How to Become a Credit Repair Agent and Succeed in 2026

Short Answer: To become a credit repair agent in 2026 and succeed, you must understand the credit repair process, stay compliant with regulations, build effective communication strategies, and leverage modern systems for lead generation and client management. It requires training, knowledge of credit laws, and the right tools, which can be learned through structured programs like Credit Veto’s CCFC course.

How to become a credit repair agent is a question many people ask when they’re looking to help others fix their financial futures while building a rewarding career. If you are part of them, you must understand that in 2026, credit repair is more essential than ever. With millions of people struggling to maintain good credit, and 46% Americans struggling with credit card debt as of 2025, the demand for credit repair services continues to rise.

This guide will walk you through the essential steps to becoming a credit repair agent, helping you understand the core skills, legal responsibilities, and systems you’ll need to succeed in the industry. Whether you want to start your own business or join an established company, we’ve got you covered.

Why Becoming a Credit Repair Agent Is Still a Smart Career in 2026

In 2026 and beyond, credit repair will definitely still be an in-demand industry. With rising costs, debt, and financial uncertainty, an increasing number of individuals and businesses are seeking professional help to improve their credit scores. As credit reporting becomes more complex and the number of financial products increases, the need for reliable credit repair agents has never been greater.

As an agent, you have the opportunity to not only help people regain financial freedom but also build a business that generates consistent revenue. The demand for credit repair services is not waning; in fact, it is increasing as more people look for solutions to their credit issues in today’s economy.

Moreover, the flexibility to run a credit repair business from home makes it an attractive career option, particularly when paired with the right systems to streamline operations and automate workflows.

Read Also: How to Become a Credit Repair Specialist (Even if You’re Starting From Scratch)

Credit Repair vs Credit Counseling: What’s the Difference?

While both credit repair and credit counseling focus on improving financial health, they serve different purposes.

Credit Repair:

- Focuses on fixing errors or outdated items on your credit report.

- Removes negative marks, like late payments or collections, that are legally incorrect or unverifiable.

- Involves direct communication with creditors and credit bureaus to dispute and correct these items.

Credit Counseling:

- Aims to help clients manage debt and improve their financial habits.

- Provides education on budgeting, saving, and handling finances.

- Often involves negotiating with creditors to reduce interest rates or establish payment plans.

While a credit repair agent focuses on improving a client’s credit score through dispute processes, credit counselors offer guidance and management strategies. Both services can be combined for optimal financial recovery.

Step-by-Step Guide: How to Become a Credit Repair Agent

Here are the top 6 steps to follow to become a credit repair agent in 2026.

1. Learn the Fundamentals of Credit Repair

To become a credit repair agent, you first need to understand how credit works. This includes learning about credit reports, credit scores, and the common errors that can harm a person’s credit. Familiarize yourself with the major credit bureaus (Experian, Equifax, and TransUnion) and their processes for reporting and updating credit information.

Some key areas to study include:

- Understanding credit reports: Learn to read and interpret credit reports, identifying errors, outdated items, and negative marks that can be disputed.

- Credit scoring: Know what makes up a credit score (e.g., payment history, credit utilization, etc.) and how it affects loan approvals.

- Legal rights: Get to know the Fair Credit Reporting Act (FCRA), Fair Debt Collection Practices Act (FDCPA), and other laws that protect consumers.

Consider enrolling in a structured credit repair course or training program, like the Certified Credit & Funding Consultant (CCFC) certification program by Credit Veto, to ensure you understand the processes thoroughly and stay compliant with legal requirements.

Step 2: Set Up Your Business (or Join a Company)

Once you have the foundational knowledge, it’s time to decide if you want to work independently or as part of an established company.

- Starting your own credit repair business: If you choose to start your own business, you’ll need to set up a legal structure (LLC, corporation, etc.), register for any necessary licenses, and establish a business bank account. You’ll also need to invest in a reliable system that can help you organize and manage leads, clients, and disputes.

- Joining an established company: If you don’t want to start from scratch, consider joining a credit repair company. Many companies, like Credit Veto, offer great pay and structured systems for new agents. Sign in here.

See Also: Do Credit Fixing Companies Work? When They Help and When They Don’t

3. Gain the Right Tools and Software

One of the most crucial aspects of becoming a credit repair agent is having the right tools to manage your client base, track disputes, and maintain compliance. Systems like Credit Veto Pro are ideal for credit repair agents, offering a full suite of tools to help you automate workflows, track client progress, and maintain a professional appearance.

Investing in software that can handle these tasks will free up your time, allowing you to focus on your clients, rather than getting bogged down in manual work.

Step 4: Build Trust and a Reputation

Trust is key in the credit repair industry. Clients need to feel confident that they’re working with someone who has their best interests at heart. As you begin to take on clients, ensure that you:

- Explain the process clearly: Clients need to know exactly how the credit repair process works, what to expect, and how long it will take. Clear communication will help build trust and prevent misunderstandings.

- Provide consistent follow-up: Many clients will need to be reminded or guided through the process. A system for follow-up will make sure you don’t miss any opportunities.

- Maintain transparency: Never make promises you can’t keep. Be upfront about timelines and potential results.

Step 5: Market Your Services

Once your business is set up and you’ve gained some experience, it’s time to market your services. If you’re an independent agent, start by building a simple website and establishing a presence on social media platforms like LinkedIn, Facebook, or Instagram. Content marketing, like writing educational blog posts or offering free resources, can also help build your reputation as an expert in the field.

For those looking to scale, leveraging paid advertising campaigns or partnering with mortgage brokers and other professionals in the financial industry can be a great way to generate leads.

Step 6: Stay Up-to-Date and Continue Learning

The credit repair industry, like most sectors, evolves. It’s crucial to stay up-to-date with changes in the law, best practices for credit repair, and new tools or software that can help you work more efficiently.

Regularly engage with industry news, take advanced courses, and join forums or communities of fellow professionals. This ongoing education will help you stay competitive and continue offering the best service to your clients.

Learn More: How to Start Your Own Credit Repair Business and Get Clients Fast

Areas to Master To Succeed as a Credit Repair Agent In 2026

To start and succeed in your credit repair business, you must master the following areas :

Training & Knowledge Requirements

Before launching your business, understanding the credit system is essential. You need to:

- Learn how credit reports work and how to read them.

- Understand the Fair Credit Reporting Act (FCRA), Fair Debt Collection Practices Act (FDCPA), and other relevant laws.

- Be familiar with common credit issues like incorrect addresses, outdated collections, and mixed files.

Compliance & Legal Requirements

Credit repair is a regulated industry. To legally offer services, you must:

- Be aware of the Credit Repair Organizations Act (CROA).

- Understand the state-by-state regulations that govern credit repair (some states require licensing).

- Follow ethical standards in communications and business practices.

Tools & Software You Need

Credit repair requires specialized tools to track disputes, manage clients, and ensure compliance:

- Credit Veto helps you organize and manage leads and disputes effectively.

- You will also need credit report tools, billing systems, and client management software to streamline operations.

Certification, Licenses & State Requirements

Credit repair certification is not legally required but is recommended to establish credibility. Some states, however, may require specific licensing. Ensure you check local regulations, as compliance is critical to running a legitimate business.

State-Specific Licenses: Some states require a license to operate as a credit repair agent. Research the specific state laws where you intend to do business.

How Much Credit Repair Agents Make (With Ranges)

The income of a credit repair agent varies depending on several factors, such as location, experience, and the number of clients served. On average, you can expect to earn:

- $30,000 to $80,000 per year for a solo agent or small business

- $100,000+ for larger agencies with multiple clients or a team of agents

While income potential is significant, success depends largely on the number of clients you can manage and the effectiveness of your marketing efforts, and with done-for-you systems like that of Credit Veto Pro, you launch a 6-figure monthly credit repair business via the Dual revenue workflow.

Most In-Demand Credit Repair Skills in 2026

To succeed as a credit repair agent, you need to master key skills:

- Understanding credit laws: Knowing the ins and outs of credit reporting laws.

- Dispute resolution: Handling disputes effectively to remove negative items.

- Customer service: Building trust with clients by explaining the repair process clearly.

- Sales skills: Converting leads into clients through follow-up and relationship building.

- Basic Tech-savviness: Leveraging tools like CreditVeto Pro to streamline operations and manage clients efficiently.

How to Get Your First Clients (Cold and Warm)

Your first clients are likely to come from:

- Past clients or contacts: Reaching out to people who have shown interest in the past. You can literally resurrect dear leads with Credit Veto done-for-you scripts.

- Referrals: Ask existing clients to refer friends or family members.

- Online ads: Leverage low-cost ads on social media to generate leads.

- Networking: Join local or online groups and attend events related to finance, real estate, and credit.

Building a client base takes time, but with structured systems, consistency, and a good follow-up strategy, you can start earning from your efforts quickly.

Case Study: Real Credit Repair Agent Workflow

Here’s a quick example of how a successful credit repair agent might work:

- Initial Contact: The agent receives an inquiry via social media or referral.

- Consultation: The agent discusses the client’s needs and explains the process.

- Report Review: The agent requests a credit report and identifies errors.

- Dispute Process: The agent files disputes with credit bureaus, providing necessary documentation.

- Follow-Up: The agent follows up with clients regularly to check on progress.

- Result Tracking: Once disputes are resolved, the agent updates the client and helps them with rebuilding efforts.

This workflow allows agents to stay organized and deliver consistent results.

Mistakes to Avoid When Starting a Credit Repair Business

Starting a credit repair business comes with its challenges. Avoid these common mistakes:

- Not staying compliant with credit repair laws

- Not following up with clients

- Overpromising results that you cannot guarantee

- Failing to track progress and results

How CreditVeto + CCFC Course Helps

CreditVeto Pro and the CCFC course are designed to make your job easier. CreditVeto Pro provides all the tools you need to track disputes, organize clients, and maintain a compliant system.

The CCFC course teaches you how to communicate effectively with clients, handle objections, and convert leads into loyal customers.

Conclusion

Becoming a credit repair agent in 2026 offers exciting opportunities, but success depends on mastering the skills, laws, and systems that drive results. With the right training, tools, and support, you can build a thriving business that helps people improve their financial futures.

If you’re serious about starting your credit repair journey, Credit Veto, combined with the CCFC course, will give you the system and skills you need to succeed.

Start today and make your credit repair business a success in 2026 and beyond.

Frequently Asked Questions (FAQs)

How long does it take to become a certified credit repair agent?

It typically takes a few weeks to a few months to complete training and certification.

Can I start a credit repair business without experience?

Yes, many successful agents start without prior experience by using structured systems and continuous learning.

Is credit repair profitable?

Yes, with the right systems and consistent client acquisition, credit repair can be highly profitable.

How much does it cost to start a credit repair business?

The cost of starting a credit repair business varies depending on whether you go solo or partner with a company. Key costs include software, training programs, and any legal fees for registering your business.

Can I become a credit repair agent without prior experience?

Yes, you can! As long as you are willing to learn and follow a structured system, you can start a successful credit repair business, even without prior experience.

How long does it take to become a successful credit repair agent?

It typically takes 3-6 months to get a solid client base and build a reputation as a credit repair agent. Success depends on your ability to learn quickly, provide value, and consistently follow up with clients, but with structured systems like Credit Veto, you can fast-track that journey.

What is the best way to find clients for credit repair?

The best way to find clients is through clear communication, follow-up, and leveraging warm leads, such as people who have already asked about credit repair, are seeking funding, or need help with credit issues.

How a Credit Repair Course Can Improve Your Credit Score and Business Faster

How a Credit Repair Course Can Improve Your Credit Score and Business Faster  How Fast Will a Car Loan Raise My Credit Score? 2026 Real Timeline

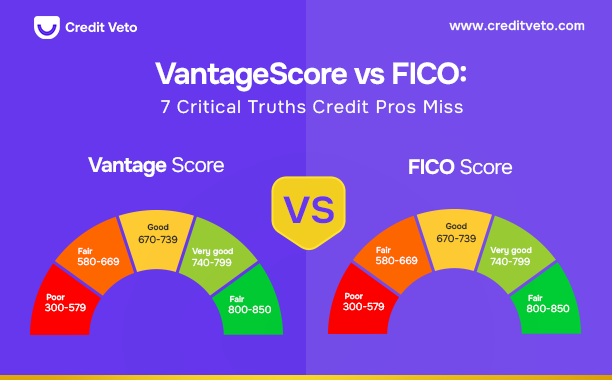

How Fast Will a Car Loan Raise My Credit Score? 2026 Real Timeline  Vantage Score vs FICO: 7 Critical Truths Credit Pros Miss

Vantage Score vs FICO: 7 Critical Truths Credit Pros Miss  What Credit Score Is Needed to Buy a UTV? (Real Limits)

What Credit Score Is Needed to Buy a UTV? (Real Limits)  Does a DUI Affect Your Credit Score? 5 Ways to Protect It

Does a DUI Affect Your Credit Score? 5 Ways to Protect It  How to Remove a Closed Account from Your Credit Report: 3 Best Steps

How to Remove a Closed Account from Your Credit Report: 3 Best Steps  How Long Do Late Payments Stay on Your Credit Report? 2026 Update

How Long Do Late Payments Stay on Your Credit Report? 2026 Update  How Many Credit Cards Should I Have? Avoid These 4 Mistakes

How Many Credit Cards Should I Have? Avoid These 4 Mistakes  How to Check Personal Credit Report: 7 Easy Steps

How to Check Personal Credit Report: 7 Easy Steps