How a Credit Repair Course Can Improve Your Credit Score and Business Faster

If you’re looking to boost your credit score or scale your credit repair business the right way, you might be wondering: “What’s the fastest and most effective way to achieve both?” The answer lies in investing in a credit repair course.

Whether you’re an individual trying to improve your credit or a business owner looking to offer expert credit repair services, a specialized course can significantly speed up the process.

In this post, we’ll explore how taking a credit repair course can benefit you and why it’s a total game-changer for both personal credit improvement and growing your credit repair business.

What is a Credit Repair Course?

A credit repair course is a structured program designed to teach individuals the process of improving their credit score. It provides detailed steps on how to dispute inaccuracies, understand credit reports, manage debt, and improve overall credit health.

These courses offer education on various aspects of credit repair, including:

- How to review your credit report

- Understanding the credit repair process

- How to dispute errors on your credit report

- How to build a positive credit history and avoid common pitfalls

In short, a credit repair course equips you with the tools you need to tackle credit issues head-on.

Why a Credit Repair Course is Crucial for Your Credit Score

If you’ve struggled with your credit score, you’re not alone. Many people face challenges with improving their credit due to misconceptions or a lack of knowledge. A credit repair course provides the education and actionable strategies needed to understand your credit report, identify errors, and dispute inaccuracies effectively.

- Comprehensive Understanding of Credit Reports

A credit repair course helps you understand what’s on your credit report and why it matters. You’ll learn how to analyze your credit score and determine areas that need improvement.

- Step-by-Step Strategies for Repairing Your Credit

From disputing errors to negotiating with creditors, a course offers a structured approach to tackling negative items on your report.

- A Focus on Long-Term Credit Health

It’s not just about fixing credit quickly. A credit repair course provides the tools to maintain and grow your credit health over time, helping you avoid pitfalls that could damage your score again.

Read Also: Does Credit Repair Really Work?

How a Credit Repair Course Can Help Grow Your Credit Repair Business

If you’re a credit repair specialist or aspiring entrepreneur, a credit repair course is just as important for you. Here’s how it can help you succeed:

- Master the Tools of the Trade

Understanding the ins and outs of credit repair is essential when offering services to clients. A credit repair course gives you the knowledge to create effective repair plans, dispute errors on behalf of clients, and increase their chances of financial success.

- Stay Ahead of Industry Trends

The credit repair landscape is constantly evolving. By taking a course, you ensure that your business is always up-to-date with the latest practices, regulations, and tools, giving you a competitive edge.

- Streamline Your Business Process

A credit repair course equips you with a structured, efficient process for handling multiple clients, improving your service delivery, and growing your business faster.

Why You Should Invest in a Credit Repair Course

While there are plenty of free resources available, investing in a structured credit repair course can provide several key benefits:

- Expert Guidance: A well-structured course gives you access to expert knowledge and proven strategies.

- Step-by-Step Process: You’ll get clear, actionable steps to improve your credit score, which will save you time and avoid costly mistakes.

- Stay Focused: Having a course to follow helps you stay disciplined and focused on your goals.

By investing in a quality credit repair course, you’re setting yourself up for success and gaining the knowledge needed to repair and build your credit effectively.

See Also: Do Credit Fixing Companies Work? When They Help and When They Don’t

Why Credit Veto’s Credit Repair Courses Stand Out

At Credit Veto, we understand the challenges both individuals and business owners face when it comes to credit repair. That’s why we offer comprehensive credit repair courses tailored to meet your specific needs, whether you’re improving your personal credit or scaling your credit repair business.

- Free Credit Repair Starter Guide: Start with our free, easy-to-follow guide to repairing your credit, and gain foundational knowledge that’s crucial for success.

- Certified Credit Repair & Funding Consultant Certification (CCFC): This course focuses on using credit repair to qualify clients for funding and loans. We’ll teach you how to guide your clients to success with credit repair strategies that are in high demand.

- Expert Tools & Resources: Our courses are packed with the best resources, tools, and actionable strategies to help you achieve your credit goals faster.

Conclusion

A credit repair course is the fastest and most efficient way to enhance your credit score and grow your credit repair business. By gaining expert knowledge, understanding credit reports, and learning proven strategies, you’ll be able to achieve lasting credit health and deliver outstanding services to your clients.

Ready to take control of your credit or scale your business? Start with Credit Veto’s Credit Repair Courses and watch your financial future unfold.

Don’t wait, join our credit repair course today and start improving your credit score or business. Sign up for the Certified Credit Repair & Funding Consultant Certification to access everything you need to succeed!

Frequently Asked Questions (FAQs)

- How long does it take to improve your credit score with credit repair?

It depends on your credit history and the actions you take, but most people see improvements within 3 to 6 months with consistent effort. - Can I repair my credit myself?

Yes, it’s possible to repair your credit by disputing inaccuracies, paying off debt, and improving your credit habits. A credit repair course from structured platforms like Credit Veto can help streamline the process. - Is Credit Veto a good resource for credit repair?

Yes, Credit Veto offers expert guidance, automated tools, and a comprehensive course to help individuals and businesses improve their credit scores.

How Fast Will a Car Loan Raise My Credit Score? 2026 Real Timeline

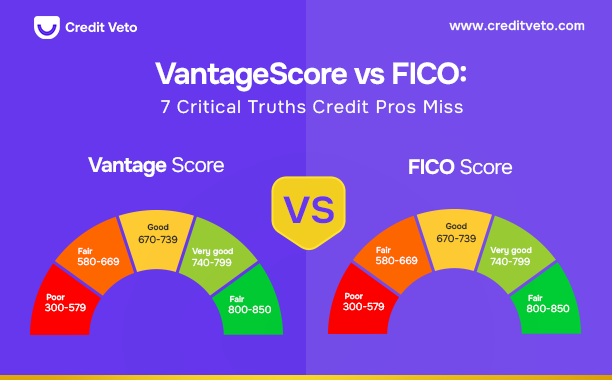

How Fast Will a Car Loan Raise My Credit Score? 2026 Real Timeline  Vantage Score vs FICO: 7 Critical Truths Credit Pros Miss

Vantage Score vs FICO: 7 Critical Truths Credit Pros Miss  What Credit Score Is Needed to Buy a UTV? (Real Limits)

What Credit Score Is Needed to Buy a UTV? (Real Limits)  Does a DUI Affect Your Credit Score? 5 Ways to Protect It

Does a DUI Affect Your Credit Score? 5 Ways to Protect It  How to Remove a Closed Account from Your Credit Report: 3 Best Steps

How to Remove a Closed Account from Your Credit Report: 3 Best Steps  650 Credit Score: Good or Bad? The Honest Answer

650 Credit Score: Good or Bad? The Honest Answer  How a Credit Repair Course Can Improve Your Credit Score and Business Faster

How a Credit Repair Course Can Improve Your Credit Score and Business Faster  How to Read a Business Credit Report: 5 Key Tips for Success

How to Read a Business Credit Report: 5 Key Tips for Success