Hard Inquiry vs Soft Inquiry: The Real Difference That Can Save or Sink Your Credit Score Fast

Short Answer: A hard inquiry happens when a lender checks your credit for a loan or credit card. It can lower your score slightly for a short time. A soft inquiry happens when you or a company checks your credit for background reasons, and it never affects your score.

Most people in the U.S. believe that every time someone checks their credit, their default credit score drops. That’s not true.

The truth is that credit checks come in two types (hard and soft), and they affect your score very differently.

Many Americans lose points on their credit report because they don’t understand how these checks work. Others avoid checking their credit altogether because they fear a score drop.

But once you understand how hard inquiry vs soft inquiry really works, you’ll stop fearing your credit report and start using it as a tool to build wealth.

Let’s break it down in simple terms.

What Is a Credit Inquiry?

A credit inquiry is a request to look at your credit report. Your credit report is like a personal history file that shows how you’ve handled loans, cards, and payments.

It helps lenders decide if they can trust you with money. Every time a lender, employer, or even you checks your credit, that action is logged as an inquiry.

But here’s what most people miss: not all inquiries are treated equally. Some inquiries tell lenders, “This person is shopping for money,” while others simply say, “This person is checking information.”

That is the difference between a soft and a hard credit check.

Examples of Hard vs Soft Inquiry

Now, let’s understand what a hard and soft credit inquiry is with some examples.

What Is a Hard Inquiry?

A hard inquiry happens when you apply for something that involves borrowing money. This could be a credit card, a mortgage, a car loan, or a personal loan.

A lender checks your credit report to decide whether to approve you. Because they are making a financial decision, the credit bureau records it as a hard pull.

Each hard inquiry can lower your credit score by around two to five points.

It’s not much, but if you apply for many loans or cards in a short period, the drops can add up. A hard inquiry stays on your credit report for two years, but it only affects your score for about twelve months.

Example:

- If you apply for a car loan today, the bank runs a hard inquiry.

- If you apply for three credit cards next week, that’s three more hard inquiries.

The scoring model might see that as risky behavior, like someone short on cash. But if you space out your applications, the impact is small and temporary.

Hard inquiries aren’t bad. They’re just signs that you’re using credit. The key is to manage how often they happen.

What Is a Soft Inquiry?

A soft inquiry is a credit check that does not affect your score. It happens when you check your own credit or when a company does a background or pre-approval check that doesn’t involve a lending decision.

Examples of soft inquiries include:

- Checking your score through credit repair apps and AI-powered systems like that as Credit Veto.

- Getting pre-approved for a loan or card.

- A potential employer is checking your report as part of a background review.

- Insurance companies running risk checks before offering coverage.

Soft inquiries show up on your personal credit report, but only you can see them. Lenders cannot. That means you can check your score every day if you want to, and your credit will stay the same.

Hard vs Soft Credit Pull: The Real Difference

The biggest difference between a hard and soft credit pull is how they affect your score.

A hard credit pull tells scoring systems that you’re seeking new credit.

A soft pull is just for information, not money.

Here’s a quick way to remember it:

| Type | Who Requests It | Purpose | Visible to Lenders | Affects Score |

| Hard Inquiry | Lender | Credit application | Yes | Yes |

| Soft Inquiry | You or the company | Background check or pre-approval | No | No |

If you’re checking your own score, it’s always a soft credit pull.

If a bank is checking your score to approve a loan, it’s a hard pull.

It’s that simple.

Why Many People Get This Wrong

A lot of people avoid checking their credit out of fear. They think that every look at their report will damage their score. That’s why misinformation spreads. But ignoring your credit is actually worse. You can’t fix what you don’t see.

Checking your credit score regularly is one of the best ways to stay alert for fraud or errors. Soft checks are your friend. They help you see where you stand without hurting your score.

The real problem is not checking your credit; it’s applying for too many loans too quickly.

The Hidden Impact on Lenders and Borrowers

Lenders use both types of inquiries differently. When they run a hard inquiry, they’re judging your risk. When they run a soft one, they’re screening you as a potential customer.

For example, when you get those “You’re pre-approved!” credit card offers in the mail, that’s based on a soft pull. The company reviewed your report lightly to see if you fit their requirements.

When you respond to that offer and apply, it turns into a hard inquiry. So one inquiry can actually turn from soft to hard depending on your next action.

The Shopping Window Secret

Here’s something the credit bureaus don’t always make clear. If you apply for several car loans or mortgages within a short period, the system treats those multiple inquiries as one.

Why?

Because it assumes you’re shopping for the best rate, not desperate for credit. This window is usually 14 to 45 days long, depending on the scoring model.

So if you’re comparing mortgage rates from three banks in two weeks, that counts as one hard inquiry.

Smart borrowers use this rule to their advantage. It lets you shop around without damaging your score.

How to Handle Hard Inquiries Without Hurting Your Score

Here are the top 5 key strategies you can use to handle a hard inquiry affecting your credit score.

- Plan before applying.

Only apply for credit when you truly need it. Don’t fill out every pre-approval you see. - Space out your applications.

Give at least three to six months between major applications. - Monitor your credit reports often.

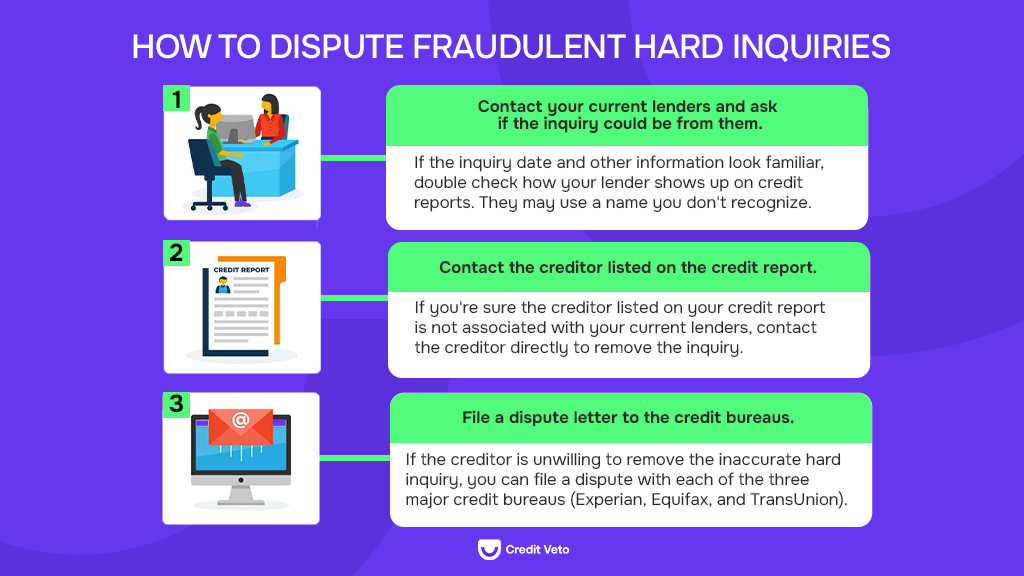

Check for unauthorized inquiries. You can get free reports from annualcreditreport.com or use systems like Credit Veto. - Dispute any inquiry you didn’t approve.

Unauthorized hard inquiries can be removed by contacting the credit bureau or working with a credit repair company like Credit Veto. - Build a strong payment history.

A few hard inquiries won’t hurt if you consistently pay on time and keep low balances.

Remember, lenders look at your full profile, not just one score drop.

Why This Knowledge Matters

A single misunderstanding about credit checks can cost you real money. People with strong scores get better loan rates, lower interest rates, and higher limits.

People with weak scores pay more for the same things: cars, apartments, phones, and insurance. The difference between a soft and hard credit check could mean saving hundreds or losing them.

For instance, someone with a 760 score might get a 5% rate on a car loan, while someone at a 680 score pays 8%. That small gap costs thousands over the life of the loan.

Understanding how inquiries work helps you stay in control of your credit journey.

Common Myths About Hard and Soft Inquiries

- Every credit check lowers my score.

False. Only hard inquiries can lower your score.

- I shouldn’t check my score often.

False. Checking your score through a soft pull keeps you informed and safe.

- Hard inquiries ruin your credit.

False. The impact is small and temporary unless you apply for many accounts at once.

- You can’t remove hard inquiries.

False. If a company checked your credit without consent, it can be disputed and removed.

- Soft inquiries don’t matter.

False. While they don’t affect your score, they help you catch identity theft and monitor your credit growth.

The Emotional Side of Bad Credit

Building credit can be stressful. Many people feel judged by a number they don’t fully understand. But your credit score isn’t a report card on your worth.

It’s simply a measure of financial behavior that can change over time. Every good payment, every low balance, and every responsible move adds up.

Knowing how hard inquiry vs soft inquiry works gives you control again. You’re not at the mercy of lenders. You can plan, build your credit, grow smarter, and even start helping others do the same and earn from it.

Read Also: How to Become a Certified Credit Repair Specialist in 2025 (Even If You’re Starting from Scratch)

Conclusion

The difference between a soft and hard credit check is small in definition but huge in impact. Soft inquiries are safe and help you stay informed.

Hard inquiries matter only when they pile up. If you’ve been rejected for credit or notice too many hard inquiries on your report, don’t panic.

At Credit Veto, we help U.S. residents remove unauthorized inquiries, fix reporting errors, and build healthy credit that lenders respect. Sign up with us today to be among the elite with exceptionally good credit.

Your credit report should be your advantage, not your barrier. Start cleaning up your report with us and start building the score you deserve.

Frequently Asked Questions (FAQs)

Do soft inquiries show up on my credit report?

Yes, but only you can see them. Lenders cannot.

How long do hard inquiries stay on my report?

They remain for two years but affect your score for only about twelve months.

How many points can a hard inquiry lower my score?

Usually between two and five points, depending on your current credit standing.

Can I remove a hard inquiry from my report?

Yes, if it was unauthorized. Contact the credit bureaus or reach out to Credit Veto for help.

Are soft credit checks safe?

Yes. They never harm your score and help you monitor your report safely.

Is it okay to have multiple hard inquiries?

Yes, if they are spread out or related to rate shopping for one type of loan.

What is the fastest way to recover from multiple hard inquiries?

Keep your balances low, pay bills on time, and avoid applying for new credit for a few months.

What is the difference between hard inquiry and soft inquiry?

A hard inquiry happens when you apply for credit and can lower your score slightly. A soft inquiry happens for background checks and does not affect your score.

What is an example of a hard inquiry?

Applying for a car loan, mortgage, or credit card.

What is an example of a soft inquiry?

Checking your own credit score on Credit Karma or getting pre-approved for a loan offer.

Does a hard inquiry mean I got approved?

No. It only means the lender reviewed your report. Approval depends on their decision after reviewing your credit.

How Long Do Late Payments Stay on Your Credit Report? 2026 Update

How Long Do Late Payments Stay on Your Credit Report? 2026 Update  How Many Credit Cards Should I Have? Avoid These 4 Mistakes

How Many Credit Cards Should I Have? Avoid These 4 Mistakes  How to Check Personal Credit Report: 7 Easy Steps

How to Check Personal Credit Report: 7 Easy Steps  How a Credit Repair Course Can Improve Your Credit Score and Business Faster

How a Credit Repair Course Can Improve Your Credit Score and Business Faster  How Fast Will a Car Loan Raise My Credit Score? 2026 Real Timeline

How Fast Will a Car Loan Raise My Credit Score? 2026 Real Timeline