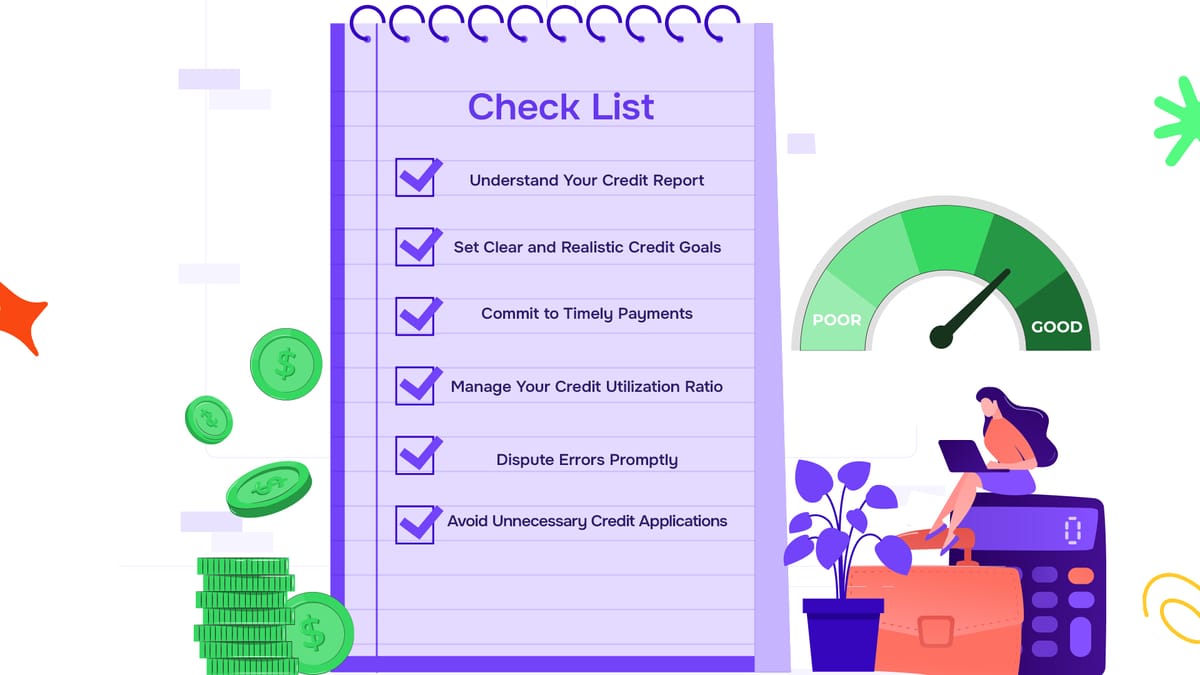

Your 2025 Credit Repair Resolutions Checklist

As the new year approaches, it’s a time for reflection and setting goals, especially financial ones. Your credit health is a cornerstone of your financial well-being. It impacts everything from securing loans with favorable terms to accessing housing and even job opportunities. If improving your credit score is one of your resolutions for 2025, you’ve come to the right place. This comprehensive checklist will guide you step-by-step toward achieving a stronger credit profile.

1. Understand Your Credit Report

A good credit score starts with understanding your credit report. Request a free copy of your credit report from each of the three major credit bureaus: Equifax, Experian, and TransUnion. By reviewing your reports, you can:

- Spot errors or inaccuracies that may be dragging down your score.

- Detect unauthorized or fraudulent activity.

- Gain insight into the factors impacting your creditworthiness.

Take the time to examine every detail. If you identify errors, such as incorrect account statuses or duplicate entries, dispute them immediately with the credit bureaus.

2. Set Clear and Realistic Credit Goals

Having defined goals makes the process more manageable. Examples of achievable credit goals include:

- Raising your credit score by 50 points by mid-year.

- Paying off a specific percentage of your debt by December.

- Establishing a routine of paying bills on time every month.

Write these goals down and break them into smaller, actionable steps to keep yourself on track.

3. Commit to Timely Payments

Your payment history accounts for 35% of your credit score, making it the most significant factor. Late payments can significantly harm your credit. Here’s how to stay consistent:

- Set up automatic payments to ensure bills are paid on time.

- Use calendar reminders or financial apps to track due dates.

- Aim to pay at least the minimum amount due, even during financially tight periods.

4. Manage Your Credit Utilization Ratio

Your credit utilization ratio reflects how much of your available credit you’re using. A lower ratio indicates responsible credit management. Aim to keep this ratio below 30%, or ideally under 10%, by:

- Paying down balances on revolving credit accounts.

- Requesting credit limit increases without increasing your spending.

- Splitting large purchases across multiple cards to avoid maxing out any single account.

5. Dispute Errors Promptly

Mistakes on your credit report can unfairly lower your score. Common errors include incorrect balances, outdated information, and accounts mistakenly reported as delinquent. To address these:

- File a dispute through credit veto with the credit bureau that issued the report.

- Provide supporting documentation, such as bank statements or correspondence with creditors.

- Follow up to ensure corrections are made in a timely manner.

6. Avoid Unnecessary Credit Applications

Each time you apply for new credit, a hard inquiry is added to your report, which can temporarily lower your score. To minimize this impact:

- Only apply for credit when it’s absolutely necessary.

- Space out applications to avoid multiple inquiries within a short period.

7. Pay Down High-Interest Debt

High-interest debt can drain your finances and hinder your credit repair journey. To tackle this effectively, focus on debts with the highest interest rates first using the avalanche method. Begin by paying off high-interest accounts like credit cards while maintaining minimum payments on other obligations. This approach reduces the total interest paid over time, allowing you to save money and accelerate your path to being debt-free.

Additionally, avoid accumulating more high-interest debt during this process. Opt for disciplined spending habits and consider consolidating debts into a lower-interest loan if it aligns with your financial situation. Lenders favor borrowers with a varied credit portfolio, including credit cards, installment loans, and mortgages, as it reflects responsible credit management across different account types. However, diversification should serve your financial goals, not compromise them.

8. Diversify Your Credit Mix Wisely

Lenders favor borrowers with a varied credit portfolio, including credit cards, installment loans, and mortgages, as it reflects responsible credit management across different account types. However, diversification should serve your financial goals, not compromise them. Before adding a new credit type, evaluate its necessity.

For instance, if you're considering a car loan but don’t need a vehicle, taking on the loan purely for diversification could lead to unnecessary debt and strain your finances. Instead, focus on managing your existing accounts well, ensuring timely payments and responsible credit use. Diversify only when it aligns naturally with your financial objectives.

9. Use Credit Responsibly

Responsible credit usage is key to building and maintaining a good score. Best practices include:

- Charging only what you can afford to pay off in full each month.

- Avoiding cash advances, which come with high fees and interest rates.

- Monitoring spending to ensure it aligns with your budget.

10. Monitor Your Credit Regularly

Stay proactive by monitoring your credit report throughout the year. Credit monitoring services help you:

- Track changes to your credit profile.

- Detect potential fraud early.

- Measure your progress toward achieving your credit goals.

11. Communicate with Creditors

If you’re struggling to meet your financial obligations, don’t wait for accounts to go into collections. Reach out to your creditors to discuss:

- Payment plan options.

- Temporary adjustments to payment terms.

Most creditors are willing to work with you to find a solution.

12. Educate Yourself on Credit Basics

Knowledge is power when it comes to credit management. Take the time to learn about:

- The factors that influence your credit score.

- The difference between hard and soft inquiries.

- Strategies for long-term credit health.

This understanding will empower you to make informed decisions.

13. Celebrate Your Progress

Improving your credit is a marathon, not a sprint. Progress takes time, effort, and consistency, which makes it even more important to acknowledge the milestones along the way. Whether it’s paying off a high-interest credit card, reducing your debt-to-income ratio, or seeing a noticeable improvement in your credit score, these moments deserve celebration.

Celebrating small victories not only keeps you motivated but also helps reinforce positive habits. For example, if you’ve successfully stuck to a budget for several months, reward yourself in a meaningful way, like treating yourself to an affordable indulgence or investing in something that contributes to your personal growth.

Keep a journal or use a financial tracking app to log your accomplishments. These tools can provide a visual representation of how far you’ve come, making your efforts feel more tangible and rewarding. Sharing your success with supportive friends or family members can also boost morale and keep you accountable.

Remember, the journey to better credit health isn’t linear. There may be setbacks, but recognizing your wins—big or small—ensures you maintain the momentum needed to reach your ultimate financial goals.

14. Consider Professional Credit Repair Help

If the process feels overwhelming, professional credit repair services like Credit Veto can offer expert guidance. They can help you:

- Dispute inaccuracies effectively.

- Negotiate with creditors for better terms.

- Create a tailored plan for long-term credit improvement.

Take Charge of Your Credit in 2025

Achieving better credit health starts with intentional steps and consistent effort. This checklist is your roadmap to making meaningful financial progress this year. Each action you take, no matter how small, builds towards your long-term credit success.

Sign up for Credit Veto Today, Download our Free Credit Repair Starter Guide, and take your first step towards a stronger financial future in 2025.

Comments ()