How to Generate Credit Repair Leads: 8 Mistakes Costing You Clients

Short answer: If you are asking how to generate credit repair leads consistently, the problem is rarely demand. It is usually broken positioning, slow follow-up, or unclear systems that cause interested people to walk away.

Every day, thousands of Americans search for credit repair help. They want fixes, guidance, and reassurance. Yet many credit repair businesses struggle to turn that demand into paying clients.

The reason is not visibility alone. It is how the business responds once interest appears. This guide breaks down the most common mistakes costing you credit repair leads and shows what actually works in today’s market.

Why Most Credit Repair Businesses Struggle to Generate Leads

Before listing the mistakes, it helps to understand the real issue. Most people searching for credit repair help are already motivated.

They are denied loans, stressed about credit scores, or preparing for big financial moves. The gap is not awareness. The gap is clarity, trust, and follow-up.

If your process is unclear or slow, leads disappear. This is why learning how to generate credit repair leads is less about ads and more about fixing what happens after someone shows interest.

Why Learning How to Generate Credit Repair Leads Is Harder Than It Looks

Credit repair is a trust-based service. People are cautious. They have been disappointed before. Many have spoken to multiple providers already.

When someone searches for how to generate credit repair leads, they often assume the answer is ads, social media, or posting more content. Those things matter, but they are not the foundation.

The foundation is:

- Clarity

- Speed

- Trust

- Follow-through

Without these, leads leak out of your pipeline, no matter how much traffic you get.

8 Mistakes Costing You Credit Repair Leads

Below are eight core mistakes most credit repair specialists make that are costing them credit repair leads that could potentially become clients, and how to fix them.

1. Focusing on Traffic Instead of Conversations

Traffic only creates awareness. Conversations create trust, and trust is what turns interest into paying clients.

One of the biggest misunderstandings about how to generate credit repair leads is assuming that more traffic automatically means more clients. It does not.

Many credit repair businesses already have a hidden pool of warm leads sitting unused, such as:

- Old DMs from people who asked questions

- Missed calls from potential clients

- Past consultations that were never followed up on

- Incomplete sign-ups that stopped halfway

These people already showed interest. They are far more likely to convert than someone seeing your content for the first time.

When businesses ignore these warm credit repair leads and focus only on getting new traffic, they spend more time and money just to replace opportunities they already had. This slows growth and creates unnecessary pressure to keep chasing attention.

The businesses that grow consistently do the opposite. They prioritize conversations over clicks and systems over volume. By reactivating people who already raised their hands, they close more clients with less effort and build steadier income.

2. Explaining Credit Instead of Solving a Specific Problem

People do not wake up wanting to understand credit laws. They wake up wanting approvals.

If your messaging sounds like:

- Educational lectures

- Long explanations

- Technical language

You lose attention.

Effective credit repair lead generation focuses on:

- What went wrong

- What can be fixed

- How long it takes

- What the next step is

When people clearly see themselves in the problem, they stay engaged.

3. No Clear First Step for New Leads

Many people searching for how to generate credit repair leads overlook one simple question every visitor asks silently:

“What do I do now?”

If your website, page, or message does not answer that immediately, the lead disappears.

A strong first step:

- Feels low pressure

- Feels safe

- Explains what happens next

Confusion kills conversion faster than price.

4. Treating Rejection as the End of the Journey

Credit repair often starts with rejection.

Denied loans, declined cards, and failed approvals are the exact moments people become serious about fixing their credit. Yet many businesses stop engaging once funding fails.

This represents a significant issue in credit repair lead generation.

The professionals who win are the ones who:

- Stay present after denial

- Offer a clear recovery path

- Position credit repair as the solution, not the fallback

5. Manual Work That Slows Response Time

Speed is a silent advantage.

People seeking credit repair often contact multiple providers within hours. The one who responds clearly and confidently first usually wins.

Manual processes cause:

- Late replies

- Missed follow-ups

- Lost momentum

If you are serious about how to generate credit repair leads at scale, automation and structure like that created by CreditVetoPro are not optional. They protect your time and your conversions.

Read Also: How to Use Automation in Business Credit to Scale Faster

6. Weak Trust Signals

Credit repair has a credibility problem in the market. Many people have heard big promises before and seen little results, so skepticism is natural.

When your content does not clearly show:

- Real processes

- Clear steps

- Simple explanations

Then, people hesitate to move forward.

Vague claims and generic advice make leads pause because they cannot tell what actually happens after they say yes. They want to know how their credit issues will be handled, what comes first, and what progress looks like.

Trust grows when people can see the path, not just the promise. When your messaging explains what you do in plain language and shows how problems are addressed step by step, hesitation drops.

This is why structured systems like CreditVeto work better than vague offers. Clear processes, visible progress, and simple communication give people confidence to take action instead of staying stuck in doubt.

7. Trying to Teach Everything at Once

Over-explaining overwhelms people. Most credit repair leads do not need a full education. They need guidance.

Instead of teaching every rule, focus on:

- One clear problem

- One clear solution

- One clear action

This approach improves both engagement and follow-through. Consumers trust clear and transparent processes more than ads

8. No Follow-Up System

This is the most expensive mistake in credit repair lead generation. Most people do not convert the first time they reach out. They need reminders, clarity, and the right timing. Without a follow-up system:

- Leads forget

- Competitors step in

- Interest fades

What many credit repair businesses overlook is that their highest-value leads are often past clients, old inquiries, and people who were not ready at the time.

This is where revenue is usually left behind.

A proper follow-up system allows you to re-engage past credit repair clients and offer additional solutions, including funding options, once their credit improves. Instead of treating each service as a one-time transaction, you create a longer client journey.

With a structured dual revenue system, such as CreditVeto, follow-up becomes predictable. You stay in touch with past clients, guide them through credit repair, and position funding as the next step. This turns old conversations into new revenue without chasing cold leads.

If you are asking how to generate credit repair leads consistently, the answer is often not more traffic. It is better to follow up and make smarter use of the clients you already have.

What Actually Works for Generating Credit Repair Leads Today

Based on what works across growing credit repair businesses, the winning formula includes:

- Clear entry points

- Fast response systems

- Simple explanations

- Structured follow-up

- Ongoing trust-building

This is how interest turns into income.

How CreditVeto Supports Better Credit Repair Lead Generation

CreditVeto was built to solve the real reason most credit repair leads do not convert. It is not traffic. It is the lack of structure after the first message.

Many people struggle with how to generate credit repair leads because they do not have a system to manage interest once it shows up. CreditVeto fills that gap by giving you a clear, repeatable process for every inquiry.

With CreditVeto Pro, you can:

- Capture and organize all incoming leads in one place

- Follow up consistently without chasing or guessing

- Guide clients through simple, clear next steps

- Reduce manual work and repeated explanations

- Build trust through a visible, professional workflow

This structure helps you convert more leads without relying on constant posting or paid ads.

CreditVeto Pro also connects credit repair with funding, which means you are not waiting months to earn. You can guide clients through credit correction while preparing them for funding, turning follow-up into a second revenue opportunity instead of a dead end.

To support this system, CreditVeto also includes access to the CCFC course. The CCFC training teaches you how to think like a credit and funding consultant, explain your process clearly, handle objections, and move clients from credit problems to real outcomes.

If you want a structured way to generate credit repair leads, convert them consistently, and earn more from every client, CreditVeto Pro gives you the system, and the CCFC course gives you the skill set to use it properly. Sign up today to stay 80% above other credit repair specialists.

Final Thoughts

Learning how to generate credit repair leads is not about posting more or chasing traffic. It is about having a system that turns interest into action and conversations into paying clients.

When follow-up is structured, trust is clear, and your process is easy to understand, leads stop slipping away. That is exactly what CreditVeto Pro was built to support.

If you want to generate better credit repair leads, convert them consistently, and earn more from every client, start with a system that does the heavy lifting.

Get started with CreditVeto and build a credit repair business that runs with clarity, structure, and results.

Frequently Asked Questions

How do I generate credit repair leads without spending more on ads?

By following up with old contacts, simplifying your process, and automating your process with structured systems like Credit Veto.

Why do credit repair leads stop responding?

Most stop responding because the next step is unclear or there is no follow-up.

Is a system really necessary for credit repair lead generation?

Yes. Systems create speed, clarity, and consistency, which directly affect conversions.

How many credit repair leads do you need to make money?

You do not need a large volume. Many credit repair businesses close clients from just 10 to 20 qualified leads per month when follow-up and trust systems are in place. Conversion matters more than traffic.

How a Credit Repair Course Can Improve Your Credit Score and Business Faster

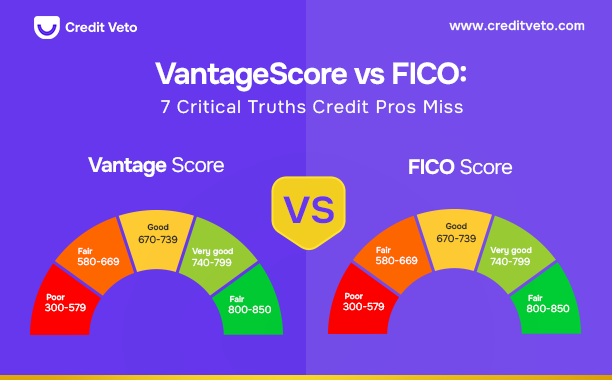

How a Credit Repair Course Can Improve Your Credit Score and Business Faster  Vantage Score vs FICO: 7 Critical Truths Credit Pros Miss

Vantage Score vs FICO: 7 Critical Truths Credit Pros Miss  How to Start a Credit Repair Business from Home in 2026

How to Start a Credit Repair Business from Home in 2026  Can I Hire a Lawyer to Fix My Credit? What Actually Works in 2026

Can I Hire a Lawyer to Fix My Credit? What Actually Works in 2026  How to Generate Credit Repair Leads in 2026: Top Tips for New & Experienced Agents

How to Generate Credit Repair Leads in 2026: Top Tips for New & Experienced Agents  How to Become a Credit Repair Agent and Succeed in 2026

How to Become a Credit Repair Agent and Succeed in 2026  How Long Do Late Payments Stay on Your Credit Report? 2026 Update

How Long Do Late Payments Stay on Your Credit Report? 2026 Update  How Many Credit Cards Should I Have? Avoid These 4 Mistakes

How Many Credit Cards Should I Have? Avoid These 4 Mistakes  How to Check Personal Credit Report: 7 Easy Steps

How to Check Personal Credit Report: 7 Easy Steps