How to Read a TransUnion Credit Report (Your Complete Guide)

Short Answer: To read your TransUnion credit report, focus on key sections like your personal information, account history, public records, and recent credit inquiries. Regularly reviewing these sections helps you monitor your financial health, spot errors, and improve your credit score.

If you have ever felt overwhelmed staring or wondering how to read a TransUnion credit report, unsure of what to make of all the numbers and jargon, you’re not alone. Understanding your credit report is crucial not just for managing your financial health, but for making informed decisions about your future.

Credit reports contain a lot of detailed financial information that can look confusing at first glance. Knowing what each section means helps you understand your credit history, spot errors, and make better decisions when applying for credit or planning financial goals.

In this guide, we’ll walk you through how to read a TransUnion credit report, highlight the most important sections, and explain how to leverage the information to boost your credit score. Whether you’re a first-time credit report reader or just want to understand your credit better, this post will give you the clarity you need to take control of your credit health.

What is a TransUnion Credit Report?

A TransUnion credit report is an official, detailed record of your credit history, maintained by TransUnion, one of the three major credit bureaus in the United States. This report serves as a snapshot of your financial activity, showing how well you manage your credit accounts, whether it’s through timely payments or maintaining low credit utilization.

Lenders use this report to evaluate your creditworthiness when you apply for loans, credit cards, mortgages, or even when you rent an apartment.

Your TransUnion credit report contains crucial information about your financial behavior, such as payment history, the number of credit accounts you’ve opened, your credit utilization, public records like bankruptcies, and any recent inquiries from companies that have checked your credit.

The report not only helps lenders determine whether you qualify for credit but also what interest rates you’ll be offered. Essentially, it serves as a window into how you handle debt, which directly affects your ability to access new credit opportunities.

Understanding how to read a TransUnion credit report is vital for anyone looking to improve their credit score and overall financial health. By knowing what’s in your report and how it’s evaluated, you can make smarter decisions about managing your credit and ensuring that you’re in the best position when applying for future loans or credit.

Read Also: Managing Credit Utilization (5 Smartest Ways to Boost Your Score

Key Sections of a TransUnion Credit Report

Your credit report from TransUnion is organized into specific sections, each offering important information about your financial history and current status. Let’s break down each one:

1. Personal Information

The top of your report contains personal details, such as your name, address, date of birth, and employment information. This section helps verify your identity. It’s crucial to ensure this information is correct, as errors here could lead to problems with your credit report.

2. Account Information

This section lists all of your credit accounts, including credit cards, loans, mortgages, and other forms of debt. For each account, you’ll see:

- The type of account (credit card, mortgage, auto loan, etc.)

- Your payment history

- Your current balance

- Your credit limit (for revolving accounts)

This section directly impacts your credit score, as your credit utilization (how much of your available credit you’re using) and payment history are two of the most important factors in credit scoring.

3. Public Records and Collections

If you’ve had major financial issues like bankruptcy or court judgments, this section will list them. These items can stay on your credit report for several years and negatively affect your score. Additionally, any accounts that have been sent to collections will appear here as well.

4. Recent Credit Inquiries

Whenever you apply for credit, the lender will perform a credit check, which appears on your credit report as an inquiry. There are two types of inquiries:

- Hard inquiries: These occur when you apply for credit, and they can slightly lower your credit score.

- Soft inquiries: These include personal checks or pre-approval offers and do not affect your score.

You’ll want to monitor these regularly to ensure no unauthorized checks are affecting your credit.

See Also: Hard Inquiry vs Soft Inquiry (The Real Difference That Can Save or Sink Your Credit Score Fast)

5. Payment and Balance Summary

Most reports also include a snapshot of your balances and payment status. This can help you see at a glance whether you’re current or past due on any accounts. Your payment history is one of the largest factors used in credit scoring models, so understanding this section is key.

Why Understanding Your TransUnion Credit Report is Important

Your TransUnion credit report plays a significant role in your financial life, impacting your ability to secure loans, credit cards, or mortgages. Lenders use this report to evaluate your creditworthiness, so understanding its contents is crucial for making informed financial decisions. Regularly reviewing your TransUnion credit report helps you:

- Spot Errors that Can Hurt Your Credit Score: Sometimes, mistakes or outdated information can appear on your credit report. By reviewing it frequently, you can identify these errors and dispute them, potentially improving your score.

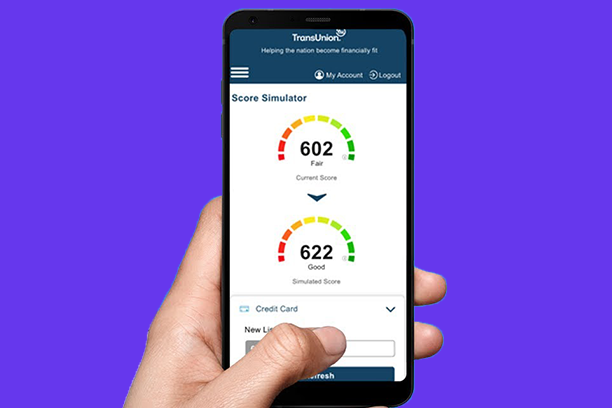

- Track Your Progress Toward Improving Your Credit: If you’re working to improve your credit score, a TransUnion credit report provides a clear picture of where you stand. It allows you to monitor the effectiveness of your efforts and make adjustments if necessary.

- Protect Against Identity Theft and Fraud: Regularly checking your credit report can help you spot any suspicious activity, such as accounts you didn’t open or inquiries you didn’t authorize. Early detection is key to protecting yourself from identity theft and fraud.

Understanding how to read and monitor your TransUnion credit report empowers you to take control of your financial future. It ensures that you’re well-informed and proactive in managing your credit.

How to Spot Errors on Your TransUnion Credit Report

It’s important to carefully review your credit report for errors or outdated information. Some common mistakes to look for include:

- Incorrectly reported late payments: A late payment may have been inaccurately reported, or the payment may have been recorded after the due date.

- Accounts that aren’t yours: Fraudulent accounts or credit inquiries may appear on your report.

- Accounts reported as open that have been closed: These can affect your credit utilization and length of credit history.

If you find any errors, you can dispute them with TransUnion directly.

Don’t Panic: Fix Your Mixed Credit File in 7 Simple Steps

How to Improve Your Credit Report After Review

If your TransUnion credit report contains negative marks or discrepancies, don’t worry, there are several steps you can take to improve your credit score. Here’s a quick guide to help you boost your credit health:

- Dispute Errors: If you find mistakes on your credit report, such as incorrect late payments or accounts that don’t belong to you, you can file a dispute with TransUnion. Resolving errors can quickly improve your credit score.

- Pay Down High Balances: One of the most important factors in your credit score is credit utilization. Keep your credit utilization ratio under 30%—this means using no more than 30% of your available credit. Paying down high balances can lower your utilization and improve your score.

- Make Payments On Time: Timely payments are a critical component of a good credit score. Missing payments can have a serious negative impact. Set up reminders or automate payments to ensure that you always pay your bills on time.

- Check for Fraud: Regularly review your credit report for signs of fraud, such as unfamiliar accounts or inquiries. If you spot any fraudulent activity, report it immediately to protect your credit and prevent further damage.

By taking these steps, you can improve your credit score over time and get back on track to achieving your financial goals.

Can Credit Veto Help You with Your TransUnion Credit Report?

If you need help reading or improving your TransUnion credit report, CreditVeto can assist. We offer tools to help you

- Monitor changes in your score

- Dispute errors on your credit report

- Get expert guidance to rebuild your credit score

- Grant you access to funding opportunities for your business

- Launch a 6-figure/ month credit repair business that stands you out from existing competitors.

Conclusion

Learning how to read a TransUnion credit report is the first step in managing your financial future. By understanding the sections of your report, spotting errors, and knowing how to improve your score, you can take control of your financial health. Regularly reviewing your credit report ensures that you remain on track for achieving your financial goals.

Want to take your credit management to the next level?

If you’re ready to improve your credit score, Sign up with Credit Veto for expert tools and personalized guidance to help you spot errors, dispute inaccuracies, and boost your credit. Don’t let your credit report hold you back, start improving it today!

Frequently Asked Questions (FAQs)

Q: Can I check my TransUnion credit report for free?

A: Yes, you can access your TransUnion credit report for free once a year through AnnualCreditReport.com. You’re also entitled to free reports if you’ve been denied credit.

Q: How often should I check my TransUnion credit report?

A: It’s a good idea to check your credit report at least once a year. If you’re working on improving your score, checking more frequently can help you monitor progress and spot errors early.

Q: How can I dispute errors on my TransUnion credit report?

A: You can dispute errors directly with TransUnion by logging into their website. You’ll need to provide documentation supporting your claim and use automated platforms like Credit Veto to monitor it.

How to Read a Business Credit Report: 5 Key Tips for Success

How to Read a Business Credit Report: 5 Key Tips for Success  Does a DUI Affect Your Credit Score? 5 Ways to Protect It

Does a DUI Affect Your Credit Score? 5 Ways to Protect It  How to Remove a Closed Account from Your Credit Report: 3 Best Steps

How to Remove a Closed Account from Your Credit Report: 3 Best Steps  How Midland Credit Management Can Affect Your Credit Score

How Midland Credit Management Can Affect Your Credit Score  Can I Lease a Car with a 500 Credit Score? What to Expect

Can I Lease a Car with a 500 Credit Score? What to Expect  Minimum Credit Score for a USDA Home Loan: Don’t Miss These Requirements!

Minimum Credit Score for a USDA Home Loan: Don’t Miss These Requirements!  How to Read a TransUnion Credit Report (Your Complete Guide)

How to Read a TransUnion Credit Report (Your Complete Guide)  What Credit Score Is Needed to Buy a UTV? (Real Limits)

What Credit Score Is Needed to Buy a UTV? (Real Limits)