Is It Easier to Lease a Vehicle with Bad Credit?

Short Answer: Yes, it is possible to lease a vehicle with bad credit, but it often comes with higher interest rates, larger down payments, and fewer vehicle options. Lenders typically see bad credit as higher risk, but understanding how the process works and preparing properly can help you improve your chances of approval.

Leasing a vehicle with bad credit isn’t out of reach, but it does present its challenges. Many individuals with bad credit wonder if they can still qualify for a lease. While a low credit score can make it harder to lease a car, it doesn’t automatically disqualify you.

Understanding how to lease a vehicle with bad credit and knowing the factors that lenders care about can make a significant difference in securing a lease.

In this post, we’ll go deep into what you need to know about leasing a vehicle with bad credit, how you can improve your chances, and why preparation is crucial for getting approved. Whether you’re looking for a car lease with bad credit or wondering if leasing a car with bad credit is even possible, we’ve got you covered.

Understanding How Bad Credit Affects Car Leasing

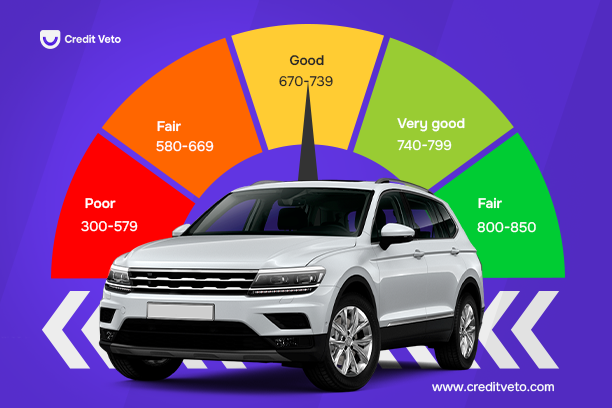

When you’re looking to lease a vehicle with bad credit, your credit score is a key factor in determining your eligibility. But your credit score isn’t the only thing that matters.

Lenders and leasing companies look at various factors before approving a lease, and bad credit typically means higher interest rates, larger down payments, and limited vehicle options.

Here’s how bad credit can affect your lease approval:

- Higher Interest Rates: Lenders may offer you a higher interest rate to offset the higher risk of leasing to someone with bad credit. This can result in higher monthly payments.

- Larger Security Deposits: Some leasing companies may require a larger security deposit to reduce their risk when leasing to someone with poor credit.

- Limited Vehicle Options: Bad credit can restrict the types of vehicles you can lease, as more affordable options may be the only ones available.

While these challenges exist, the good news is that you can still lease a vehicle with bad credit by following the right strategies and improving your chances.

Read Also: Default Credit Score, The Surprising Truth & Alternative Scores

Can You Lease a Vehicle with Bad Credit?

The short answer is yes, you can lease a vehicle with bad credit, but it’s likely to come with stricter terms and higher costs. Many dealerships specialize in helping people with poor credit get into a car, but expect these terms:

- A Co-Signer: Having a co-signer with good credit can improve your chances of approval. The co-signer’s creditworthiness helps the lender feel more secure in offering you a lease.

- Larger Down Payment: A larger down payment reduces the lender’s risk and may help secure a better deal on your lease.

- Affordable Vehicle Choice: Opting for a more affordable vehicle can increase your chances of getting approved for a lease when you have bad credit.

By taking these steps, you improve your chances of being approved to lease a vehicle with bad credit and may even be able to secure better terms.

Leasing vs. Buying: Which is Better for Those with Bad Credit?

For individuals with bad credit, buying a car can often seem more difficult than leasing. The high interest rates, larger down payments, and long-term commitment associated with buying can be overwhelming.

On the other hand, leasing offers more flexibility and lower monthly payments, making it an attractive option for those with less-than-ideal credit scores.

Here’s how leasing compares to buying when you have bad credit:

- Leasing: Leasing offers lower monthly payments and smaller upfront costs. However, you don’t own the car at the end of the lease, and you may be subject to mileage limits and wear-and-tear fees.

- Buying: When you buy a car, you own it outright once the loan is paid off. However, the monthly payments are usually higher, and you’ll need a larger down payment, making it more challenging for those with bad credit.

Understanding the differences between leasing and buying can help you decide the best option for your financial situation. Leasing a vehicle with bad credit might be the more accessible option, especially if you’re working on rebuilding your credit.

Tips for Getting Approved to Lease a Vehicle with Bad Credit

To improve your chances of leasing a vehicle with bad credit, here are a few tips:

- Check Your Credit Report: Before applying for a lease, pull your credit reports from the major bureaus (Experian, Equifax, and TransUnion). This will give you a clear understanding of your credit status and any issues that need addressing.

- Improve Your Credit Score: Take steps to improve your credit score before applying. Pay down outstanding debts, correct any errors on your credit report, and reduce your credit utilization.

- Shop Around: Not all dealerships are the same. Some specialize in working with individuals with bad credit, so it’s important to find a dealership that’s willing to work with you.

- Negotiate Lease Terms: Don’t be afraid to negotiate the terms of your lease, including the down payment and monthly rate. It’s possible to find a more favorable deal by being proactive.

See Also: Managing Credit Utilization: 5 Smartest Ways to Boost Your Score

How Credit Veto Can Help You Improve Your Credit for Leasing

If you’re struggling with bad credit, Credit Veto can help you repair your credit and prepare for future leasing opportunities. By identifying errors on your credit report, disputing inaccuracies, and rebuilding your credit profile, Credit Veto gives you the tools you need to improve your credit score over time.

A stronger credit score can lead to better leasing options, lower down payments, and more favorable terms. If you’re planning to lease a vehicle with bad credit, improving your credit now can make a big difference in your chances of approval.

Conclusion

Leasing a vehicle with bad credit is definitely possible, but it often comes with higher costs and more stringent terms. By understanding how your credit impacts the leasing process and taking steps to improve it, you can increase your chances of securing a lease with better terms.

If you’re struggling with bad credit, Credit Veto can help you repair your credit and set you up for success in future leasing or buying situations.

Ready to improve your credit? Start today with Credit Veto to take control of your financial future and discover better leasing opportunities.

FAQs (Frequently Asked Questions)

1. Can I lease a car with bad credit?

Yes, you can lease a car with bad credit, but it may come with higher costs and stricter terms.

2. How can I improve my chances of leasing a car with bad credit?

You can improve your chances by saving for a larger down payment, considering a co-signer, and shopping around for dealerships that specialize in bad credit leases.

3. Is it easier to lease a car with a 600 credit score?

While a 600 credit score is considered below average, it’s often easier to lease a car at this score than with lower scores, especially if you take steps to improve your chances.

How Long Do Late Payments Stay on Your Credit Report? 2026 Update

How Long Do Late Payments Stay on Your Credit Report? 2026 Update  How Many Credit Cards Should I Have? Avoid These 4 Mistakes

How Many Credit Cards Should I Have? Avoid These 4 Mistakes  How to Check Personal Credit Report: 7 Easy Steps

How to Check Personal Credit Report: 7 Easy Steps  How a Credit Repair Course Can Improve Your Credit Score and Business Faster

How a Credit Repair Course Can Improve Your Credit Score and Business Faster  How Fast Will a Car Loan Raise My Credit Score? 2026 Real Timeline

How Fast Will a Car Loan Raise My Credit Score? 2026 Real Timeline