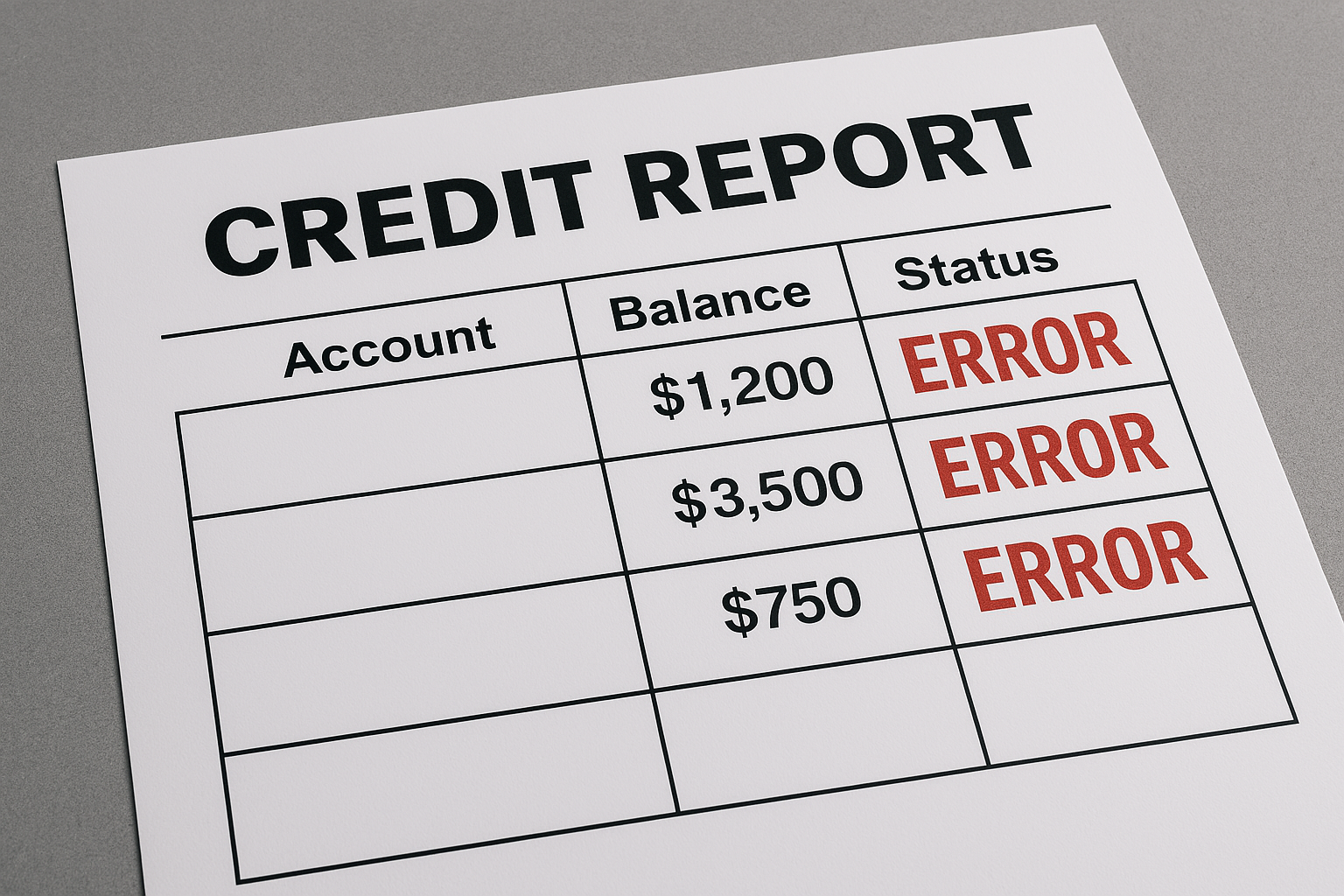

How to Dispute Credit Report Errors and Win Every Time

Credit report errors are more common than you think. Learn how to dispute them step-by-step and win; plus tools and tricks to protect your score for good.

Imagine working hard to rebuild your credit, only to be denied a car loan because of a debt you’ve already paid off. Or worse, something that was never yours in the first place.

This isn’t just frustrating. It’s unfair. And it’s way more common than you’d think.

A Federal Trade Commission study found that 1 in 5 Americans has at least one error on their credit report. These mistakes can cost you higher interest rates, declined applications, and even missed job opportunities. But here's the good news: You can dispute credit report errors and win.

This guide walks you through exactly how to do it, the right way, and introduces a few surprising tools (yes, even things like a totally free background check no credit card needed) that can help along the way.

You’re Not Powerless, You Just Need the Right Playbook

Disputing credit errors used to feel like fighting a giant with a pen. But now, with the Fair Credit Reporting Act (FCRA) on your side and digital tools at your fingertips, you can actually fix mistakes that hurt your credit—and even remove accounts that shouldn’t be there in the first place.

Whether it’s a duplicate account, outdated collection, or an account that’s flat-out fraudulent, this guide will show you:

- What counts as a disputable error

- How to gather the right evidence

- Where and how to submit disputes

- What to do if the bureaus push back

- How to track results—and get results faster.

Common Credit Report Errors (and Why They Matter)

Before you jump into disputing items on your credit report, it’s essential to know exactly what errors to watch out for. Many people assume their credit report is accurate—but the truth is, mistakes happen all the time. Some errors are simple typos, while others can be serious red flags indicating potential fraud.

Here are the most common credit report errors that should be disputed immediately to protect your score and your financial future:

- Incorrect Personal Information

This includes wrong names, outdated addresses, or even incorrect Social Security numbers. Such mistakes can cause your report to be mixed up with someone else’s, or cause lenders to hesitate when verifying your identity.

- Accounts You Never Opened

If you spot credit cards, loans, or other accounts you don’t recognize, this could be a sign of identity theft. Fraudsters may have used your information without your knowledge, and these accounts can severely damage your credit score.

- Duplicate Debts Listed More Than Once

Sometimes the same debt or collection account appears multiple times under different creditor names or with slight variations. This artificially inflates your debt load, making it look like you owe more than you really do.

- Paid Collections Still Showing as Unpaid

Have you paid off a collection? If it’s still listed as unpaid or delinquent, it can drag your credit score down unfairly. Disputing this error can clear your record and improve your score.

- Wrong Payment Dates or Missed Payments You Didn’t Miss

Sometimes payments are reported late or missed due to clerical errors or a creditor reporting mistake. Even a single wrongly reported late payment can hurt your credit score significantly.

- Old Debts That Should Have Fallen Off Already

Most negative information, like late payments or collections, should only stay on your credit report for up to seven years. If older debts remain, they’re outdated and must be removed by law.

Why These Errors Matter So Much

These aren’t minor issues or small print details—they directly impact your credit score and your ability to get loans, credit cards, insurance, and even jobs.

An error like a duplicate debt or an unpaid collection can slash your score by dozens of points, leading to higher interest rates or outright denials. Worse yet, if these mistakes go unnoticed and unchallenged, they cost you thousands over time.

That’s why learning how to spot and dispute these errors is critical. Taking control of your credit report means taking control of your financial future—and that starts with knowing exactly what to look for.

Step-by-Step: How to Dispute Credit Report Errors (the Right Way)

Here are 5 pivotal steps you can take to dispute your credit report errors the legit way.

1. Request and Review Your Credit Reports

Start by pulling your reports from the three major bureaus: Equifax, Experian, and TransUnion. You can get all three for free once a year at AnnualCreditReport.com or request them more frequently from Credit Veto.

Pro Tip: For an added layer of security, run a totally free background check (no credit card needed) on yourself. These tools sometimes surface alternate data that can tip you off to identity theft.

2. Identify the Error Clearly

When you spot an error, highlight it and note what’s wrong. Is it a missed payment that wasn’t late? A collection you already paid for? A loan you never took out?

Use terms that match the bureau’s language. For example, if you're disputing a “Charged-Off Account,” use that exact term in your dispute.

3. Gather Evidence

Your dispute should come with proof, like:

- Bank statements

- Emails or letters from creditors

- Screenshots of payments

- Payoff letters

- Identity documents (if disputing identity-related errors)

Attach these to strengthen your case. Even Experian Smart Money debit card reviews show how people track charges and payment records, which can be used as supporting evidence.

4. File Your Dispute with the Right Bureau(s)

You can file disputes online, by mail, or by phone, but online is usually fastest.

- Experian: experian.com/disputes

- Equifax: equifax.com/personal/disputes

- TransUnion: transunion.com/disputes

Explain your dispute clearly and calmly, include your evidence, and request a correction.

If you're using snail mail, include copies—not originals—and use certified mail with a return receipt.

5. Wait (Up to 30 Days), Then Follow Up

By law, the credit bureau has 30 days to investigate and respond to your dispute. They’ll contact the creditor, verify the information, and update your report if they confirm the error.

You’ll get results by mail or online.

If it’s corrected—great! If it’s not, don’t give up. You have options, including submitting a "statement of dispute" and escalating to the Consumer Financial Protection Bureau (CFPB).

What If the Dispute Doesn’t Work? Try These Power Moves

Sometimes the bureaus push back, especially if the creditor verifies the error (even when they’re wrong). Here’s what you can do:

- Send a Goodwill Letter asking the creditor to remove or correct the item (especially if it was a one-time issue)

- File a formal complaint with the CFPB

- Request a free debt review removal with a credit repair service

- Add a consumer statement explaining your side (not ideal, but better than nothing)

- Track reviews from tools like Wisely dispute reviews to see what platforms work best for others

And if you're still stuck? Consider legal advice or credit repair support.

Other Tools to Help You Stay in Control

While you’re cleaning up your credit, consider these tools and reviews that can support your journey:

- Lending Tree insurance reviews: Help you compare providers without multiple hard inquiries

- Factor Trust freeze: Lock down your alternative credit data

- Data entry goodwill: Some banks mislabel accounts. A polite goodwill request can fix it

- Quick Credit complaints: Monitoring platforms where people report fraud or abuse

- Bureau of Education and Research reviews: If you're a professional looking to learn about credit law or regulation, this is a solid educational tool

- Even understanding how to write a review on Expedia teaches you how to present complaints with clarity—use that same clarity when disputing credit issues

Real Story: Maria’s Dispute Changed Everything

Maria came to us after being denied a mortgage. Her credit report showed a $2,100 collection from a utility bill she never opened. After pulling her report and attaching a lease from a different state during that time, we helped her submit a dispute to all three bureaus.

The Result?

The error was removed in less than three weeks, and her score jumped 42 points.

FAQs

Q: Will disputing hurt my credit? No. Disputing an error does not lower your score. In fact, if it’s fixed, it could increase it.

Q: Can I dispute something that’s over 7 years old? Yes—if it’s still on your report and it shouldn't be, it needs to be removed.

Q: How many items can I dispute at once? As many as you need to. But keep each one clear and separate.

Q: Can a paid collection still hurt me? Yes, but disputing it with proof of payment can lead to its removal or correction.

The Bottom Line

Fixing your credit report isn’t just about numbers; it’s about taking back your power. Every error you correct brings you closer to the life you want: the home, the car, the freedom.

So don’t let fear or confusion stop you.

Start your dispute today or join the 5x5 Credit Repair Challenge, where we walk you through the process, step by step—with real templates, sample letters, and support.

Your credit is your reputation. Make sure it’s telling the truth.

Comments ()