit repair and funding help, leading to successful outcomes. For consumers’ rights and dispute mechanics, see the Consumer Financial Protection Bureau’s guidance on correcting credit report errors.

Governance That Protects Clients and Your Brand

When running a real estate business, especially one that handles credit repair and funding, it’s important to follow clear rules and guidelines to keep things smooth and safe for both your clients and your business.

Just like regulated industries, creating a system of checks and balances, known as governance, will help you stay organized and maintain trust as your business grows.

Here’s how you can set up governance for your team:

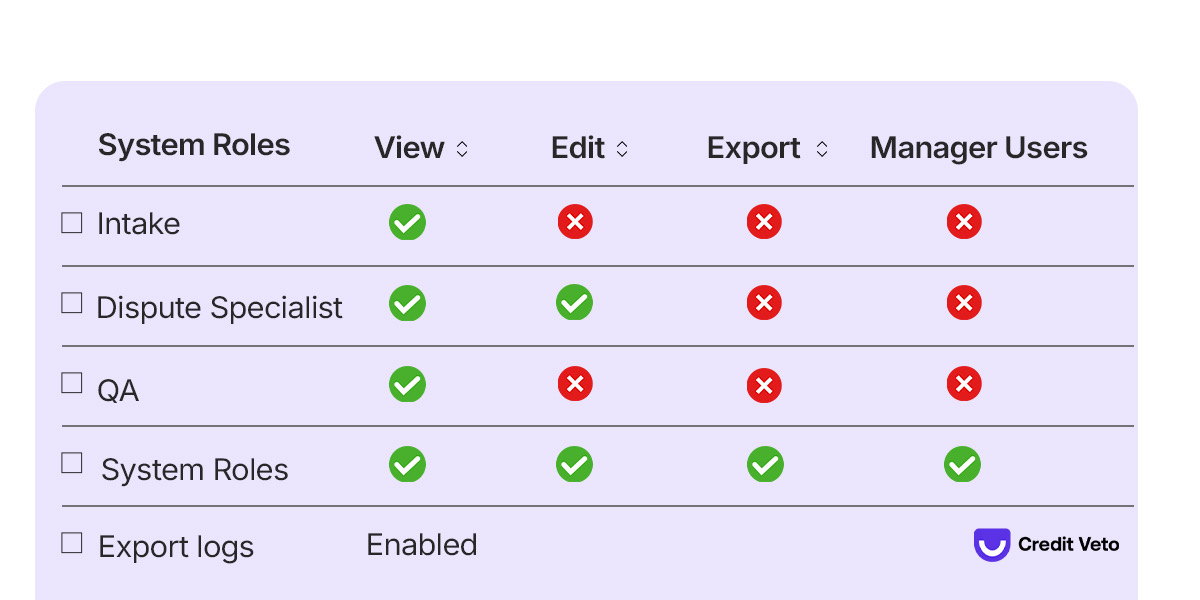

1) Roles & Permissions (RBAC)

Make sure that only the right people have access to the information they need. For example, someone working on intake shouldn’t have access to the same data as a dispute specialist or someone handling client success.

This helps ensure that your team is working with the right information, but it also protects sensitive client data. Set up access controls that limit what each role can see and do, keeping everything secure and organized.

Add-on detail: Enforce multifactor authentication (MFA), session timeouts, and disable “everyone is admin.” For real estate agent bad credit files, limit exports to named roles only.

2) Export Controls & Logs

It’s important to track who is accessing what documents and when. For example, if someone downloads a credit report or a client’s personal information, make sure you can see who did it and at what time.

Regularly reviewing these logs (weekly is a good rule of thumb) helps spot any unusual activity and ensures your data stays protected.

Add-on detail: Flag mass exports, watermark sensitive PDFs, and keep a monthly audit report for broker oversight.

3) Document Control

Establish a system for naming files, organizing folders, and storing documents in a way that’s easy to manage. For example, you could use standard names for files (like “ClientName_CreditReport”) and set up folders by stages (e.g., “Intake Documents,” “Dispute Letters,” “Funding Forms”).

Make sure to redact any personal details before sharing files with clients, especially in client portals. Additionally, make sure you have clear rules on how long documents should be kept and when they should be securely deleted to comply with privacy rules.

Add-on detail: Encrypt at rest and in transit. The test is restored quarterly. This is essential if you want to scale credit repair business operations in a brokerage context.

4) Quality Assurance (QA)

Double-checking your work is key to maintaining a high level of service. Before sending anything out, make sure a second person reviews it for accuracy; this is a two-step pre-send review process.

Additionally, regularly sample previous documents to ensure everything is consistent and on track. Having a structured QA process will help maintain high standards and build trust with your clients.

Add-on detail: Code outcomes (corrected/deleted/verified/ follow-up) and teach agents how to explain them neutrally—no promises about deletions, scores, or approvals.

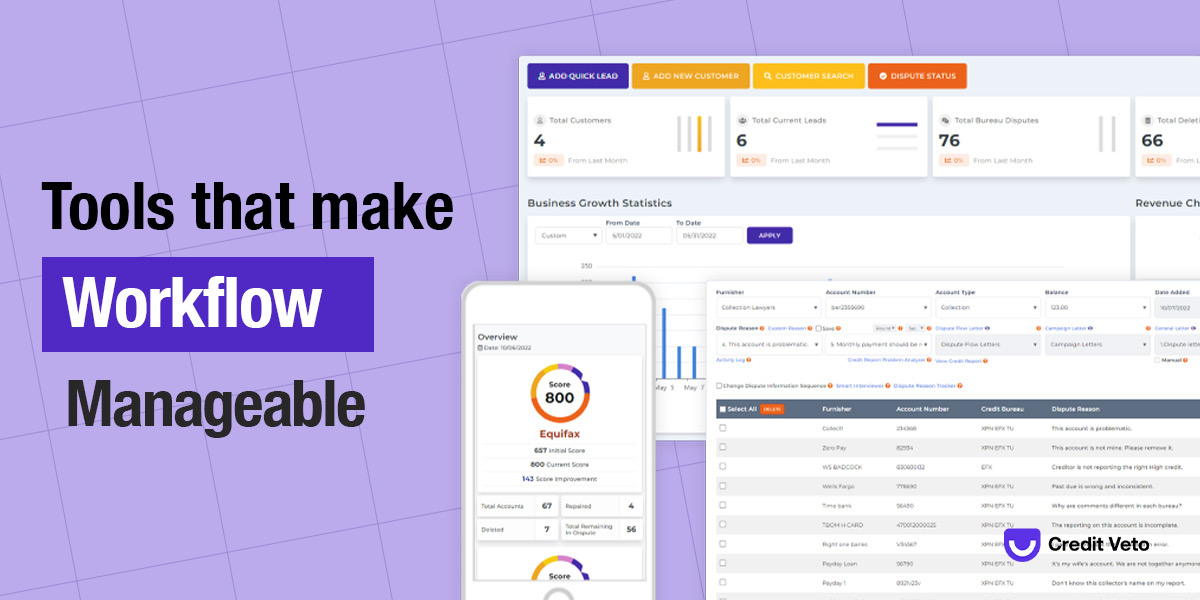

Tools That Make the Workflow Manageable

When choosing credit repair business software, focus on features that streamline your workflow, like lead capture, one-click audits, digital onboarding, automated reminders, and results summaries. These tools help manage tasks efficiently and keep your process compliant.

For example, Credit Veto Pro offers lead-capture pages, automated workflows, one-click audits, and all-in-one case management. These features allow real estate teams to track timelines, document evidence, and keep clients updated without disputing accurate entries.

Add-on detail (selection checklist):

- Client portal with updates and document uploads

- SLA timers for bureau windows and follow-ups

- Funding workflows (intake → doc checklist → lender routing → status → payouts)

- Payments & signatures with audit logs

- Territory options if you partner with multiple offices/zip codes

Messaging That Respects Compliance (and Converts Better)

- Set expectations:“We correct report inaccuracies and document timelines; results vary.”

- Explain the “why”: Show the specific field that’s wrong and the correction requested.

- Avoid outcome language: No promises of deletions, scores, or approvals.

- Keep updates predictable: “Round started,” “Awaiting responses,” and “Results posted,” with what changed / what didn’t / next steps.

This neutral, explain-the-work approach consistently outperforms hype in retention and referrals—for both credit repair for realtors and business funding for real estate programs.

What Good Looks Like (A Quick Scorecard)

- On-time reviews ≥ 95% (investigation windows tracked)

- Evidence completeness ≥ 90% (each disputed item has labeled exhibits)

- Outcome coding in every case (corrected/deleted /verified / follow-up)

- Client-visible summaries ( one-pagers each cycle)

- Secure handling (RBAC enforced; export logs reviewed; redactions for previews)

Add-on: KPIs to watch in your dashboard

- Lead → consult → program start rate for “denied” cohort

- Time-to-readiness (credit milestones hit)

- Funding pre-approval and approval rates

- Re-engaged buyer conversion to contract/close

Responsible Re-Engagement of Your Database

Many CRMs hide opportunity in “Denied,” “Cold,” or “Nurture” buckets. Re-engagement should be consent-based and educational, not promotional:

- Segment by reason (credit accuracy vs capital needs).

- Offer a short explainer (funding-readiness or credit-accuracy), not a pitch.

- Provide a simple opt-in for an assessment and set the next milestone date, not a hard sell.

For example, email to the “real estate agent bad credit” cohort:

Subject: Your path to mortgage-ready

Body: We’ve added a documented, no-hype path to credit accuracy and funding readiness. If you’d like a quick review and timeline, reply “READY,” and we’ll send your next two steps.

Takeaways for Realtors

- Treat credit accuracy and capital access as one documented workflow, not two disconnected services.

- Adopt governance (roles, permissions, QA, document control) before volume scales.

- Choose tooling that supports evidence handling, timelines, client updates, and audit trails.

- Keep communications neutral and educational; let the documentation, not promises, do the convincing.

Conclusion

If you’re a realtor or broker, the fastest way to win back “not yet” buyers is to unify credit accuracy and funding readiness into a single, auditable workflow.

The second-chance framework above (intake and consent, evidence-based review, and timeline tracking, funding readiness, and clean re-engagement) lets you deliver progress without hype and convert more buyers when they’re truly eligible.

Pair it with governance (RBAC, export logs, QA) and the right credit repair business software, and you’ll scale credit repair business capability inside your real estate shop the right way.

Want to operationalize this playbook fast? Credit Veto Pro is the ScaleTech platform for real estate agents, as we provide your credit repair and business funding in one compliant system. Book a 15-minute strategy call today and get started.

FAQs (People Also Ask)

- What is “credit repair for realtors,” exactly?

It’s a documented, evidence-based process to correct inaccurate credit reporting (with exhibits and timelines) so buyers can progress toward mortgage-ready or funding-ready—without disputing accurate, verifiable items.

- Can real estate agents handle business funding for real estate, too?

Yes, if you use a compliant workflow: eligibility checks, document checklists, lender routing, and clear disclosures. Many realtors on the Credit veto pro platform run credit and funding in one system.

- How long does credit correction take before a buyer is ready?

Timelines vary. Bureau reinvestigations typically run on fixed windows; behavior changes (like lowering utilization) can help within 1–3 cycles. Set expectations in the portal and update with what changed / what didn’t.

- Is this approach compliant?

Yes—when operated correctly. Only dispute inaccuracies, maintain RBAC, keep export logs and audit trails, and avoid outcome promises (deletions, scores, approvals).

- What software should a realtor use to scale this?

Choose credit repair business software with a client portal, SLA timers, funding workflows, audit trails, and RBAC. Platforms like Credit Veto Pro unify both services in one pipeline.

- How do I re-engage my denied/old leads without spamming?

Segment by reason (credit vs capital), send a short educational note, and invite them to opt in for an assessment and milestone plan. Keep communications consent-based and value-first.

- Will offering credit help make us seem like we promise approvals?

Not if you message it correctly: “We correct inaccuracies and document timelines; results vary.” Focus on education and documentation, not guarantees.

- What KPIs should I track as we scale?

On-time reviews ≥95%, evidence completeness ≥90%, funding pre-approvals and approvals, re-engagement conversion, and closed-loop analytics (where buyers stall and why).

Comments ()