How to Start Your Own Credit Repair Business and Get Clients Fast

Short Answer: You can start your own credit repair business by learning the rules, setting up a compliant system, and focusing on conversations with people who already need help instead of chasing cold traffic.

Every day, people are denied loans, funding, housing, and credit cards because of errors or unresolved issues on their credit reports. Many of them do not know where to start or who to trust. That gap is where credit repair businesses step in.

The opportunity is real, but success in credit repair is not about sending dispute letters or posting endlessly on social media. It is about structure, trust, and having a clear process you can explain to everyday people. Businesses that grow understand how to guide clients from the first question to enrollment without confusion or pressure.

In this guide, you will learn how to start your own credit repair business the right way, how to get clients faster by using conversations instead of cold traffic, and how systems like CreditVeto Pro and the CCFC course help turn interest into paying clients consistently.

Why Credit Repair Is Still a High-Demand Business

Every year, millions of people are denied loans, funding, housing, or credit cards because of credit report issues. These problems are not always caused by irresponsible spending. Errors, outdated negative items, unauthorized inquiries, mixed files, and incorrect personal details are far more common than most people realize.

Most consumers do not know how to read a credit report properly, which items can be challenged, or how long negative information should legally remain. Even when they want to fix the problem, they often lack the time, confidence, or clarity to handle disputes, follow-ups, and rebuilding on their own. This confusion is what keeps people stuck and creates ongoing demand for credit repair services.

That demand exists not because people want shortcuts, but because they want guidance through a process that feels technical and overwhelming. When credit repair is done correctly, it provides structure, direction, and accountability, not false promises.

The mistake many beginners make is assuming credit repair is only about sending dispute letters. In reality, it is about building trust, explaining the process clearly, managing follow-up, and guiding clients through each stage with confidence. Businesses that understand this treat credit repair as a service, not a tactic, and that is why the demand continues to grow.

Don’t Panic: Fix Your Mixed Credit File in 7 Simple Steps

Common Myths That Stop People From Starting a Credit Repair Business

Many people delay starting a credit repair business because of misconceptions that are simply not true. These myths create unnecessary fear and keep capable people stuck on the sidelines.

One common belief is that credit repair is only for experts or lawyers. In reality, successful credit repair businesses are built by people who understand the process, follow compliance rules, and communicate clearly with clients. You do not need to be a financial professional to guide someone through fixing errors on their credit report.

Another myth is that the market is already saturated. The truth is, demand keeps growing because credit problems affect people every year. Errors, denials, and funding issues are not going away. What separates successful businesses from struggling ones is not competition, but structure and follow-up.

Some also believe credit repair businesses fail because clients do not trust the industry. Trust is only a problem when there is no clear process. When clients see timelines, steps, and consistent communication, confidence increases quickly.

Understanding these myths early helps you approach credit repair as a real service business instead of a risky idea. With the right system and communication framework, credit repair remains a practical and sustainable opportunity.

Read Also: How to Scale Credit Repair Business The Right Way

What You Actually Need to Start a Credit Repair Business

Starting a credit repair business does not require a finance degree or years of experience, but it does require clarity and structure. Most people fail not because they lack knowledge, but because they do not have a system to apply that knowledge consistently.

At a minimum, you need:

- A basic understanding of how credit reports work and the consumer rights that govern disputes

- A compliant way to communicate with credit bureaus and document every action properly

- A simple system to manage leads, follow-ups, and active clients

- A clear, repeatable process you can explain to everyday people without sounding technical or confusing

Without structure, most beginners stall after their first few inquiries. They receive messages, answer questions one by one, and rely on memory instead of processing. Follow-ups get missed, interested prospects go cold, and confidence drops quickly.

This is where most credit repair businesses fail early. Not because demand is low, but because there is no framework to handle conversations, guide clients forward, and keep momentum once interest shows up.

How to Get Credit Repair Clients Fast

The fastest way to get credit repair clients is not ads or viral content. It is conversations. Real growth happens when you respond clearly and follow up with people who already shown interest.

Most beginners already have access to warm opportunities such as:

- Old messages where someone asked about fixing credit

- Past consultations that never turned into clients

- Friends or contacts who were denied funding or loans

- People who watch posts quietly but never comment

These are warm credit repair leads. They already trust you enough to ask questions or pay attention. They do not need to be convinced. They need clarity.

Businesses that get clients quickly focus on:

- Consistent and timely follow-up

- Simple explanations that remove confusion

- One clear next step, instead of long conversations

Instead of chasing strangers or waiting for new traffic, they guide people who already raised their hands. When conversations are handled with structure and confidence, clients come faster and with less effort.

Discover: New Dual-Service Model Turning Credit Clients Into Funding Wins (From One Contact Stream)

Why Systems Matter More Than Skill

Credit repair has a credibility problem. Many people hesitate because they have heard promises before and seen little follow-through. Skill alone is not enough to overcome that doubt.

Trust is built when clients can clearly see:

- A defined process

- What happens after they say yes

- How long each stage takes

- What realistic results look like

When clients understand the journey, hesitation drops and confidence increases.

This is why CreditVeto Pro exists on the B2B side. It was built to remove guesswork and inconsistency from how credit repair businesses operate.

CreditVeto Pro gives credit repair businesses a structured system to:

- Capture and organize all inquiries in one place

- Follow up consistently without chasing people

- Guide clients through clear, step-by-step actions

- Reduce manual work and repeated explanations

- Present a professional, trustworthy process from day one

With the right system in place, businesses rely less on individual skill and more on a structure that converts interest into paying clients.

Where the CCFC Course Fits In

Starting a credit repair business is not just about having tools or software. It is about knowing how to communicate your process in a way people understand and trust.

The Certified Credit & Funding Consultant™ (CCFC Course), an innovative credential designed to elevate professionalism in the credit repair and funding sectors focuses on the conversations that determine whether interest turns into a client. It teaches:

- How to explain credit repair in simple, everyday language

- How to handle objections calmly without sounding sales-driven

- How to guide clients from the first message to enrollment

- How to introduce funding conversations at the right time

This training helps beginners avoid common mistakes that slow growth. It also helps existing credit repair businesses stop losing interested leads because of unclear explanations or weak follow-up.

When tools and communication work together, client confidence increases, and conversion becomes more consistent.

Credit Repair as a Business, Not a Hustle

The credit repair businesses that last do not operate on guesswork or daily scrambling. They treat credit repair as a professional service with clear systems and repeatable processes.

When credit repair is structured properly, businesses can:

- Help clients in a consistent and organized way

- Earn income that is predictable instead of sporadic

- Follow up without feeling overwhelmed or chasing people

- Grow steadily without burnout

CreditVeto Pro supports this approach by providing the infrastructure needed to manage credit repair alongside funding opportunities. This allows businesses to earn from clients even while they are waiting for approvals, instead of relying on one outcome or one moment to get paid.

This shift from hustle to structure is what turns credit repair into a sustainable business.

Final Thoughts

If you are serious about how to start your own credit repair business and get clients fast, the answer is not more noise or shortcuts. It is structure, follow-up, and clarity.

CreditVeto Pro gives you the system.

The CCFC course gives you the communication skills.

Together, they help you build a credit repair business that converts interest into real clients.

Start with CreditVeto Pro and access the CCFC course to build a business that works with consistency and confidence.

Frequently Asked Questions

Is starting a credit repair business legal in the US?

Yes. Credit repair businesses are legal when they follow consumer protection laws, use compliant processes, and provide real services instead of false promises.

Do I need certification to start a credit repair business?

No formal certification is required, but you must understand credit reports, consumer rights, and how to communicate disputes properly to avoid compliance issues.

How long does it take to get your first credit repair client?

Many beginners get their first client within days or weeks by following up with existing contacts and having a clear process instead of waiting for ads to work.

Can I start a credit repair business part-time?

Yes. Many people start part-time using simple systems to manage conversations, follow-ups, and clients before scaling full-time.

What is the biggest mistake new credit repair businesses make?

The biggest mistake is operating without structure. Without a system for follow-up, explanations, and client management, most leads are lost.

Does CreditVeto Pro replace learning credit repair?

No. CreditVeto Pro provides the system and structure, while the CCFC course teaches how to communicate, explain the process, and convert interest into clients.

Can credit repair be combined with funding services?

Yes. Combining credit repair with funding conversations helps businesses earn more from each client and keeps past leads profitable instead of forgotten.

How a Credit Repair Course Can Improve Your Credit Score and Business Faster

How a Credit Repair Course Can Improve Your Credit Score and Business Faster  How Fast Will a Car Loan Raise My Credit Score? 2026 Real Timeline

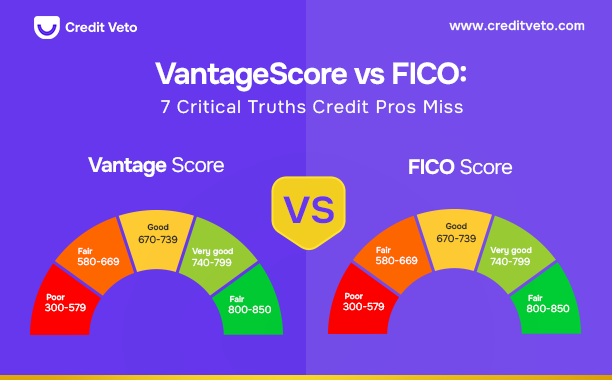

How Fast Will a Car Loan Raise My Credit Score? 2026 Real Timeline  Vantage Score vs FICO: 7 Critical Truths Credit Pros Miss

Vantage Score vs FICO: 7 Critical Truths Credit Pros Miss  What Credit Score Is Needed to Buy a UTV? (Real Limits)

What Credit Score Is Needed to Buy a UTV? (Real Limits)  Does a DUI Affect Your Credit Score? 5 Ways to Protect It

Does a DUI Affect Your Credit Score? 5 Ways to Protect It  How to Remove a Closed Account from Your Credit Report: 3 Best Steps

How to Remove a Closed Account from Your Credit Report: 3 Best Steps  How Long Do Late Payments Stay on Your Credit Report? 2026 Update

How Long Do Late Payments Stay on Your Credit Report? 2026 Update  How Many Credit Cards Should I Have? Avoid These 4 Mistakes

How Many Credit Cards Should I Have? Avoid These 4 Mistakes  How to Check Personal Credit Report: 7 Easy Steps

How to Check Personal Credit Report: 7 Easy Steps