Do Credit Fixing Companies Work? When They Help and When They Don’t

Short answer: Yes, credit fixing companies work when there are real errors, unauthorized activity, or inaccurate information on your credit report. They do not work when someone expects legal negative items to disappear without time, proof, or proper rebuilding.

If you are searching for whether credit fixing companies actually work, the confusion usually comes from unrealistic promises made by bad actors in the industry, not from what legitimate credit repair is designed to do.

This guide explains what credit fixing companies can and cannot do, when their services are effective, when they are a waste of money, and how to know if working with one makes sense for your situation.

What Credit Fixing Companies Are Legally Allowed to Do

Credit fixing companies, also called credit repair companies, operate under federal law . Their role is not to magically erase bad credit. Their job is to help consumers correct inaccurate, incomplete, or unverifiable information on their credit reports.

Legitimate credit fixing companies focus on:

- Incorrect personal information

- Accounts that do not belong to you

- Unauthorized hard inquiries

- Duplicate or misreported collections

- Inaccurate balances or late payments

- Negative items that should have aged off

They work by disputing these items with Experian, Equifax, and TransUnion using consumer protection laws like the Fair Credit Reporting Act (FCRA).

This is why the answer to “Do credit fixing companies work?” depends entirely on what is actually on your credit report.

Do Credit Fixing Companies Work in Real Life?

Yes, when there is something to fix.

Credit fixing companies work best for people who:

- Have errors across one or more credit bureaus

- Were affected by identity mix-ups or old data

- Have collections reported incorrectly

- See different information across Experian, Equifax, and TransUnion

- Have negative items close to aging off but still reported

In these situations, dispute work often leads to score improvements within weeks or months.

Discover: 7 Proven Ways to Dispute a Credit Report

When Credit Fixing Companies Actually Work

Credit fixing companies work best when there is something provably wrong with your credit file.

They are effective if you have:

- Errors on your credit report

- Accounts you do not recognize

- Incorrect addresses or personal details

- Duplicate collections

- Old negative items close to aging off

- Unauthorized credit inquiries

In these cases, disputing inaccurate data can lead to real score improvements, sometimes within weeks.

Credit fixing also works best when combined with:

- Proper credit rebuilding

- Lower credit utilization

- On-time payments

- Smarter credit usage

This combination is what produces lasting results, not just short-term score bumps.

See Also: Default Credit Score: The Surprising Truth & Alternative Scores

When Credit Fixing Companies Do Not Work

Credit fixing companies do not work when someone expects them to remove accurate, legally reported information.

They cannot:

- Remove legitimate late payments just because you regret them

- Delete accurate collections without a creditor agreement

- Erase bankruptcies before the legal reporting period ends

- Change your score if spending habits stay the same

If your credit report is accurate but damaged due to missed payments or high debt, credit repair alone will not fix the problem. Rebuilding behavior matters just as much.

This is where many people conclude credit fixing companies do not work, when in reality, they were expecting the wrong outcome.

Why People Think Credit Fixing Companies Don’t Work

Most negative reviews come from mismatched expectations.

Common reasons people feel it “didn’t work”:

- They had no real errors to dispute

- They stopped the process too early

- They did not rebuild credit alongside disputes

- They expected score jumps without behavior changes

Credit fixing is a process, not a one-time action.

How Long Does Credit Fixing Take to Work

Credit fixing is not instant.

Typical timelines include:

- 30 to 45 days for first dispute responses

- 60 to 90 days for visible improvements

- 3 to 6 months for stronger score movement

- 6 to 12 months for major profile recovery

People who see the best results are consistent and follow rebuilding steps alongside disputes.

At Credit Veto, this is why repair and rebuilding are treated as one system, not separate actions.

Credit Fixing vs Doing It Yourself

You can dispute errors yourself for free

So why do people hire credit fixing companies?

Because:

- The process is time-consuming

- Many disputes require follow-up and strategy

- People miss violations or report them incorrectly

- Consistency matters more than effort

A good credit fixing company brings structure, tracking, and experience that most consumers do not have time to manage.

What Makes a Credit Fixing Company Legit?

A legitimate credit fixing company will:

- Explain exactly what can and cannot be removed

- Focus on credit report accuracy, not promises

- Show you the dispute process step by step

- Encourage credit rebuilding, not shortcuts

- Comply with the Credit Repair Organizations Act

Transparency is the biggest trust signal.

Why Some Credit Fixing Companies Fail Clients

The biggest reason people feel credit fixing does not work is poor execution.

Common problems include:

- No clear process

- No follow-up on disputes

- No education on rebuilding

- No visibility into what is being done

- Overpromising fast results

Credit repair fails when it lacks structure, transparency, and guidance.

Do Credit Fixing Companies Work Better With Rebuilding?

Yes. Always.

The best results come when fixing is combined with:

- Lower credit utilization

- On-time payments

- Smarter credit use

- New positive accounts added correctly

Fixing removes obstacles. Rebuilding creates long-term strength.

How CreditVeto Helps You Fix Credit the Right Way

CreditVeto focuses on accuracy, structure, and rebuilding, not empty promises.

We help you:

- Identify real errors across all bureaus

- Handle disputes properly and consistently

- Track progress clearly

- Rebuild credit alongside fixes

- Avoid repeat reporting issues

So if you are still asking, “do credit fixing companies work?”, the better question is whether your report actually has issues that can be corrected.

You can start by reviewing your credit the right way at Credit Veto and decide your next step with clarity, not guesswork.

Many People Enjoyed Reading: How to Scale a Credit Repair Business the Right Way

Final Verdict

Yes, credit fixing companies work when there are legitimate problems to fix and when the process is done correctly.

They are not magic.

They are not scams by default.

They are tools.

Used the right way, they help people clean their reports, recover lost points, and qualify for approvals faster.

Frequently Asked Questions

Do credit fixing companies really remove negative items?

Yes, but only when the information is inaccurate, unverifiable, outdated, or reported incorrectly. Credit fixing companies cannot legally remove correct negative information.

Is credit fixing legal in the United States?

Yes. Credit fixing is legal under the Fair Credit Reporting Act (FCRA) and regulated by the Credit Repair Organizations Act (CROA). What’s illegal are false promises and advance-fee scams.

Can credit fixing companies raise your score?

They can help raise your score indirectly by removing errors that are dragging it down. Score increases depend on how many issues are corrected and how your overall credit profile is managed.

How do I know if I actually need a credit fixing company?

You need one if:

You see different information across credit bureaus

You notice accounts or inquiries you don’t recognize

You’ve disputed before with no results

Your report feels confusing or inconsistent

Are credit fixing companies better than doing it yourself?

They are not “better” by default, but they are more consistent and structured. Many people hire help because they lack time, clarity, or follow-through.

Do credit repair restoration services work?

Yes, credit repair services work when your credit report contains errors, outdated negative items, or unauthorized activity. They do not create shortcuts, but they help remove inaccuracies that legally should not be there.

Can credit repair remove collections from my credit report?

Credit repair can remove collections if they are inaccurate, duplicated, unverifiable, outdated, or reported incorrectly. Legitimate collections may not be removed unless errors are found or a settlement agreement includes deletion.

Are credit repair companies worth it?

Credit repair companies are worth it if you lack the time, knowledge, or consistency to dispute errors yourself. They add value by managing disputes properly, tracking responses, and guiding rebuilding steps that improve results faster.

How a Credit Repair Course Can Improve Your Credit Score and Business Faster

How a Credit Repair Course Can Improve Your Credit Score and Business Faster  How Fast Will a Car Loan Raise My Credit Score? 2026 Real Timeline

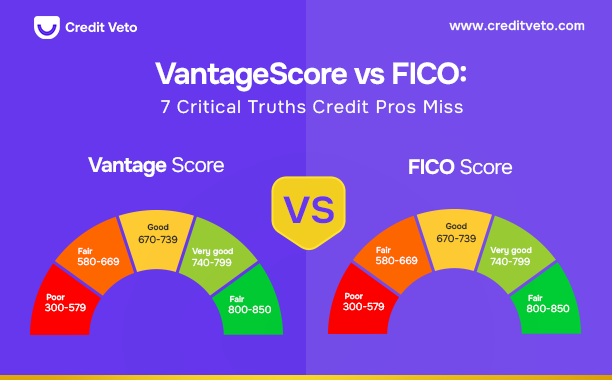

How Fast Will a Car Loan Raise My Credit Score? 2026 Real Timeline  Vantage Score vs FICO: 7 Critical Truths Credit Pros Miss

Vantage Score vs FICO: 7 Critical Truths Credit Pros Miss  What Credit Score Is Needed to Buy a UTV? (Real Limits)

What Credit Score Is Needed to Buy a UTV? (Real Limits)  Does a DUI Affect Your Credit Score? 5 Ways to Protect It

Does a DUI Affect Your Credit Score? 5 Ways to Protect It  How to Remove a Closed Account from Your Credit Report: 3 Best Steps

How to Remove a Closed Account from Your Credit Report: 3 Best Steps  How Long Do Late Payments Stay on Your Credit Report? 2026 Update

How Long Do Late Payments Stay on Your Credit Report? 2026 Update  How Many Credit Cards Should I Have? Avoid These 4 Mistakes

How Many Credit Cards Should I Have? Avoid These 4 Mistakes  How to Check Personal Credit Report: 7 Easy Steps

How to Check Personal Credit Report: 7 Easy Steps

I think one of the most overlooked aspects of credit repair is the time factor. It’s not just about fixing errors, but about consistently rebuilding. Thanks for highlighting that even legitimate companies can’t promise instant results.