How Fast Will a Car Loan Raise My Credit Score? 2026 Real Timeline

Short Answer: How fast will a car loan raise my credit score? Most people begin to see credit score improvement within 3 to 6 months after making consistent on-time payments. Larger improvements usually happen between 6 and 12 months, depending on your starting score, payment history, and overall credit profile.

You bought a car. You’re making payments. Now you’re waiting. And the question keeps coming back.

“How fast will a car loan raise my credit score?”

This question matters more than most people realize. Your credit score affects your ability to qualify for mortgages, business funding, credit cards, and lower interest rates. A car loan can help, but the timing depends on what happens after the loan appears on your credit report.

Many people expect instant results and feel frustrated when nothing changes in the first month. Others see small increases and wonder if it will continue.

The good news is that a car loan can have a positive impact on your credit score, especially if you manage it well. However, the timeline for seeing improvements can vary depending on several factors. In this blog post, we’ll break down the steps involved and give you a realistic timeline for how long it typically takes for a car loan to raise your credit score.

What Happens First When You Open a Car Loan

Before your score increases, something else usually happens. Your score may drop slightly.

This happens because:

• A hard inquiry appears

• Your total debt increases

• The account is brand new

This drop is usually small. Often between 5 and 20 points. This is temporary. What matters next determines how fast a car loan will raise your credit score.

What Happens to Your Credit Score When You Take Out a Car Loan?

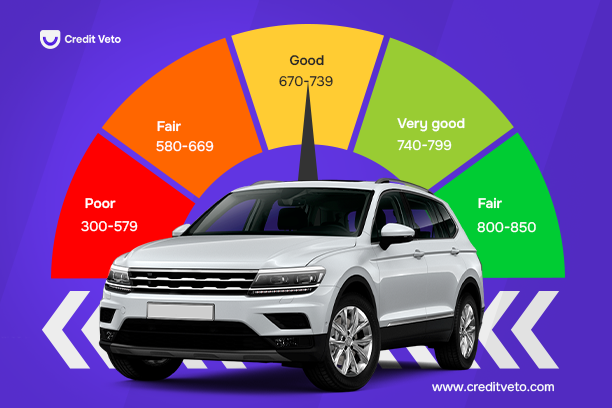

When you take out a car loan, it can affect your credit score in several ways. Here’s how:

- Credit Utilization: A car loan increases your total available credit. Since your credit utilization ratio (the ratio of your credit balances to credit limits) accounts for 30% of your credit score, keeping it low is essential. A car loan can improve this ratio if you keep balances on revolving accounts low.

- Credit Mix: Having different types of credit accounts (e.g., credit cards, installment loans like auto loans) can benefit your credit score. A car loan adds to your credit mix, which makes up 10% of your credit score calculation.

- Payment History: The biggest factor in determining your credit score is your payment history, which makes up 35% of your credit score. Timely payments on your car loan will help improve your score over time.

While a car loan can have an immediate negative impact when it’s first reported due to the hard inquiry, the long-term effect can be positive if you consistently make on-time payments.

How Fast Will a Car Loan Raise My Credit Score Based on Timeline

Let’s go through the short, medium, and long-term impact.

Short-Term Impact (0-3 Months)

When you first take out a car loan, your credit score may drop slightly due to the hard inquiry (credit check) conducted by the lender. This usually causes a small dip in your score. However, the dip is typically short-lived.

During the first 30 to 60 days, you may not see any significant improvement in your score. The credit bureaus will first report the loan, and it might take some time before they reflect positive payment behavior.

Mid-Term Impact (3-6 Months)

After three to six months of consistent, on-time payments, you should start seeing a gradual improvement in your credit score. The exact time depends on the factors mentioned earlier, but typically, you will start to see the positive effects as your payment history improves.

This period is crucial for your credit score, as the credit bureaus will begin to notice your responsible credit usage, and your credit utilization ratio may improve, resulting in a modest score increase.

Long-Term Impact (6-12 Months)

The full benefits of your car loan on your credit score will likely be seen after six months to a year. By this point, your credit mix will improve, and the loan will begin to have a more significant, positive effect on your score. If you’ve maintained on-time payments during this period, your credit score will likely see a substantial increase.

This is because timely payments make up a large portion of your score and positively influence your creditworthiness. Additionally, you might see a greater improvement in your score if you have other factors, such as reducing credit card debt or eliminating other negative marks on your report.

This stage answers the full potential of “how fast will a car loan raise my credit score?”

Factors That Affect How Fast Your Car Loan Will Raise Your Credit Score

Here are four pivotal factors you must take note of.

1. Payment History (35% of Your Score)

Making on-time payments is critical to improving your credit score. If you make consistent payments every month, your score will improve over time. Missing payments or making late payments will only hurt your score, especially in the early stages of your car loan.

2. Credit Utilization (30% of Your Score)

Your credit utilization ratio is the second most important factor in your credit score. By taking on a car loan, you’re reducing your overall credit utilization, especially if you maintain low credit card balances. The lower your utilization rate, the better your credit score will be.

3. Credit Mix (10% of Your Score)

Having a good credit mix helps improve your credit score. A car loan adds another layer to your credit mix, which can help strengthen your overall credit profile.

4. Hard Inquiries (10% of Your Score)

Every time you apply for new credit (including a car loan), a hard inquiry is made, which can cause a temporary dip in your score.

However, the impact of a hard inquiry is usually minimal and temporary. Multiple inquiries within a short period, like when applying for a car loan, can lower your score slightly but shouldn’t drastically affect it if managed properly.

How to Maximize Your Car Loan’s Impact on Your Credit Score

If you’re looking to maximize the impact of your car loan on your credit score, here are a few tips:

- Make Timely Payments: Consistency is key. Always pay your car loan on time.

- Keep Your Credit Card Balances Low: Lower your overall credit utilization by keeping your credit card balances as low as possible.

- Avoid Applying for New Credit: Too many new applications can hurt your credit score. Only apply for credit when necessary.

Why a Car Loan Can Increase Your Credit Score

Car loans help your score in three main ways.

1. Payment History Improves

Payment history makes up 35 percent of your credit score. Each on-time payment increases trust. This is the most important factor.

2. Credit Mix Improves

Credit scoring models reward variety. A car loan adds installment credit. This makes your profile stronger.

3. Long-Term Account Stability

Older accounts improve your score. Over time, your car loan becomes a positive reference.

What Slows Down Credit Score Growth After a Car Loan

Not everyone sees fast improvement. These mistakes slow progress:

- Collections

- Late payments

- High credit card balances

- Errors on your credit report

These issues block the positive impact. This is why some people ask how fast a car loan will raise my credit score and see slower results.

Biggest Mistake People Make After Getting a Car Loan

They stop managing the rest of their credit. A car loan helps. But your full credit profile determines results.

This includes:

- Errors

- Collections

- Credit cards

- Payment history

Fixing these increases score growth faster.

How Credit Veto Can Help You Improve Your Credit Score

At Credit Veto, we understand the importance of managing your credit score, especially when making significant financial moves like purchasing a car. Our platform offers a variety of tools to help you repair, monitor, and optimize your credit profile, ensuring that your car loan’s impact on your credit score is as positive as possible.

- Dispute Errors: We help you identify and dispute errors on your credit report to ensure accuracy.

- Credit Monitoring: Keep track of your credit score and changes in real-time.

- Personalized Advice: Get actionable steps to improve your credit and maximize your loan benefits.

If you want to ensure your car loan is working for you and not against you, visit CreditVeto today for expert guidance.

Final Answer: How Fast Will a Car Loan Raise My Credit Score

Most people see improvement within 3 to 6 months. Larger increases happen within 6 to 12 months. Long-term improvement continues as long as payments remain on time.

A car loan can be one of the fastest ways to build credit if managed correctly, but it requires time and discipline. By making on-time payments, keeping credit utilization low, and understanding the factors that affect your credit score, you can maximize the benefits of your car loan.

Take proactive steps by signing up with Credit Veto to ensure that your loan improves your credit in the long term.

Frequently Asked Questions (FAQs)

- How fast will a car loan raise my credit score after first payment

Typically, you’ll see improvements in your score after 3 to 6 months of timely payments.

- Does a car loan hurt your credit score?

A car loan can cause a temporary dip due to a hard inquiry, but over time, it can improve your credit score with consistent, on-time payments.

- Can I get approved for a car loan with a 600 credit score?

Yes, it’s possible, but expect higher interest rates and less favorable terms.

- Will a car loan increase my credit score immediately

No. It may drop slightly first before improving.

- How many points will a car loan raise my credit score

It varies, but increases of 20 to 60 points over time are common.

- Does paying off a car loan increase a credit score

Yes. It helps, but keeping accounts open longer often helps more.

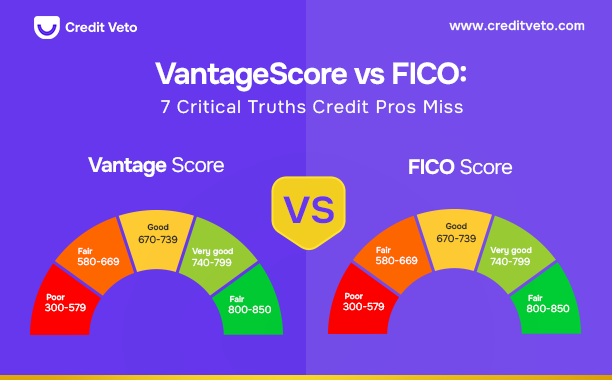

Vantage Score vs FICO: 7 Critical Truths Credit Pros Miss

Vantage Score vs FICO: 7 Critical Truths Credit Pros Miss  How to Read a Business Credit Report: 5 Key Tips for Success

How to Read a Business Credit Report: 5 Key Tips for Success  How to Read a TransUnion Credit Report (Your Complete Guide)

How to Read a TransUnion Credit Report (Your Complete Guide)  What Credit Score Is Needed to Buy a UTV? (Real Limits)

What Credit Score Is Needed to Buy a UTV? (Real Limits)  Does a DUI Affect Your Credit Score? 5 Ways to Protect It

Does a DUI Affect Your Credit Score? 5 Ways to Protect It  How to Remove a Closed Account from Your Credit Report: 3 Best Steps

How to Remove a Closed Account from Your Credit Report: 3 Best Steps  How Fast Will a Car Loan Raise My Credit Score? 2026 Real Timeline

How Fast Will a Car Loan Raise My Credit Score? 2026 Real Timeline