Managing Credit Utilization: 5 Smartest Ways to Boost Your Score

Intentional about boosting your credit score fast? Learn how managing credit utilization and smart spending can raise your credit in 2025 and beyond with these 5 smart tips.

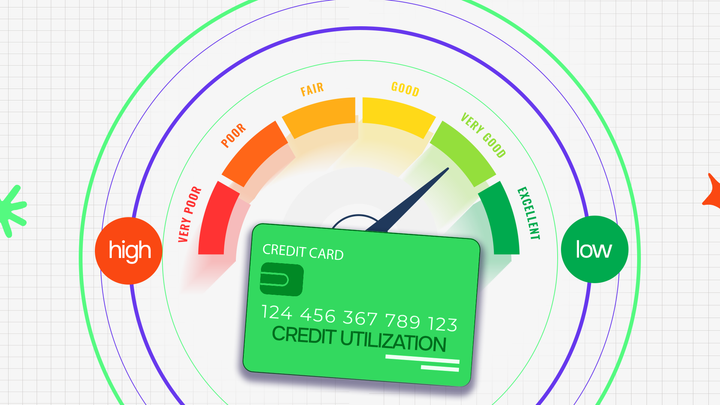

Managing credit utilization is one of the fastest ways to improve your credit score. While paying bills on time and removing collections help, keeping your credit usage low is often the real game changer most people miss.

If you’ve ever asked yourself, “Should I reduce my credit card limit?” or “Is it beneficial to use some of your available credit?” you’re not alone. These questions point to one of the most powerful, yet misunderstood, parts of your credit health: your credit utilization ratio.

In this blog, we’ll break it all down. Whether you’re at a 565 credit score trying to climb or already have a 680 credit score and want to optimize it, this guide will give you real, practical answers.

Let’s get into it.

What Is Credit Utilization Ratio, and Why Does It Matter?

Your credit utilization ratio refers to how much of your available revolving credit (like credit cards) you’re using at any given time. It’s calculated by dividing your current credit balances by your total available credit.

So, if you have a $1,000 balance on a $5,000 credit limit, your utilization is 20 percent.

Credit utilization makes up about 30 percent of your credit score, which means it can either be your biggest ally or your sneakiest enemy.

Experts often recommend keeping this number below 30 percent, but for better optimization for credit health, aim for under 10 percent.

Why Managing Credit Utilization Impacts Your Score

Your credit score is essentially a snapshot of how responsibly you manage debt. One of the biggest signals credit bureaus use is how much of your available credit you’re using; this is called your credit utilization ratio. And here’s the thing: managing credit utilization is just as important as paying your bills on time.

Even if you’ve never missed a payment, high credit utilization can still drag your score down. Why? Because it signals that you might be relying too much on credit to get by, and that makes lenders nervous.

Think of it like this:

- Low utilization = You’re in control. It shows that you’re using credit as a tool, not a crutch.

- High utilization = You might be risky. Even if you’re paying things off, maxed-out cards suggest your finances are stretched.

And here’s where most people get tripped up: Your credit card balance is reported to the bureaus once a month, usually right around your statement closing date. So even if you pay your card in full after that date, the high balance can still show up on your report and hurt your score.

That’s why managing credit utilization proactively is so important. It’s not just about paying off debt; it’s about when and how much you use at any given time. Keeping your usage low before the reporting date can make a noticeable difference in your score, even if nothing else changes.

Read Also: Why Maxing Out Your Credit Card Hurts Your Score—and What to Do

5 Smartest Ways to Boost Your Score and Improve Your Utilization Ratio

Now that you understand why managing credit utilization matters, let’s look at what you can actually do about it. These are five of the smartest ways to boost your credit score by improving how you use your available credit, and they work even if your income isn’t high or your debt feels overwhelming.

1. Spread Out Your Charges Across Multiple Cards

If you use just one card for everything, that card’s utilization ratio can climb fast. Even if your total utilization is low, the high balance on a single card can still impact your score.

Try this:

Distribute your spending across two or three cards. Keep each card’s balance under 30 percent of its individual limit.

This way, your total utilization stays healthy, and none of your cards are flagged as “maxed out.”

See Also: Do Secured Cards Still Work for Credit Building in 2025?

2. Ask for a Credit Limit Increase (Without Increasing Spending)

If you’re wondering whether to reduce your credit limit, here’s the truth: It may actually be smarter to increase your credit limit, not decrease it. Why?

Because increasing your limit lowers your utilization, as long as your spending stays the same.

Let’s say your current limit is $2,000 and you carry a $1,000 balance. That’s 50 percent utilization.

But if your limit increases to $4,000 and your balance stays at $1,000, your utilization drops to 25 percent. That’s a big score improvement without paying off anything extra.

Pro-Tip: Call your issuer or request a limit increase online. Just avoid doing this right before a major loan application; it could trigger a hard inquiry.

3. Make Early Payments Before the Statement Closes

Your balance is reported to credit bureaus around your statement closing date; not your due date. So if you always wait until your due date to pay, you might be reporting high balances even though you’re not carrying debt.

Solution:

Make a mid-cycle payment before the statement closes. That way, a lower balance gets reported, and your utilization looks better.

This is especially important if you’re using your card heavily for everyday expenses.

4. Don’t Close Old Cards Unless You Have To

“Should I reduce my credit card limit?”

It depends. If your card has a high annual fee and no real benefits, it might make sense. But if the card is fee-free, consider keeping it open.

Closing a credit card reduces your total available credit, which instantly increases your utilization ratio. That’s risky if you still carry balances on other cards.

Example:

Let’s say you have three cards with limits of $3,000 each (total of $9,000) and you carry a $1,500 balance.

Your utilization: 16 percent.

Now you close one card. Your limit drops to $6,000, and your utilization jumps to 25 percent, without spending a dime.

Better option? Hide the card, freeze it, or ask for a product change to a no-fee version instead.

5. Monitor and Optimize with Tools Like Credit Compass

If you want to stay on top of your score and utilization trends, consider using a credit tracking tool. Credit Compass and other services like Credit Veto offer dashboards where you can see your score, utilization by card, and get smart tips.

Benefits of using a tool:

- See when your balances are getting too high

- Track real-time changes to your score

- Get optimization tips to improve credit health faster

At Credit Veto, we believe in helping you simplify all this with a plan you can install and follow, even if you’ve never checked your score before.

Extra Tip: Is It Beneficial to Use Some of Your Available Credit?

Yes, but in moderation.

Lenders like to see that you’re using credit responsibly. So using some of your available credit and paying it off regularly shows healthy activity.

But if you’re maxing out your cards, even temporarily, it could send the wrong signal.

Stay active, but stay low. That’s the rule.

Final Thoughts: Master the Ratio, Master Your Score

Whether you’re working to improve a 675 credit score or aiming to push your 680 score past 700, managing credit utilization is one of the easiest ways to make progress fast.

It doesn’t require you to spend more or even pay off huge amounts. It’s all about strategy.

Here’s what to remember:

- Use less of what’s available to you

- Don’t reduce your limits unless you must

- Spread spending across cards

- Pay before statements close

- Track and optimize with tools

Small shifts here can move the needle in a big way.

And if you’re feeling stuck? Credit Veto is built to make all this easier. With tools, templates, and real help, we don’t just tell you what to fix; we help you install a smarter system.

Because good credit isn’t about working harder. It’s about working smarter. Join our 5x5 Credit Repair Challenge today to not just fix your credit but help hundreds of people do the same and earn from it.

Comments ()