Short answer: There isn’t a universal default credit score. If you’re new to credit, you may have no score until your file has enough data to be scorable. Models like FICO and VantageScore range from 300–850, but new files often show “no score,” not 300. Some lenders also use a proprietary credit score alongside FICO/VantageScore.

Most people don’t start at 300; there’s no universal default credit score. If you’re new to credit, you’re often unscorable until enough data appears.

This guide explains how FICO/VantageScore creates your first number, why some lenders use a proprietary credit score, and the fastest ways to become scorable, safely.

What Is a Credit Score?

A credit score is a three-digit number that represents your creditworthiness based on your credit history. Lenders use it to assess risk and set pricing and terms.

Scores typically range 300–850; higher is better. With a new file, there is no default credit score—you may simply be unscorable until data is reported.

Why Your “Default” Might Be No Score (Not 300)

Your credit score is a three-digit estimate of risk. To generate it, scoring models need tradelines and recent activity. With a thin or brand-new file, the system can’t calculate a result, so your “default” status is simply unscorable until data appears (e.g., an account reported in your name).

- Typical ranges: 300–850 (FICO, VantageScore).

- No universal start point: There is no default credit score assigned at birth or at 18.

- Become scorable: Once accounts report (and meet minimum data rules), a score is generated.

How Mainstream Scoring Works (FICO & VantageScore)

The mechanics below mirror your original explainer, which is kept intact, condensed for clarity, and reoriented to the default credit score question.

What a credit score measures

A credit score predicts the likelihood you’ll pay on time. Higher scores generally unlock better rates and approvals.

How scores are calculated (FICO factors)

- Payment history (35%): On-time streaks help, but late payments, collections, and bankruptcies hurt.

- Amounts owed / utilization (30%): Keep revolving credit balances low (ideally single digits).

- Length of history (15%): Older, well-managed accounts help your score.

- Credit mix (10%): Responsible use of both revolving and installment credit is a plus.

- New credit (10%): Hard inquiries and many new accounts can trim points short-term.

VantageScore evaluates similar inputs but can score files with shorter history and places slightly different emphasis on usage trends and available credit.

Pro Tip: For best early outcomes once you become scorable, keep utilization low, make every payment on time, and avoid opening multiple accounts at once.

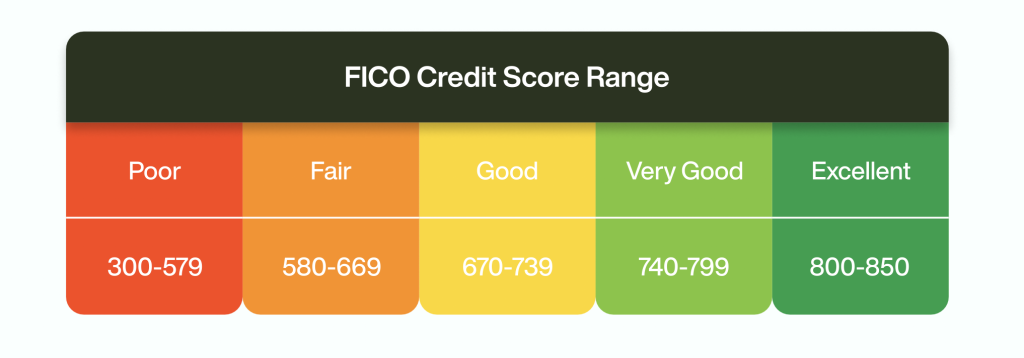

Score Ranges (Where You Stand Once You Have A Score)

- 300–579 (Poor): High risk; denials and high APRs are common.

- 580–669 (Fair): Subprime but workable; terms are tighter.

- 670–739 (Good): Competitive rates and broader approvals.

- 740–799 (Very Good) : Strong pricing and limits.

- 800–850 Excellent – Top-tier offers and lowest rates.

Again, your first score isn’t a default credit score; it’s the number the model calculates once enough data exists.

What Is A Proprietary Credit Score?

A proprietary credit score is an in-house model a lender or platform uses alongside (or instead of) FICO/VantageScore. It blends bureau data with the lender’s own signals, application history, internal performance, deposit patterns, or sector-specific risks.

Two borrowers with identical FICO scores might look different under a lender’s proprietary credit score.

Why this matters: Even if you’re asking what is the default credit score, approvals can still hinge on a lender’s proprietary credit score and policy overlays (income stability, Debt to income ratios, recent delinquencies).

Factors That Move Your Score (And How to Manage Them)

Think of your credit score like a school grade. Good habits make the grade go up; messy habits make it drop. Here’s what changes it and what to do.

- Late payments

Missing a payment is like missing homework; your grade drops fast. Even one 30-day late can sting.

Easy fix: Turn on autopay for at least the minimum, set phone reminders, and if you’re short, call the lender and pay something before it’s 30 days late.

- Credit utilization (how much of your limit you use)

Using almost all your limits looks risky. Try to stay under 30% of your limit—under 10% is best.

Easy fix: Make a small extra payment before the statement date, ask for a credit-limit increase (if your budget is steady), or split spending across cards so no single card looks “maxed.”

- New inquiries (hard checks when you apply)

Every full application adds a tiny “ding.” Many dings close together can add up.

Easy fix: Space out applications. When shopping for a car or mortgage, do your rate checks within a short window so they count as one group. Use pre-qualify tools that are soft checks when possible.

- Account age (how long you’ve had credit)

Older accounts show longer good history.

Easy fix: Keep old, no-fee cards open. Make a small purchase every few months and pay it off so the card stays active. Avoid closing your oldest account.

- Credit mix (types of credit you use)

It’s okay to have just a few accounts. Lenders like seeing you can handle a card (revolving) and maybe a loan (installment), but you don’t need every kind.

Easy fix: Manage what you already have well—on time, low balances. Don’t open new loans “just for mix.”

- Public records (big negatives like bankruptcy/foreclosure)

These hit hard, but they fade with time if you keep good habits.

Easy fix: Focus on on-time payments, low balances, and no new trouble. Over time, the old mark matters less and can fall off your report (typically 7–10 years, depending on the item).

Fast checklist: Pay on time ✔️ keep balances low ✔️ apply sparingly ✔️ keep old no-fee cards ✔️ use what you have wisely ✔️ stay patient if you’ve had a big setback ✔️

Building from no score to a healthy score (practical Steps)

Here are top five steps you should take to achieve this

- Become scorable

Add a starter tradeline: secured card, credit-builder loan, or authorized-user status (if the primary has perfect history and low utilization).

- Protect payment history

Autopay minimums; use reminders for full balances.

- Keep balances light

Pay before the statement date to lower reported utilization.

- Avoid application bursts

Apply deliberately; wait for results before adding new credit.

- Monitor and correct inaccuracies

Pull all three reports. Dispute only inaccurate, incomplete, outdated, or unverified items—never accurate negatives.

Common myths about the default credit score

- Everyone starts at 300.

Truth: Many people start with no score; the first score appears once you have enough data.

- One proprietary model sets the default.

Truth: Proprietary credit scores vary by lender and are not universal defaults.

- Paying off everything instantly gives an 800.

Truth: Time, on-time history, and low utilization drive high scores—there’s no overnight default to excellent.

Conclusion

There’s no “default” score you start with, most new files are simply unscorable until you generate enough clean data. The fastest path is boring and reliable: open the right starter account, pay on time, keep utilization low, and watch your reports for errors.

Credit Veto helps you do exactly that with tri-bureau monitoring, instant alerts, and compliance-first guided disputes (inaccuracies only), plus a simple plan to become scorable, safely.

Next step: set up monitoring and your build-credit checklist by signing up with Credit Veto and start improving your score today.

FAQs

Q: What is the default credit score?

There’s no universal default credit score. Most people begin with no score until they have enough reported data. Once scorable, your number reflects your actual file, not a default starting point.

Q: How long until I get a score from no credit?

Often 1–6 months after your first account reports, depending on the model and activity levels.

Q: What is a proprietary credit score?

A proprietary credit score is a lender’s private model that uses bureau data plus internal signals. It can complement or override how a traditional FICO/VantageScore is interpreted.

Q: Why does my lender say I’m approved if my score seems low?

Their proprietary credit score and policy overlays may view your risk differently (income stability, deposit history, relationship length).

Q: Does closing a card help my score?

Usually not. It can raise utilization and reduce average age. Consider keeping long-standing, no-fee cards open.