Short Answer: Revolving utilization refers to the percentage of your available credit that you’re currently using. High utilization can negatively impact your credit score, making it harder to qualify for loans or secure favorable interest rates. To improve your credit score, aim to keep your utilization below 30% by paying down balances, increasing your credit limit, or seeking alternative solutions.

Understanding revolving utilization is crucial for anyone looking to maintain or improve their credit score. It’s the percentage of your available credit that you’re using at any given time, and it plays a significant role in how lenders assess your creditworthiness.

A high revolving utilization rate can signal financial stress, lowering your credit score and making it harder to access loans or credit. But don’t worry, there are simple steps you can take to reduce your utilization and improve your score.

In this blog, we’ll explain what revolving utilization is, how it impacts your credit, and most importantly, how to fix it.

What is Revolving Utilization?

Revolving utilization is one of the key factors used to calculate your credit score, yet it’s often misunderstood. Simply put, it refers to how much of your available credit you’re using across all revolving accounts, like credit cards or lines of credit.

The higher your revolving utilization, the more it can negatively impact your credit score. Understanding and managing your revolving utilization can make a significant difference in how lenders view you.

Read Also: 5 Smartest Ways to Manage Credit Utilization and Boost Your Score

The Connection Between Revolving Utilization and Your Credit Score

Credit scores are calculated based on five factors:

1. Payment history

2. Credit usage (or utilization)

3. Length of credit history

4. New credit inquiries

5. Types of credit.

Among these, credit utilization is one of the most impactful. Lenders look at your revolving utilization as a sign of how well you manage your credit.

How High Utilization Affects Your Credit Score

When your revolving utilization is high, it can signal to lenders that you may be over-leveraged or having trouble managing debt.

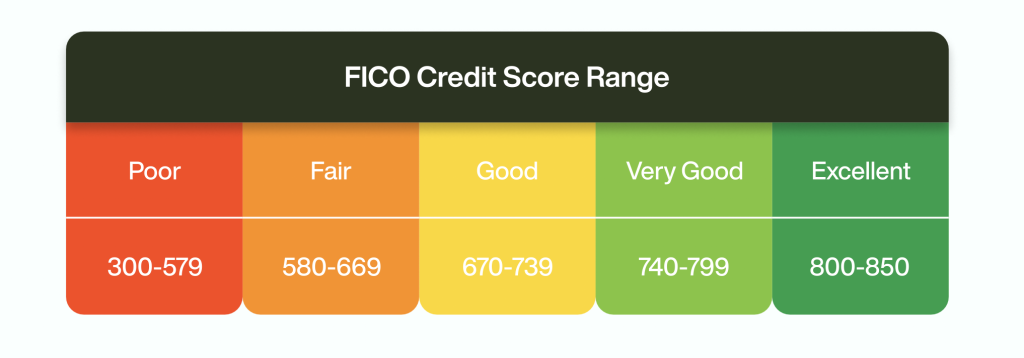

This could lead to lower credit scores, making it harder to get approved for loans, credit cards, or even a mortgage. A utilization rate above 30% is considered high, and anything higher will typically start to hurt your score.

Why Does High Credit Utilization Decrease Your Credit Score?

Credit bureaus use your revolving utilization to determine how much of your credit you’re actually using. Here’s how it affects your score:

- Risk Indicator: If you’re using too much of your available credit, it can be a red flag for lenders that you’re financially stretched and might struggle to pay back your debts.

- Credit Scoring Models: FICO, one of the most widely used credit scoring models, places a significant weight on credit utilization, about 30% of your overall score. The higher your utilization, the more it drags down your score.

How to Calculate Revolving Utilization

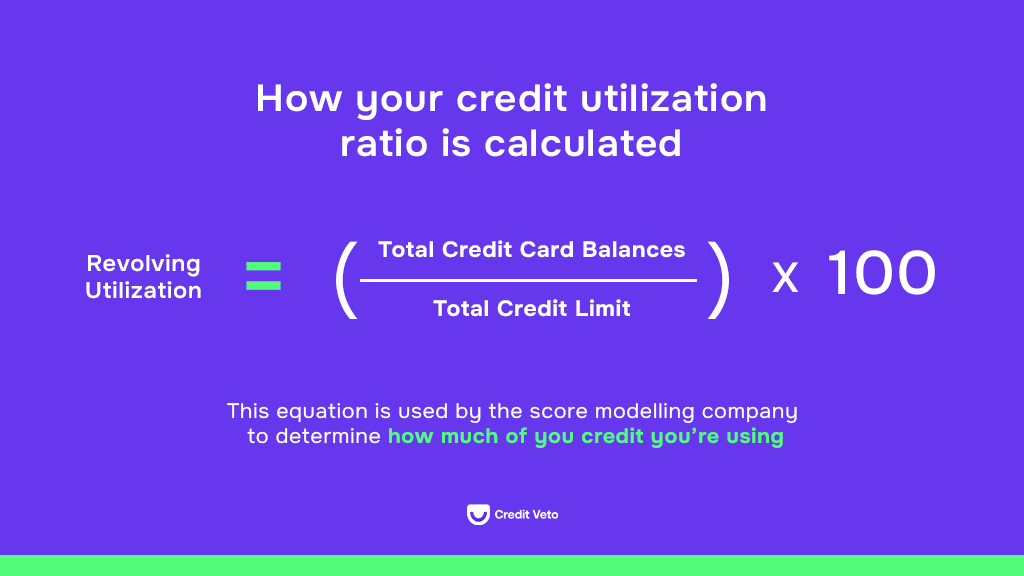

The formula for calculating revolving utilization is simple:

Where:

- Total Credit Card Balances is the sum of the outstanding balances across all your revolving credit accounts (credit cards, lines of credit, etc.).

- Total Credit Limit is the total credit limit across all your revolving credit accounts.

This formula gives you the percentage of your available credit that you’re using. The lower this percentage, the better it is for your credit score. Aim to keep it below 30% for optimal results.

For instance, if you have a credit card with a $5,000 limit and a balance of $2,000, your utilization rate is 40%.

Calculating your credit utilization is straightforward. Take the balance on each of your revolving credit accounts and divide it by your total credit limit. Multiply the result by 100 to get your utilization percentage.

Example:

- Balance: $2,000

- Credit Limit: $10,000

- Utilization: ($2,000 / $10,000) * 100 = 20%

Ideally, you’d want your revolving utilization to be under 30%. If you’re above that, it’s time to take action by signing up with Credit Veto.

What Happens When Your Revolving Utilization Is Too High?

If your revolving utilization is above 30%, you might start to see some negative effects. Here’s what could happen:

- Higher Interest Rates: Lenders may offer you loans or credit at higher interest rates due to the perceived risk.

- Lower Approval Chances: When you have high revolving utilization, you may struggle to get approved for additional credit, especially if you’re already maxing out existing credit lines.

- Negative Impact on Credit History: Repeatedly carrying high balances can have a long-term impact on your credit score, making it harder to improve.

How to Lower Your Revolving Utilization

Reducing your revolving utilization is one of the quickest ways to boost your credit score. Here are a few steps you can take:

1. Pay Down Your Balances

The most straightforward way to lower your utilization is by paying off your credit card balances. Try to pay off at least 20-30% of your balance to get under that critical 30% mark.

2. Ask for a Credit Limit Increase

If your credit card issuer allows it, requesting a higher credit limit can automatically reduce your utilization rate, as long as you don’t increase your spending.

3. Consider Transferring Your Balance

If you’re struggling with multiple high-interest credit cards, consider transferring your balance to one with a lower interest rate or a 0% introductory APR. This can help you pay off debt faster and reduce your utilization.

4. Avoid Closing Old Accounts

Closing old credit card accounts can decrease your total available credit, which will increase your utilization rate. Keep older accounts open and avoid closing them, even if you’re not using them.

Do Personal Loans Affect Credit Utilization?

Personal loans are installment loans, meaning they aren’t factored into your revolving utilization because they aren’t revolving lines of credit.

However, using a personal loan to pay down credit card debt can lower your revolving utilization and, in turn, help improve your credit score. This strategy allows you to consolidate your debt while keeping your credit usage under control.

Credit Utilization Penalties and How to Avoid Them

One of the most significant penalties for high credit utilization is the negative impact on your credit score. But there are other penalties too, like:

- Over-the-limit Fees: Exceeding your credit limit can result in fees that further add to your debt.

- Increased Interest Rates: High utilization can also lead to higher interest rates on future credit.

To avoid these penalties, keep your balance low, make payments on time, and monitor your credit regularly.

Why Credit Repair Matters for Managing Utilization

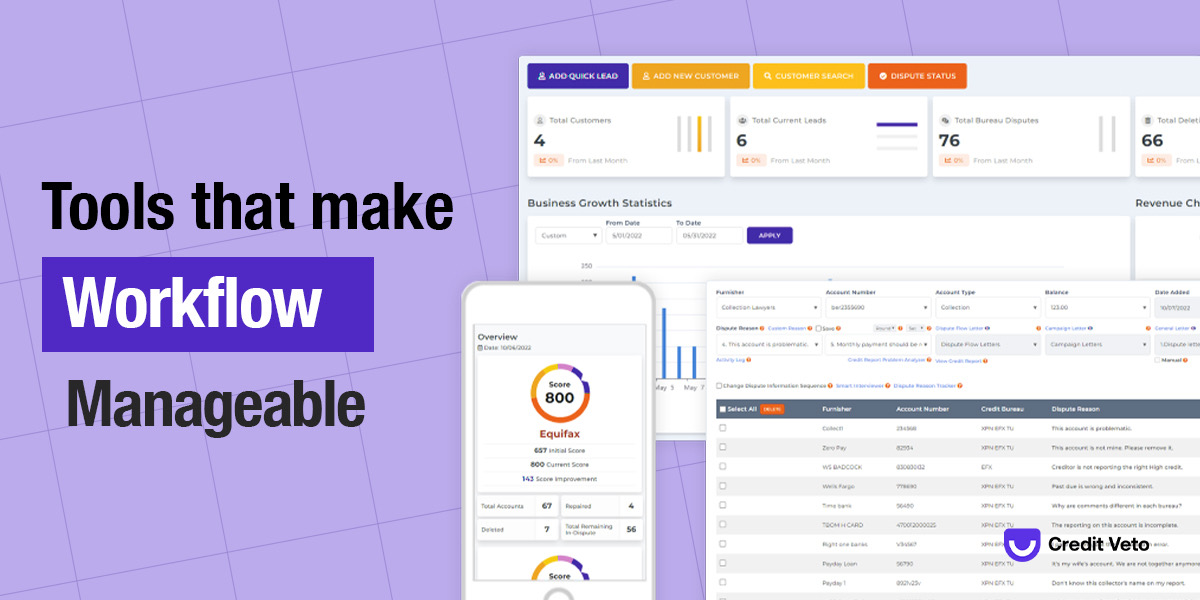

If you’re struggling to improve your credit utilization, credit repair services like those offered by CreditVeto can help. We provide expert fixes to help you address negative credit report items, reduce debt, and manage your credit more effectively.

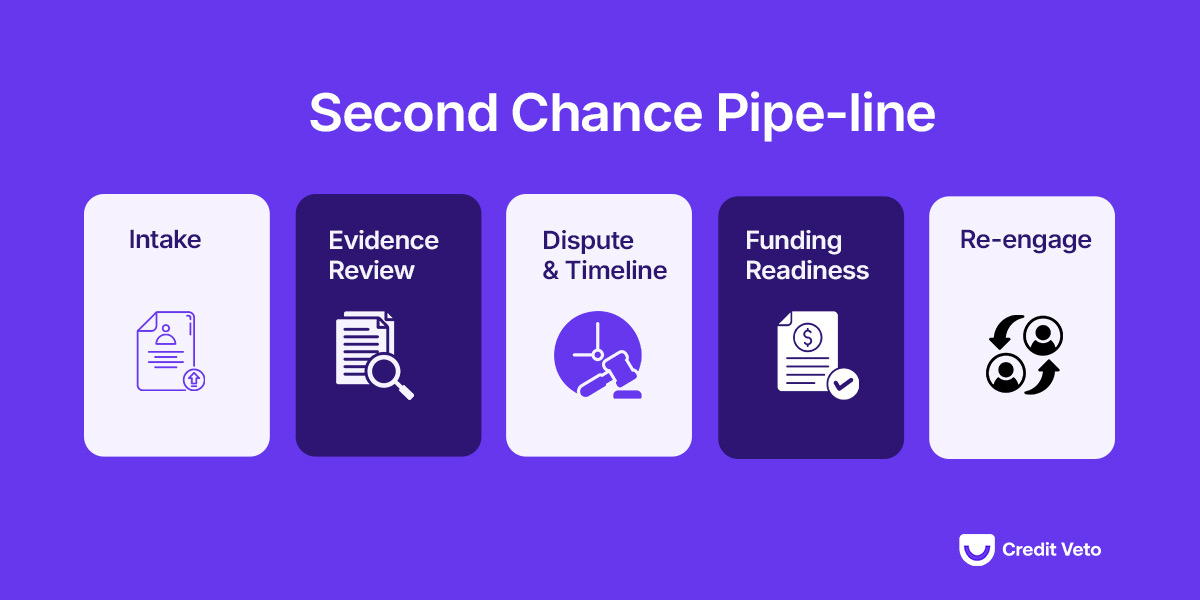

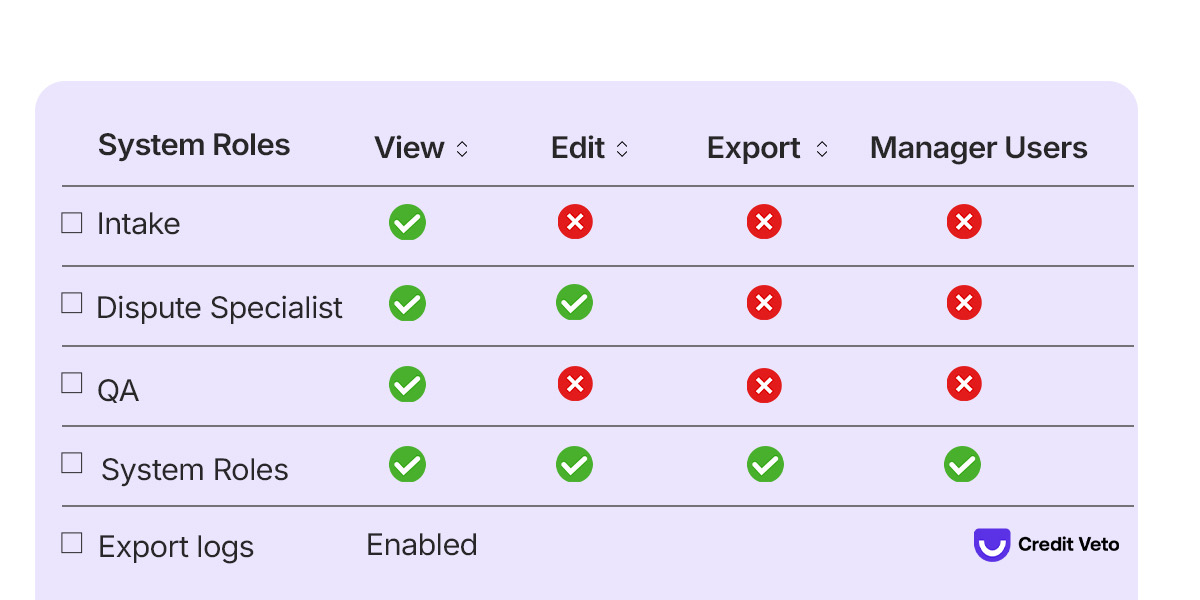

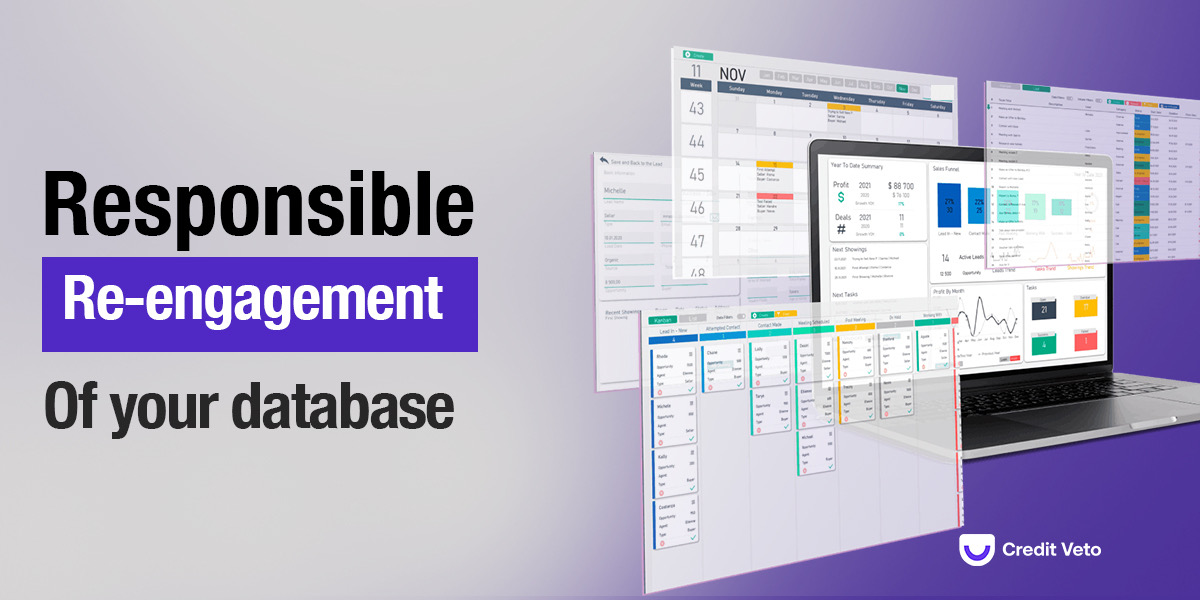

Our Dual-Service Model allows businesses to help clients not only improve their credit but also access funding. This combination is a powerful way to help your clients repair their credit while simultaneously securing the funding they need to grow.

If you’re a credit repair specialist looking to increase your revenue with credit repair services, integrating credit repair and funding services into your offerings can lead to increased client satisfaction and business growth.

See Also: How to Become a Certified Credit Repair Specialist

Final Thoughts

Understanding and managing your revolving utilization is essential for maintaining a healthy credit score. By keeping your utilization low, paying off balances, and using credit wisely, you can boost your score and increase your chances of securing the credit you need.

Whether you’re working on your own credit or offering credit repair services, mastering utilization is a crucial step toward financial success. Sign up with credit veto today to get started.

Frequently Asked Questions (FAQs)

Is 20% revolving utilization good?

Yes, a 20% revolving utilization rate is considered good for your credit score. It’s well below the 30% threshold, which is recommended for maintaining a healthy credit score.

Does 0% utilization hurt credit score?

No, a 0% utilization rate does not hurt your credit score. In fact, it can be beneficial as it shows that you are not relying heavily on credit. However, it’s important to use credit occasionally to maintain an active credit history.

What is revolving utilization on Discover?

Revolving utilization on Discover refers to the percentage of your credit limit that you’re using on Discover credit cards. It is calculated by dividing your balance by your credit limit and multiplying by 100.

What is an example of a revolving account?

A revolving account is a type of credit account where you can borrow up to a limit and carry a balance month-to-month. Examples include credit cards, home equity lines of credit (HELOC), and lines of credit from financial institutions.

How does revolving utilization affect my credit score?

Revolving utilization affects your credit score by showing how much of your available credit you’re using. High utilization (above 30%) can lower your score, while low utilization helps improve it.