What Credit Score Is Needed to Buy a House in 2025?

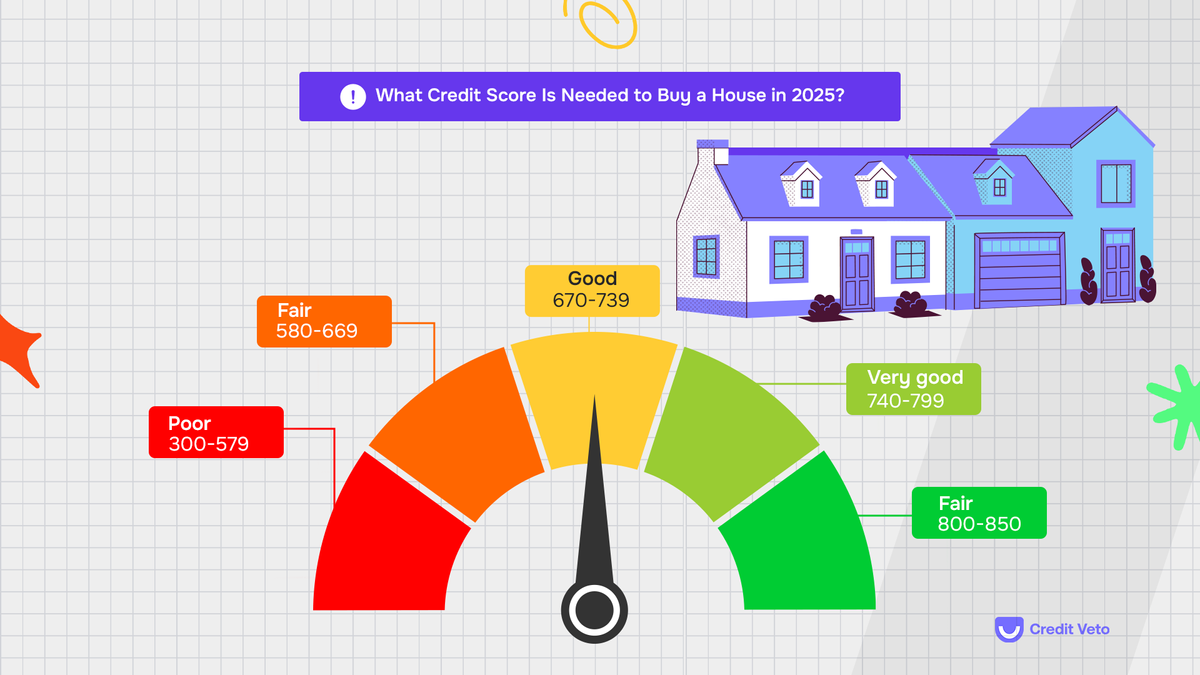

A credit score of 700 or higher is ideal for securing the best mortgage rates, though you can qualify for some loans with scores as low as 500 or 620

Whether it's a workspace building or your dream home, buying a house is one of the biggest financial commitments you’ll ever make. Your credit score plays a crucial role in determining whether you qualify for a mortgage and what interest rate you’ll receive.

In 2025 and beyond, mortgage lenders continue to rely on credit scores to assess borrowers, but fluctuating market conditions and lending policies make it even more important to understand the minimum credit score requirements.

If you’re wondering what credit score is needed to buy a house in 2025, this guide will break it all down for you—covering different loan types, how your credit score affects your mortgage rate, and ways to improve your score to secure the best loan terms.

Why Does Your Credit Score Matter When Buying a House?

Your credit score is one of the most critical factors lenders consider when evaluating your mortgage application. It determines:

- Loan eligibility – Whether you qualify for a mortgage

- Interest rate – Higher scores lead to lower interest rates, saving you money over time

- Loan terms – Credit scores influence your down payment requirements and loan flexibility

According to a recent report by the Federal Reserve, borrowers with credit scores of 760 or higher secure the lowest mortgage interest rates, while those with lower scores often pay significantly more in interest over the life of the loan.

A study from Experian also found that homebuyers with credit scores above 700 are more likely to qualify for competitive mortgage rates, while those below 620 may struggle to find affordable loan options. With home prices and mortgage rates fluctuating, ensuring you have a solid credit profile is more important than ever in 2025.

Minimum Credit Score Requirements for Different Mortgage Loans in 2025

Not all installment loans, like that of a mortgage, have the same credit score requirements. The minimum credit score needed depends on the type of loan you're applying for. Here’s a breakdown:

1. Conventional Loans (620 Minimum Credit Score)

Conventional loans, backed by Fannie Mae and Freddie Mac, typically require a minimum credit score of 620. However, to secure the best interest rates, a score of 740 or higher is recommended.

Pros of Conventional Loans:

- Lower mortgage insurance costs compared to FHA loans

- Flexibility in property types (single-family homes, condos, second homes)

- Competitive interest rates for high-credit-score borrowers

Cons:

- Requires higher credit scores for lower interest rates

- Stricter debt-to-income (DTI) ratio requirements

2. FHA Loans (500–580 Minimum Credit Score)

FHA loans, insured by the Federal Housing Administration, are popular among first-time homebuyers and those with lower credit scores.

- 580+ credit score: Qualifies for a 3.5% down payment

- 500–579 credit score: Requires a 10% down payment

Pros of FHA Loans:

- Easier credit qualification than conventional loans

- Low down payment options

Cons:

- Requires mortgage insurance premiums (MIP), which add to loan costs

- Lower credit scores result in higher interest rates

3. VA Loans (Typically 620 Minimum Credit Score)

VA loans, backed by the Department of Veterans Affairs, are available to eligible military service members, veterans, and their families.

While the VA does not set a minimum credit score, many lenders require at least 620. Some lenders may approve scores as low as 580 with strong compensating factors.

Pros of VA Loans:

- No down payment required

- No private mortgage insurance (PMI)

- Competitive interest rates

Cons:

- Only available to eligible military personnel and veterans

4. USDA Loans (640 Minimum Credit Score)

USDA loans, backed by the U.S. Department of Agriculture, are designed for low-to-moderate-income borrowers in rural and suburban areas.

Most lenders require a minimum credit score of 640 for USDA loans. However, lower scores may be considered with manual underwriting.

Pros of USDA Loans

- No down payment required

- Competitive interest rates

Cons

- Geographic restrictions (must be in USDA-eligible areas)

- Income limits apply

5. Jumbo Loans (700+ Minimum Credit Score)

Jumbo loans are for borrowers who need financing that exceeds conventional loan limits (typically $726,200 in most areas). Most lenders require a minimum credit score of 700 or higher to qualify for a jumbo loan.

Pros of Jumbo Loans

- Higher loan amounts available

- Can finance luxury properties or high-cost homes

Cons

- Stricter credit requirements

- Higher down payment typically required (10–20%)

How Your Credit Score Affects Your Mortgage Interest Rate

Your credit score doesn’t just determine whether you qualify for a mortgage—it also affects how much you’ll pay in interest over the life of the loan.

For example, let’s compare estimated mortgage rates based on credit score:

Note: A borrower with a 760+ credit score could save over $90,000 in interest compared to someone with a 620 credit score! Amazing, right?

How to Improve Your Credit Score Before Buying a House

If your credit score isn’t where it needs to be, there’s still time to fix and improve it before applying for a mortgage. Here’s how:

- Pay bills on time – Payment history makes up 35% of your credit score. Set up automatic payments to avoid missed due dates.

- Reduce credit card balances – Keep credit utilization below 30% (ideally under 10%) for the best impact.

- Avoid opening new credit accounts – Hard inquiries can lower your score temporarily.

- Check your credit report for errors – Dispute any inaccuracies on your report to prevent unfair damage to your score.

- Build a longer credit history – If you have a thin file, consider becoming an authorized user on a trusted account.

- Monitor your credit regularly – Sign up for credit monitoring services like Credit Veto to help you eep track of your credit score improvement on your credit report.

FAQs About Credit Scores and Home Buying

Q: What is the ideal credit score to buy a house in 2025?

A: A credit score of 700 or higher is ideal for securing the best mortgage rates, though you can qualify for some loans with scores as low as 500 (FHA) or 620 (conventional).

Q: Can I buy a house with a 580 credit score?

A: Yes, FHA loans allow borrowers with a 580 credit score to qualify for a 3.5% down payment. However, you may face higher interest rates.

Q: What credit score do I need for a 0% down payment?

A: For VA loans, a 620 credit score is typically required for zero down. USDA loans also offer 0% down but require a minimum score of 640.

Q: Does my spouse's credit score affect my home loan?

A: If you’re applying for a joint account with your partner, both credit scores are considered. A lower credit score could affect your interest rate or approval chances.

Bottom Line

If you’re planning to buy a house in 2025, your credit score will be a key factor in determining your mortgage options. While higher scores enable better rates and loan terms, even those with lower scores still have options with government-backed loans like FHA, VA, and USDA.

Take proactive steps to boost your credit before applying, and shop around for the best mortgage rates to maximize your home-buying potential.

Want to monitor and improve your credit before applying for a home loan? Check out Credit Veto’s credit repair services today and be on your way to owning your own home today.

Comments ()