Is a 609 Credit Score Bad or Just Misunderstood?

Is a 609 credit score bad? Not really. Discover what it means, how to fix it fast, and the loopholes others won’t tell you in this 2025 credit guide.

If you’ve ever pulled your credit report and seen a 609 credit score staring back at you, you’re not alone. It’s the kind of score that sits in that uncomfortable middle ground.

Not quite bad, but definitely not great either. So the big question is: Is a credit score of 609 good, or are you in trouble? Let’s break this down honestly and give you the clarity most articles don’t.

What Does a 609 Credit Score Really Mean?

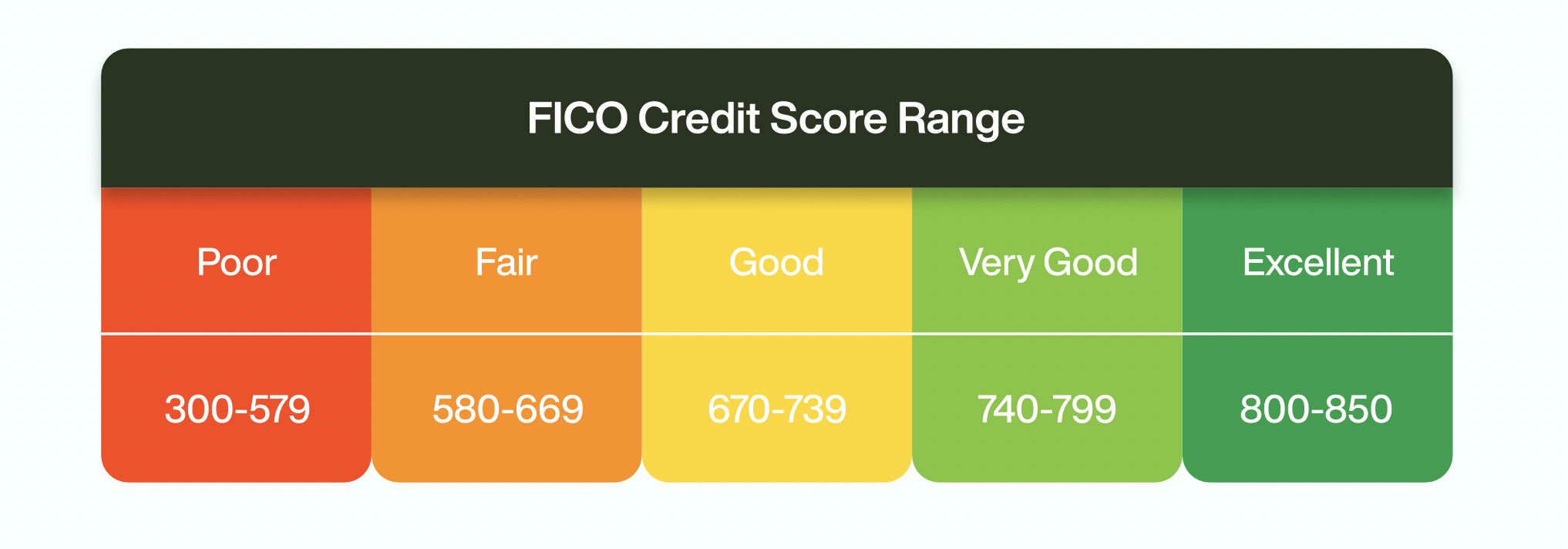

A 609 credit score sits in the “fair” range on the FICO scale, which spans from 300 to 850. It’s not considered a bad score outright, but it definitely signals to queen lenders that you may have had some financial hiccups like missed payments, high utilization, or possibly collections.

If you’re asking, “Is a credit score of 609 good?” The answer depends on your goals. For premium credit cards or low-interest mortgage rates, it’s not ideal. But it’s not the worst either.

Most lenders see a 609 credit score as a financial yellow light,not a full stop, but not a green light either. You’re still able to qualify for credit products, but usually under less favorable terms. This includes higher interest rates, lower approval limits, and sometimes additional requirements like a cosigner or security deposit.

So, is a 609 credit score bad? Not exactly. It’s more of a warning that your credit profile needs improvement—and fast—if you want to access better financial opportunities. This is where many blogs stop short, but here’s what most don’t tell you:

- A 609 score often contains outdated or fixable negative items such as collections, old inquiries, or incorrect account details. These can be disputed and possibly removed.

- Many consumers stay stuck at 609 simply because they don’t know which credit behaviors matter most. Knowing how to prioritize your actions, like focusing on utilization and removing errors, can push you above 640 in a few weeks.

Bottom line? A 609 credit score is not your final destination. With the right strategies and tools, you can rebuild your credit and escape the high-interest trap that most “fair credit” borrowers fall into.

Is a 609 Credit Score Bad? Or Just Misunderstood?

This is where most articles miss the mark. Some sugarcoat it. Others lean heavily on fear. But the truth is this; a 609 credit score is not excellent, yet it’s far from hopeless. What people really need to hear is that it’s not just about the number. It’s about why the number exists.

So, is 609 credit score bad? Technically, it falls into the fair category, which means it’s below average but not dangerous. You might not get premium credit cards or the best loan rates, but you’re not locked out of financial opportunities either.

In reality, many people land at a 609 credit score because of things like:

- Old or unpaid medical bills

- High balances on revolving credit cards

- One or two late payments

- No credit history at all, especially for immigrants, young adults, or people who avoided debt entirely

Most of these issues aren’t rooted in recklessness. They stem from a lack of credit education, missed notices, or financial emergencies. That’s why calling a 609 credit score “bad” is misleading. What you actually need is the right roadmap, not more shame or confusion.

And this is where you have an edge. If you take action early, a 609 credit score can be turned around in less time than you think. Unlike the articles that simply label it fair or poor, we’re showing you how to move forward with clarity and strategy.

Why It Matters More in 2025 Than Ever

In 2025, a 609 credit score matters more than it ever did. Lenders are no longer just looking at your score, they’re analyzing your entire credit behavior with AI-driven tools and deeper data models. So even if your credit score lands in the “fair” range, you’re being evaluated far beyond just the number.

Is a credit score of 609 good enough today? Not quite. It’s still considered fair, but in today’s stricter lending environment, that often means higher costs and fewer options.

Here’s what a 609 credit score could mean for you right now:

- You might miss out on competitive mortgage interest rates, which could cost you tens of thousands over the life of a loan

- Auto loan lenders may approve you, but with significantly higher interest rates

- You may be required to pay upfront deposits when renting an apartment or setting up utilities

And here’s the part many people overlook: AI-powered underwriting tools now weigh patterns, not just points. This means that having a 609 credit score—even if it’s stable—can still be flagged if lenders see high utilization, late payments, or inconsistent activity.

So if you’re asking is 609 credit score bad, the answer depends on what you plan to do with your credit. But one thing is clear: fixing and improving that score is more urgent now than ever.

609 Credit Score: What You Can Still Do

If you have a 609 credit score, don’t assume your options are gone. While it’s not the strongest score, it’s still workable. What matters is knowing where to start.

So, is a credit score of 609 good? Not exactly. But it’s not the end either.

Here are smart ways to start rebuilding and still access credit:

- Secured credit cards: These require a refundable deposit and help build positive credit history

- Unsecured cards with low limits: Some lenders will approve you for a card with a higher interest rate or smaller credit line

- Credit builder loans: These are designed to improve your score through structured, manageable payments

- Rent and utility reporting: Use tools that add rent, phone, or utility payments to your credit file to boost your history

These steps are often overlooked in generic advice, but they are proven to work. Having a 609 credit score doesn’t make you irresponsible. It usually means you’ve had a setback or lacked guidance. The good news is, you can move up the right approach.

The Fastest Way to Improve a 609 Credit Score

If you have a 609 credit score, you’re not alone. Many people are in this range and often ask, “Is a 609 credit score bad?” The truth is, it’s not ideal, but it’s fixable. The key is knowing exactly where to start.

Here are five proven steps to improve your score fast.

1. Check Your Credit Report for Errors

Start by reviewing your reports from Experian, Equifax, and TransUnion. One in five reports contains errors that could be dragging your score down. These mistakes might include outdated accounts, incorrect balances, or wrongly reported late payments.

Disputing and correcting even a single error could give your score a boost of 30 points or more.

2. Lower Your Credit Card Utilization

Your utilization rate is how much of your credit you’re using. For example, if your card limit is $1,000 and your balance is $800, your utilization is 80 percent, which hurts your score.

Keep it below 30 percent, and ideally under 10 percent, to see real improvements.

3. Add New Positive Accounts

To balance out past negatives, add new positives. Use tools that report rent, utility payments, or streaming service subscriptions to credit bureaus. You can also apply for a credit builder loan or secured credit card to build a better history.

4. Request a Credit Limit Increase

Call your credit card provider and ask for a limit increase. If approved, your credit utilization improves without you needing to open a new account. Just make sure not to increase your spending along with the new limit.

5. Dispute Unverifiable or Outdated Items Legally

If you have old collections or questionable accounts, you may be able to dispute them under the Fair Credit Reporting Act (FCRA).

Use personalized letters, not generic templates, and challenge items that cannot be verified or are beyond the legal reporting limit. This approach works best when done carefully and within legal guidelines.

The Problem With Most Advice Online

We analyzed the top-ranking blogs for the keyword 609 credit score as well as social media posts. And while they explain the basics, they often fall short where it really counts.

Most of these articles:

- Gloss over practical next steps you can take right now

- Avoid talking about real-life credit challenges, like living on a low income or having no credit history at all

- Skip over legal loopholes you’re actually allowed to use to fix your credit

One key strategy that rarely gets a proper breakdown is the 609 dispute letter method. It’s based on Section 609 of the Fair Credit Reporting Act, which gives you the right to request full details about items on your report.

Here’s the truth: the 609 letter isn’t a magical fix, but when written correctly and used strategically, it can trigger investigations that lead to outdated or unverified accounts being removed.

The secret is personalization. Don’t use copy-and-paste templates from the internet. Write your letters in your own words. Include specific details. And always follow up with the credit bureaus.

So… Is a Credit Score of 609 Good?

In simple terms: no, a 609 credit score is not considered good but it’s also not bad enough to stop your progress.

Think of it as a warning light, not a closed door. It means there’s work to do, but the path forward is still wide open. With the right credit habits, many people can:

- Move from 609 to 650+ within a month or two

- Reach 700 or higher in three to six months

- Start qualifying for lower interest rates, better credit cards, and stronger loan options

If you’ve been asking if a credit score of 609 bad or good bad, the real answer lies in what you do next. The number doesn’t define you; your next steps do.

Don’t just scroll through advice. Pick one action today. Then follow it with another tomorrow. That’s how credit improvement happens.

Final Thoughts

Whether you searched for things like “ is 609 credit score bad” or just finished checking your report, remember this; your 609 credit score isn’t the end. It’s a snapshot, not a life sentence.

That number might feel like a wall right now, but it’s really a window. A window into better habits, smarter credit decisions, and real opportunities waiting to be unlocked.

At Credit Veto, we don’t just teach you what to do; we give you the templates, tools, and guided systems to actually do it. From disputing errors legally to building positive credit history, we help everyday people go from 609 to 720 and beyond, without guessing or falling into common traps.

If you’re serious about turning that score around, the first smart move is simple. Start with Credit Veto. Your future self will thank you.

Comments ()