How Can I Dispute a Credit Report? (7 Proven Ways)

Short Answer: To dispute a credit report, review your credit report for errors, identify the source of the issue, and contact both the credit bureaus and the lender directly. If the dispute is legitimate, file a dispute with the credit bureaus or the creditor.

Disputing errors on your credit report is crucial for maintaining a healthy credit score. Whether it’s a misreported account, fraudulent activity, or an outdated item, fixing these errors can help improve your financial health.

If you’re wondering how to dispute a credit report and get those negative items removed, you’re not alone. In this guide, we’ll walk you through 7 proven ways to dispute a credit report, get rid of errors, and regain control of your credit history.

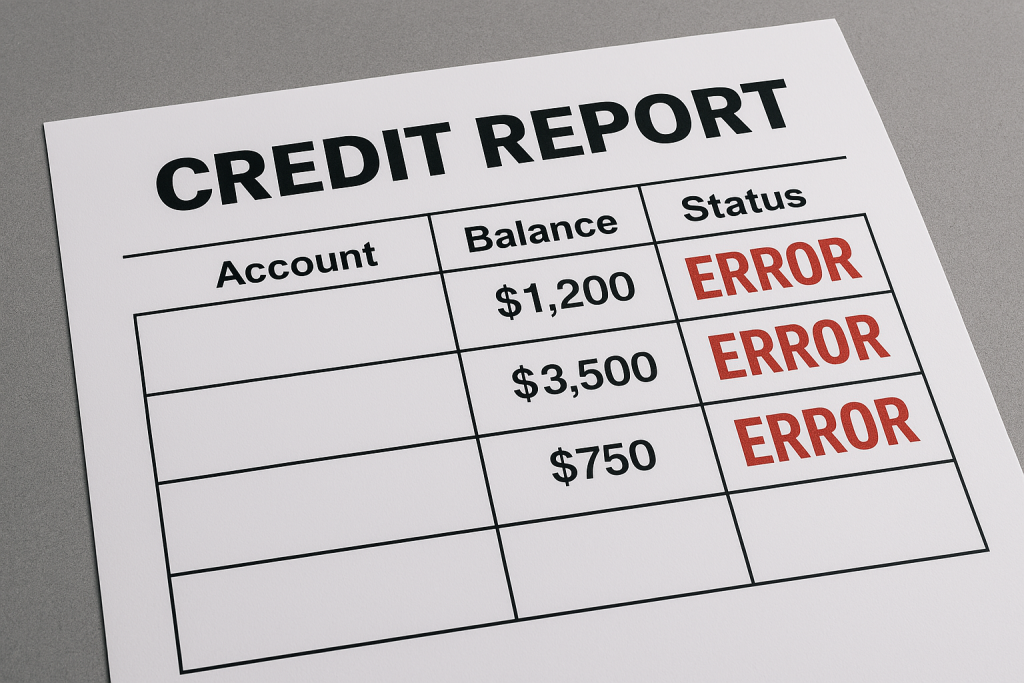

Understanding Credit Report Discrepancies and Their Impact

Before jumping into how to dispute a credit report, it’s crucial to understand why discrepancies appear in the first place. Whether it’s an incorrect entry, fraudulent activity, or outdated information, each can significantly affect your credit score.

Credit reports are essential for your financial health, and inaccuracies can have lasting consequences. An error on your credit report can lower your credit score, making it harder to get approved for loans, credit cards, or even a rental application.

Addressing these discrepancies as soon as they appear is vital to avoid unnecessary setbacks, and knowing the process to dispute these errors gives you more control over your financial future.

Now, let’s explore the proven ways to dispute a credit report effectively and efficiently.

7 Proven Ways to Dispute a Credit Report

Here are the top seven ways you can dispute your credit report.

1. Review Your Credit Report Regularly for Errors

Before you can dispute any inaccuracies, you first need to identify them. Get a copy of your credit report from the three major bureaus (Experian, Equifax, and TransUnion). You’re entitled to a free report once a year from AnnualCreditReport.com.

Look for:

- Incorrect personal details (name, address, etc.)

- Accounts that don’t belong to you

- Missed payments that were actually made on time

- Fraudulent accounts opened in your name

Once you spot an error, you can move forward with disputing it.

2. Identify the Type of Error on Your Credit Report

Errors can fall into different categories:

- Incorrect personal information: Outdated names or addresses.

- Accounts you don’t recognize: This could be the result of fraud or a reporting mistake.

- Late payments: These can be due to errors or a reporting mix-up.

Understand the error type to know how best to dispute it. For instance, if someone opened a fraudulent account in your name, you’ll need to report it as identity theft, which involves a more specific process.

3. Contact the Credit Bureau Directly

Once you’ve identified the error, the next step is to dispute it with the credit bureaus. You can do this online, over the phone, or by mail. Here’s how you can go about it:

- File an online dispute: This is often the fastest method. Each bureau has a dedicated online portal for credit disputes (e.g., Experian, Equifax, TransUnion).

- Dispute by mail: Send a dispute letter to the bureau, providing the necessary details and any supporting documentation.

- Provide evidence: Make sure to submit supporting documents such as bank statements, receipts, or screenshots to show proof of your claim.

4. Contact the Creditor Directly

If the error is linked to a specific creditor or lender, reach out to them directly. This is particularly useful if you believe an account was reported incorrectly.

- Dispute with the creditor: Contact the creditor or the entity that reported the error and request an investigation. Provide them with details and documents to support your claim.

In many cases, creditors will work with you directly to resolve issues, especially if there is a clear mistake.

5. Use the Dispute Process with Wells Fargo (WFBNA)

If you’re dealing with a WFBNA inquiry on your credit report and it’s incorrect, follow these steps:

- Verify with Wells Fargo: Call their fraud and credit reporting department to verify if the inquiry was authorized.

- Dispute with the credit bureaus: After confirming, you can file a dispute with Experian, Equifax, and TransUnion.

If the inquiry wasn’t authorized, Wells Fargo may remove it, or the credit bureau will if they find it invalid.

6. Add a Fraud Alert or Credit Freeze

If you suspect identity theft or fraudulent activity on your credit report, it’s crucial to protect yourself. Adding a fraud alert or a credit freeze can stop additional fraudulent accounts from being opened in your name.

- Fraud alert: This warns lenders to verify your identity before extending credit.

- Credit freeze: This locks your credit file, preventing creditors from accessing your credit report.

Both of these steps will help protect you from further damage and reduce the risk of additional errors on your credit report.

7. Monitor Your Credit Regularly

Once your dispute is resolved, it’s essential to monitor your credit report to ensure the error doesn’t reappear. You can use credit monitoring services or regularly check your credit reports to spot discrepancies early.

- Credit Services: Utilize effective credit tools like Credit Veto for update credit monitoring and credit leaks

- For more comprehensive monitoring, consider using services that offer detailed alerts on your credit report changes.

Conclusion

Disputing a credit report may seem daunting, but with the right approach, you can remove errors and improve your credit score. Whether it’s a fraudulent account or a mistake, the key is to take action quickly.

At Credit Veto, we understand how important your credit report is for securing loans, getting favorable interest rates, and improving your financial situation.

If you’re struggling with disputing errors or need help with credit repair, our Credit Repair System can guide you through the entire process. Start your credit repair journey today and take control of your financial future!

Frequently Asked Questions (FAQs)

How long does it take to dispute a credit report?

Credit disputes typically take 30-45 days to resolve. However, it may vary depending on the complexity of the issue and the responsiveness of the credit bureaus.

Can I remove a legitimate error from my credit report?

Only errors or unauthorized inquiries can be removed. Legitimate entries, such as late payments or debts, cannot be removed unless they are inaccurately reported.

What happens if my dispute is not resolved?

If your dispute is not resolved in your favor, you can appeal the decision or seek professional help from a credit repair company like Credit Veto and get it sorted promptly

650 Credit Score: Good or Bad? The Honest Answer

650 Credit Score: Good or Bad? The Honest Answer  How Midland Credit Management Can Affect Your Credit Score

How Midland Credit Management Can Affect Your Credit Score  Can I Lease a Car with a 500 Credit Score? What to Expect

Can I Lease a Car with a 500 Credit Score? What to Expect  Minimum Credit Score for a USDA Home Loan: Don’t Miss These Requirements!

Minimum Credit Score for a USDA Home Loan: Don’t Miss These Requirements!  What Credit Score Do You Need for Dental Implants? Complete Financing Guide

What Credit Score Do You Need for Dental Implants? Complete Financing Guide  Can Divorce Affect Your Credit Score? What You Must Know

Can Divorce Affect Your Credit Score? What You Must Know