From Beginner to Pro: Credit Repair Business Training That Boosts Profits

Starting a credit repair business can feel overwhelming when you don’t know where to begin. From understanding the legal requirements to mastering client acquisition and using the right credit repair business software, there’s a lot to learn. But the good news is you don’t have to figure it out alone.

With the right credit repair business training, you can go from unsure beginner to confident business owner; equipped with the skills, tools, and strategies to help clients and boost your profits.

This blog post will walk you through what proper training looks like, why it’s essential, and how it can transform your journey in the business credit repair industry.

Why Credit Repair Business Training Is Essential

Many first-time founders jump in and “figure it out as they go.” In credit repair, that trial-and-error path usually ends in one of three painful ways:

- Legal missteps: Miss a CROA disclosure or charge an illegal advance fee and the regulators notice. In August 2024, the Federal Trade Commissions (FTC) shut down a credit-repair pyramid scheme and froze $12 million in assets; two weeks later, the CFPB fined a popular software platform $3 million for enabling unlawful fees.

- Operational chaos: Without a repeatable workflow, every ,round turns into a fire drill, letters go out late, clients churn, and refunds pile up.

- Slow or negative cash flow: According to U.S. Bureau of Labor Statistics data, 1 in 5 small businesses closes within the first year, and poor pricing strategy and weak marketing are leading reasons.

Solid credit repair business training compresses that learning curve. It takes everything you must master (federal & state compliance, step-by-step dispute workflows, client acquisition, and retention) and packages it into a proven framework you can apply immediately. Done right, training does three things:

- De-risks compliance: You get model contracts, CROA-approved disclosures, and a clear checklist of state bonding or registration rules, so you don’t become the next FTC headline.

- Systemizes delivery: Templates, SOPs, and purpose-built credit repair business software turn a five-hour manual process into a one-hour automated cycle, freeing time for revenue-generating tasks.

- Speeds profitability: In our 2025 partner survey, founders who completed structured training reached break-even in ≈90 days, while DIY operators averaged 6–8 months.

In short, comprehensive training is the difference between guesswork that risks fines and burnout and a scalable, compliant credit-repair business that earns predictable profits.

Read Also: How to Scale Credit Repair Business The Right Way

What the Best Training Programs Cover

Here are five pivotal aspects the best credit repair business training should entail.

1. Legal Foundations

- Federal rules: CROA, FCRA, GLBA, and the Telemarketing Sales Rule.

- State requirements: bonding, registration, and fee caps where applicable.

- Contracts & disclosures: clear scope of work, no-guarantee language, and cancellation windows.

2. Workflow & Service Delivery

- Intake → Credit analysis → Dispute strategy → Follow-up → Client coaching.

- How to structure 30-day, 60-day, and 90-day service tiers.

- Business credit repair add-ons for entrepreneurs and small-business owners.

3. Tool Stack & Automation

- Evaluating credit repair business software (vs. spreadsheets).

- API automations: pulling tri-bureau reports, generating letters, e-notarizing, and certified mail.

- KPI dashboards for dispute outcomes, revenue per client, and churn.

4. Marketing & Client Acquisition

- Audience targeting: consumers vs. real-estate partners, auto dealers, loan officers.

- Startup credit repair business funnels (lead magnets, webinars, consult calls).

- Paid vs. organic channels and the exact numbers you need to hit breakeven.

5. Pricing & Profitability

- Flat-fee vs. pay-per-delete vs. subscription models.

- Upsells: identity-theft monitoring, budgeting courses, DIY templates.

- Tracking cost of acquisition (CAC) and lifetime value (LTV) so you can scale safely.

How to Choose the Right Credit Repair Business Training

Check that the program teaches how to start a credit repair business end-to-end, not just how to send letters. If you ever ask, “How do I start a credit repair business?” the curriculum should answer with a checklist you can execute immediately.

Naming Your Business the Right Way

Your name does three jobs on day one: signal trust, clarify what you do, and make it easy to find. Aim for clear, friendly, and legally safe.

Core rules (keep these tight):

- Trustworthy; avoid hype or promises (“erase,” “guaranteed,” “instant”).

- Memorable; short, easy to say/spell, and passes the “say-it-on-the-phone” test.

- Domain-ready; clean .com if possible; if not, use a brandable .com (add “group,” “advisors,” or “partners”) or a strong local modifier.

Words to lean on (safe, professional):

credit, score, report, advisors, solutions, partners, group, consulting, legal, compliance, fair, clear, true, north, path, rise, bright.

Words to avoid (can trigger mistrust or compliance issues):

erase, delete, guarantee, fix overnight, clean sweep, credit clinic, rapid repair, any implication of results you can’t legally promise.

Five proven naming patterns (pick one and iterate):

- Trust + Service: FairScore Advisors, ClearCredit Partners

- Direction + Outcome: NorthPath Credit, BrightRise Credit

- Metaphor + Service: Anchor Credit, Lighthouse Credit

- Founder + Descriptor: Madu Credit Consulting, Okoro & Co. Credit

- Place + Service: Houston Credit Solutions, Bay State Credit Advisors

Credit Veto Pro tip: Use the brand name alone for your logo (e.g., BrightRise), but keep “credit repair” in your site title tag and Google Business Profile so you still rank for service intent (e.g., “BrightRise; Credit Repair & Dispute Solutions”).

Quick 15-minute naming workflow:

- Choose a pattern above and brainstorm 20 options (no judging yet).

- Read each one aloud. Cut anything confusing or hard to spell.

- Check .com availability and common social handles.

- Do a basic USPTO TESS search and your state Secretary of State business registry for conflicts.

- Pick 3 finalists; get quick feedback from two trusted people who match your target client.

SEO & local visibility tips:

- Keep the brand short, then clarify with a tagline: “BrightRise; Credit Report Dispute & Coaching.”

- For local pages, use “Brand | Credit Repair in [City, ST]” to capture service + geography without stuffing.

- Ensure NAP (name, address, phone) is consistent across your website, Google Business Profile, and directories.

Handle the legal housekeeping:

- Make sure your name doesn’t imply outcomes you can’t legally guarantee under CROA.

- Register your business name with your state; get the matching domain and email before announcing.

- If you plan to operate in multiple states, confirm there’s no name conflict where you’ll market.

Sample, brandable placeholders (use for brainstorming, not final picks):

ClearPath Credit, TrueNorth Credit Advisors, Summit Score Group, Harbor Credit Consulting, BrightLedger Credit, Cedar & Co. Credit, BlueAnchor Credit Solutions, FirstLight Credit Partners.

Credit Veto Pro tip: Run a quick USPTO search (and your state registry) before you print cards or launch the website. It’s a five-minute step that can save a rebrand later.

The Software Question: Buy vs. Build

Good credit repair business software is your operations backbone. Look for:

- Secure client portal with real-time updates.

- A letter generator that supports custom merge fields and dispute reasons.

- Task automation—reminders, re-investigation tracking, and billing.

- Multi-seat management if you plan to hire processors or sales reps.

If you’re evaluating options, make a table that scores each platform on ease of use, integrations, compliance features, and price. The best credit repair software for business pays for itself in time saved within the first 60 days.

See Also: Best Credit Repair Software for Credit Repair Business

Training Into a Business in 14–90 Days

Below is a tighter roadmap that matches our site promise: launch in 14 days, then stabilize and scale within 90 days. This is a playbook, not a guarantee; outcomes vary by effort, offer, and market.

Days 1–14: Launch Sprint

- Set up the business fast: register the LLC, business bank, domain, and inbox. Load our compliant service agreement and disclosures.

- Configure your stack: install your credit repair business software, import our SOPs, and turn on the client portal, e-signature, billing, letter drafts, and certified mail/e-notary options.

- Package your offer: choose one clear service (personal repair) plus an optional business credit repair add-on. Set transparent pricing and a simple 30/60/90-day timeline.

- Open the funnel: publish a lead magnet (“7 Credit Report Errors to Fix First”), a bookable calendar, and the 15-minute strategy video to pre-sell. Start warm outreach (past clients, friends, local pros) and list your Google Business Profile.

Days 15–30: First Clients & Proof

- Run the audit call: use our script to convert interest into paid plans; deliver a clean intake → analysis → dispute plan in one session.

- Fulfill with discipline: send the first dispute round using templates tailored to the facts; log tasks, due dates, and bureau timelines in software.

- Validate the unit economics: track CAC, refund rate, and average revenue per client to confirm a workable credit repair business opportunity before you spend more on marketing.

Days 31–90: Systemize & Scale

- Measure what matters: dispute cycle time, letters sent per client, on-time delivery, client satisfaction, and churn.

- Add acquisition channels: realtor and mortgage-broker referrals, local SEO pages, and short video content that points to your audit call.

- Add capacity safely: train one processor using the SOPs; keep weekly QA and compliance checks. Offer business credit repair as a structured upsell once delivery is stable.

A focused 14-day launch followed by 60–75 days of disciplined delivery turns a startup credit repair business into a compliant, repeatable operation. That’s what strong credit repair business training is built to do.

Watch the 15-Minute Strategy and see the exact setup we teach: intake, software, offers, and the audit call that closes. Then use the templates to launch in two weeks.

Your Next Step: Graduate From Beginner to Pro

A profitable, compliant credit-repair agency isn’t luck; it’s a process. Credit Veto Pro gives you:

- Regulatory-approved contracts and letter libraries.

- Step-by-step launch modules covering every legal and operational detail.

- All-in-one software that automates disputes, billing, and client updates.

- Weekly coaching calls so you never get stuck.

Ready to turn knowledge into revenue?

Join Credit Veto Pro and launch (or relaunch) your credit repair business with confidence.

Start today and get instant access to the complete training, software, and community that transform beginners into profitable pros.

How a Credit Repair Course Can Improve Your Credit Score and Business Faster

How a Credit Repair Course Can Improve Your Credit Score and Business Faster  How Fast Will a Car Loan Raise My Credit Score? 2026 Real Timeline

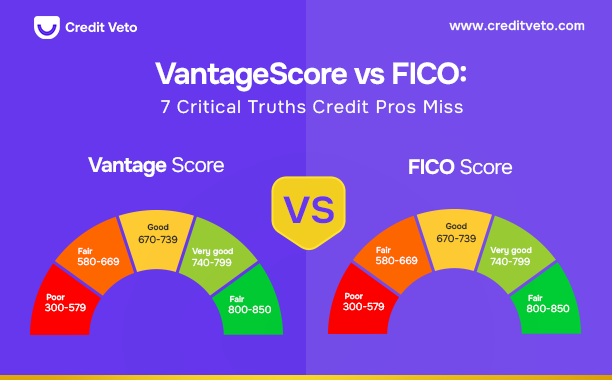

How Fast Will a Car Loan Raise My Credit Score? 2026 Real Timeline  Vantage Score vs FICO: 7 Critical Truths Credit Pros Miss

Vantage Score vs FICO: 7 Critical Truths Credit Pros Miss  What Credit Score Is Needed to Buy a UTV? (Real Limits)

What Credit Score Is Needed to Buy a UTV? (Real Limits)  Does a DUI Affect Your Credit Score? 5 Ways to Protect It

Does a DUI Affect Your Credit Score? 5 Ways to Protect It  How to Remove a Closed Account from Your Credit Report: 3 Best Steps

How to Remove a Closed Account from Your Credit Report: 3 Best Steps  How Long Do Late Payments Stay on Your Credit Report? 2026 Update

How Long Do Late Payments Stay on Your Credit Report? 2026 Update  How Many Credit Cards Should I Have? Avoid These 4 Mistakes

How Many Credit Cards Should I Have? Avoid These 4 Mistakes  How to Check Personal Credit Report: 7 Easy Steps

How to Check Personal Credit Report: 7 Easy Steps