The Credit Score Killer No One Talks About: Fix Your Utilization Fast

If your credit score is stuck, this could be why. Learn how to fix high credit utilization and watch your score finally rise.

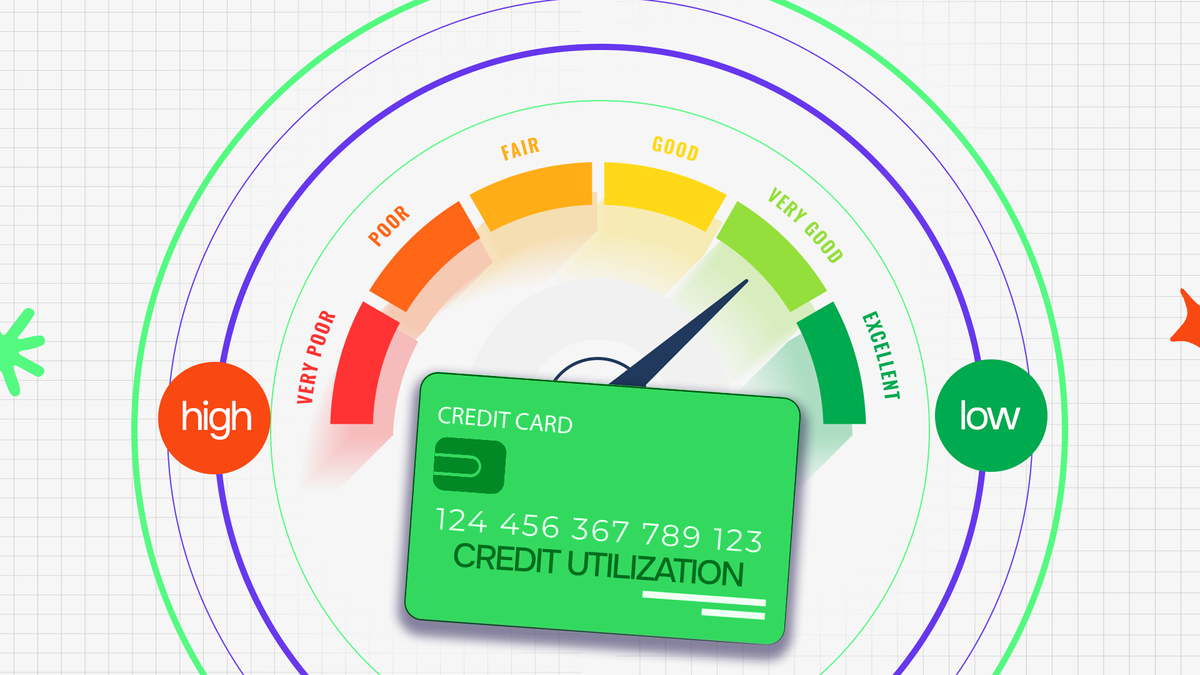

Did you know that how you use your credit could be the key to unlocking a better credit score? Credit utilization accounts for 30% of your score, and getting it wrong can cost you big. But don't worry, we're here to help you get it right!

Credit utilization is simply the percentage of your available credit that you're using, and it's one of the biggest factors in determining your credit score. Keeping your utilization low can boost your score, while high utilization can drag it down.

Many people unknowingly hurt their credit by maxing out cards or carrying high balances. Since credit bureaus see high usage as a sign of financial risk, it can negatively affect your score, making it harder to get approved for loans.

In this article, we’ll walk you through how credit utilization works, its impact on your credit score, and how you can manage it with smart credit goals to strengthen your credit profile. Ready to take control of your credit? Let’s dive in, one step at a time.

How Credit Utilization Works

Credit utilization is calculated by dividing your total credit card balances by your total available credit limit. For example, if you have a credit limit of $10,000 and you are using $3,000, your credit utilization ratio is 30%. This ratio is used by credit scoring models, like FICO and VantageScore, to determine how responsibly you manage your credit.

Your utilization rate is calculated both on a per-card basis and across all your credit accounts. If you have multiple credit cards, each one’s utilization affects your score individually, as well as your total combined utilization.

Key Points About Credit Utilization:

- Credit utilization applies primarily to revolving credit accounts, such as credit cards.

- Installment loans, such as mortgages or auto loans, are not factored into utilization in the same way.

- A utilization rate above 30% may start to hurt your credit score, while a rate below 10% is ideal for boosting your score.

How Does Credit Utilization Affect Your Credit Score?

Since credit utilization makes up 30% of your FICO score, it has a major impact on your overall creditworthiness. Here’s how it influences your credit:

1. High Credit Utilization Can Lower Your Score

When your credit utilization is consistently above 30%, it lowers your credit score because lenders assume you are over-reliant on credit. This can make it harder to get approved for loans or credit cards.

Example:

- If your credit card has a $5,000 limit and your balance is $4,500 (90% utilization), your score could drop significantly.

Maxing out your credit cards or carrying high balances relative to your limits can lead to a significant drop in your credit score.

2. Low Credit Utilization Strengthens Your Score

Credit bureaus favor borrowers who use less than 10% of their available credit. Maintaining low balances demonstrates responsible credit use, helping to boost your credit score. Keeping your credit utilization low shows lenders that you are responsible with your credit. Borrowers who consistently maintain a low balance relative to their limits are seen as financially stable and less risky. Since credit utilization makes up 30% of your FICO score, it has a major impact on your credit profile.

3. Utilization is Updated Monthly

Your utilization rate changes each month when your lender reports your balance to credit bureaus. If your balance is high when your statement closes, it could reflect poorly—even if you pay it off in full after the due date.

To maintain a healthy credit utilization ratio, it’s important to understand when your issuer reports your balance. Most credit card companies report at the end of the billing cycle, not after you make a payment. This means that even if you clear your balance in full after the due date, a high reported balance could still negatively impact your credit score.

To prevent this, consider making an early or mid-cycle payment before your statement closes. This strategy ensures a lower balance is reported, helping you manage your credit utilization effectively and strengthen your credit score over time.

4. Fluctuations Can Impact Your Score Monthly

Credit utilization is updated on your credit report each month when your lenders report your balances. If you have a high utilization one month, your score may drop, but reducing your balance in the next billing cycle can help it recover.

This fluctuation happens because credit scoring models assess your debt-to-limit ratio in real-time. If your reported balance is high relative to your credit limit, lenders may see you as a higher risk, even if you plan to pay it off soon.

On the other hand, lowering your utilization before the next reporting cycle can quickly improve your score. Keeping your utilization below 30%—or ideally under 10%—on all credit cards helps maintain score stability. Regularly monitoring your balances and making early payments can prevent drastic score changes and support long-term credit health.

5. Credit Limits Matter

Even if you are responsible with credit, having a low credit limit can make it difficult to maintain a low utilization rate. Increasing your credit limit (without increasing spending) can improve your utilization ratio and strengthen your credit score.

How to Manage Your Credit Utilization Effectively

To maintain a strong credit score, you need to manage your credit utilization wisely. Here are some proven strategies to keep your utilization low and improve your financial health:

1. Pay Off Balances Regularly

One of the most effective ways to lower your credit utilization is to pay off your credit card balances before the statement closing date. This ensures that a lower balance is reported to the credit bureaus, reducing your utilization ratio. Instead of waiting until your bill is due, pay off your balance before the statement closing date.

2. Make Multiple Payments Per Month

Instead of waiting for your monthly bill, consider making multiple payments throughout the month. This strategy helps keep your balances low and prevents your utilization from spiking before your statement is issued. Making multiple payments throughout the month keeps your balances low and prevents utilization spikes. Even if you use your credit card frequently, paying off small amounts consistently keeps your reported utilization low.

3. Increase Your Credit Limit

If you have a good credit history, requesting a credit limit increase can instantly lower your utilization rate.

Example:

- If your credit limit is $5,000 and your balance is $1,500 (30%), an increase to $10,000 lowers your utilization to 15% without changing your spending.

However, avoid increasing your limit if you’re tempted to spend more—this defeats the purpose!

4. Keep Old Credit Accounts Open

Your credit limit is based on all open accounts, so closing an old credit card could reduce your total available credit and raise your utilization percentage. Unless a card has high fees, keeping it open helps maintain a low utilization rate.

5. Spread Out Balances Across Multiple Cards

Instead of maxing out one credit card, spread your balances across multiple cards to keep individual utilization rates lower.

Example:

- Card A: $5,000 limit, $4,500 balance (90% utilization) → Bad

- Card A: $5,000 limit, $2,000 balance (40% utilization)

- Card B: $5,000 limit, $2,000 balance (40% utilization)

- Total Credit Limit: $10,000, Total Balance: $4,000 (40% overall utilization)

By distributing your debt, you can keep each card’s utilization rate lower.

Common Credit Utilization Myths Debunked

These are common myths around credit utitlization you have believed might be ruining your credit report.

1. “I Need to Carry a Balance to Build Credit”

You don’t need to carry a balance to build credit. As long as you use your card and pay it off, your credit activity is still reported.

2. “Closing a Credit Card Will Improve My Score”

Closing a credit card reduces your total available credit, which raises your utilization rate and can lower your score.

3. “Utilization Only Matters When Applying for Credit”

Credit utilization affects your score every month, not just when applying for a loan. Keeping it low consistently is key to a strong credit profile.

Master Credit Utilization to Strengthen Your Credit Score

Credit utilization is a key factor in maintaining a healthy credit score. To recap:

- Keep your utilization below 30% (ideally under 10%).

- Pay off balances before the statement closing date.

- Increase your credit limit (if you can manage it responsibly).

- Keep old accounts open to maintain a higher credit limit.

- Spread balances across multiple cards to lower individual utilization rates.

By following these smart money habits, you can strengthen your credit score and achieve long-term financial stability.

Struggling With High Credit Utilization? Let Credit Veto Help!

Managing credit utilization can be challenging, but you don’t have to do it alone. At Credit Veto, we specialize in helping clients reduce credit utilization, improve credit scores, and unlock better financial opportunities. Sign up with Credit Veto at our flat-rate packages and take the first step toward a stronger credit score in 2025.

Want step-by-step help managing your credit better? Join the free 5x5 Credit Veto Challenge and take control of your financial future!

Comments ()