Is 635 Credit Score Bad? What It Means and How to Fix It

Short answer: A 635 credit score is not terrible, but it is not good either. It sits in the lower end of the “fair” range and can limit approvals, raise interest rates, and reduce your borrowing options unless you take steps to improve it.

If you are asking “is 635 a good credit score?” or “is 635 credit score good enough?” The honest answer is this: It works for some things, but it holds you back from many others.

This blog post explains what a 635 credit score really means, how lenders view it, what you can qualify for, and how to move out of this range faster.

What a 635 Credit Score Actually Means

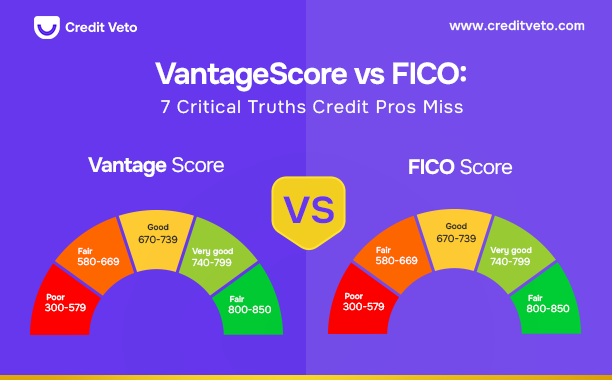

According to the FICO score range, a 635 credit score falls into the fair credit range under most scoring models.

Here is how lenders typically categorize scores:

- 300–579: Poor

- 580–669: Fair

- 670–739: Good

- 740–799: Very Good

- 800–850: Excellent

So when people ask, “is 635 credit score good?”, the technical answer is no. It is fair, not good.

To lenders, a 635 score signals moderate risk. It suggests that you may have:

- Missed payments in the past

- High credit card balances

- Collections or charge-offs

- Recent negative marks

- Too many hard inquiries

- Short or unstable credit history

None of this means you are irresponsible. It simply means your credit profile has unresolved issues that matter during approvals.

Discover What Default Credit Scores are: The Surprising Truth & Alternative Scores

What a 635 Credit Score Means for Your Next Move

A 635 credit score is not the end of the road, but it is a warning sign. It tells lenders you are a moderate risk, and that means higher interest rates, lower limits, and fewer approvals. The good news is that this score is very fixable when the right actions are taken.

Most people with a 635 credit score are being held back by a small number of issues. These often include errors on the report, high balances, outdated negative items, or missed payments that were never corrected. Addressing those problems directly is what creates real movement, not waiting and hoping the score improves on its own.

Is 635 a Good Credit Score for Loans?

This is where reality matters more than definitions. With a 635 credit score, you may get approved for some products, but usually with strings attached.

Auto loans

You can often qualify, but:

- Interest rates are higher

- Down payments may be required

- Loan terms are less flexible

Credit cards

Most premium cards are off the table.

You may qualify for:

- Entry-level cards

- Secured cards

- Cards with lower limits

Personal loans

Approval is possible, but:

- Rates are significantly higher

- Loan amounts may be smaller

Mortgages

This is where a 635 credit score becomes limiting.

- FHA loans may still be possible

- Conventional loans are harder

- Rates and mortgage insurance costs increase

So if you are wondering if a 635 credit score is bad for buying a house, the answer is that it creates obstacles, not automatic denial.

Why a 635 Credit Score Costs You More Than You Think

Many people underestimate the cost of a fair score. With a 635 credit score, lenders often charge:

- Extra fees

- Larger deposits

- Higher interest rates

- Stricter approval conditions

Over time, this can mean:

- Thousands more paid on a car loan

- Higher monthly mortgage payments

- More expensive insurance

- Missed business and funding opportunities

This is why improving a 635 credit score is not about vanity. It is about reducing long-term financial drag.

Why Your Credit Score Is Stuck at 635

Most people with a 635 credit score are stuck there for one of these reasons:

- Errors on their credit report

- Old negative items that were never disputed

- High credit utilization

- Missed payments that were never corrected

- Collections that should not be reporting

- Incorrect personal information

- Unauthorized or excessive inquiries

A key thing to understand is this:

Time alone does not fix credit. Action does.

Can a 635 Credit Score Be Improved?

Yes. And often faster than people expect. A 635 credit score is not “damaged beyond repair.” It is unfinished.

The biggest improvements usually come from:

- Removing inaccurate negative items

- Correcting personal information

- Addressing collections properly

- Reducing credit card balances

- Stopping unnecessary inquiries

- Rebuilding positive payment history

This is where credit repair becomes relevant.

Does Credit Repair Help a 635 Credit Score?

Credit repair works best in the fair range because there is room to remove errors and reposition the profile.

If your 635 credit score includes:

- Accounts that do not belong to you

- Incorrect late payments

- Duplicate collections

- Old negative items that should have aged off

- Unauthorized inquiries

- Wrong addresses or personal details

Then, credit repair can help by:

- Challenging inaccurate data

- Forcing verification

- Cleaning report inconsistencies

- Improving lender confidence

Credit repair does not create fake scores. It restores accuracy.

See Also: 6 Simple Ways to Delete Old Addresses From Your Credit Report Fast

How Long Does It Take to Move Past a 635 Credit Score?

There is no overnight fix, but improvement is realistic.

Typical timelines:

- 30–45 days: First dispute responses

- 60–90 days: Early score movement

- 3–6 months: Stronger improvements

- 6–12 months: Major profile recovery

People who see the best results combine:

- Credit repair

- Lower utilization

- On-time payments

- Structured rebuilding

- Smarter credit usage

- Structured automated systems like Credit Veto

Is a 635 Credit Score Good Compared to Average?

The average U.S. credit score is around the low 700s. That means a 635 credit score is below average.

This matters because lenders compare you not just to rules, but to other applicants. Improving your score moves you into a more competitive group.

When a 635 Credit Score Is a Warning Sign

A 635 score becomes more concerning if:

- It has not changed in years

- You keep getting denied

- Your interest rates keep increasing

- Collections keep appearing

- Errors stay unresolved

That usually means your credit report needs structured attention, not guesswork.

How Credit Veto Helps Improve a 635 Credit Score

Credit Veto focuses on correcting the issues that keep fair credit scores stuck. Instead of generic advice, the process starts with identifying errors, disputing inaccurate negative items, fixing personal information issues, and guiding proper credit rebuilding so that progress is not reversed.

For many people, removing just a few incorrect items and adjusting how credit is used can unlock approvals that were previously out of reach. This is how a 635 credit score begins to move into the good credit range.

If your goal is better loan terms, easier approvals, or preparing for a major financial step like starting or scaling your credit repair business, the fastest path is cleaning the report first and rebuilding correctly.

Start your credit repair process with Credit Veto and take control of your credit profile instead of letting a 635 score limit your options.

Final Thoughts

A 635 credit score is not the end of the road, but it is a signal.

It tells lenders you need improvement before they offer their best terms. The good news is that fair credit is often the easiest range to improve once the right issues are addressed.

If you want help correcting errors, rebuilding your profile, and moving past a 635 score with confidence, Credit Veto provides the structure and support to do it properly. Start taking control of your credit today at Credit Veto

Frequently Asked Questions

Is a 635 credit score bad?

A 635 credit score is considered fair, not good. It may qualify you for some loans, but usually with higher interest rates and stricter terms.

Is 635 a good credit score to buy a car?

You can buy a car with a 635 credit score, but you will likely pay a higher interest rate and may need a larger down payment compared to borrowers with good credit.

Is 635 credit score good enough for a mortgage?

A 635 credit score may qualify for FHA loans, but conventional mortgage options are limited and usually come with higher costs and additional requirements.

Can I improve a 635 credit score quickly?

Yes. Many people improve a 635 credit score within a few months by correcting errors, reducing balances, removing inaccurate negative items, and rebuilding positive payment history.

Why is my credit score stuck at 635?

Credit scores often stay at 635 due to unresolved errors, high credit utilization, collections, missed payments, or outdated negative items that were never addressed.

Does credit repair work for a 635 credit score?

Credit repair can be effective if your report contains inaccuracies, unauthorized inquiries, incorrect personal information, or negative items that should not be reporting.

How long does it take to go from 635 to 700?

With consistent effort, many people move from a 635 credit score to the 700 range within 3 to 6 months, depending on the issues affecting their report.

Is 635 credit score good compared to average?

No. The average credit score in the U.S. is above 700, so a 635 credit score is below average and less competitive for approvals.

How Long Do Late Payments Stay on Your Credit Report? 2026 Update

How Long Do Late Payments Stay on Your Credit Report? 2026 Update  How Many Credit Cards Should I Have? Avoid These 4 Mistakes

How Many Credit Cards Should I Have? Avoid These 4 Mistakes  How a Credit Repair Course Can Improve Your Credit Score and Business Faster

How a Credit Repair Course Can Improve Your Credit Score and Business Faster  How Fast Will a Car Loan Raise My Credit Score? 2026 Real Timeline

How Fast Will a Car Loan Raise My Credit Score? 2026 Real Timeline  Vantage Score vs FICO: 7 Critical Truths Credit Pros Miss

Vantage Score vs FICO: 7 Critical Truths Credit Pros Miss  How to Check Personal Credit Report: 7 Easy Steps

How to Check Personal Credit Report: 7 Easy Steps