How to Start a Credit Repair Business That Transforms Lives in Just 6 Weeks

Do you feel stuck in a job that doesn’t fulfil you or worse, doesn’t pay you enough to live the life you dream of? What if there was a way to not only change your financial future but also help others rewrite theirs?

Starting a credit repair business might sound like a leap, but in just a few weeks, it can become the game-changing move that puts you back in control.

In this blog post, we’ll walk you through exactly what it takes to start a credit repair business, how it works, and why it’s one of the most powerful side hustles (or full-time ventures) you can launch today.

You’ll learn the step-by-step process, the emotional and financial rewards, and how Credit Veto Pro makes the journey easier, faster, and legally compliant. Whether you’re looking for freedom, impact, or a fresh start, this post is for you.

Why Start a Credit Repair Business

For many people, the motivation to start a credit repair business comes from a deeply personal place. Maybe you’ve experienced the frustration of being denied a loan because of a low credit score, or you’ve watched someone you love feel stuck and powerless due to poor credit history. That emotional connection often becomes the driving force behind building something meaningful.

Starting a credit repair business isn’t just about making money. It’s about stepping into a role where you can genuinely help people who feel lost in the system. Every client you serve is a chance to change a story to help a family buy their first home, to support a single mom in qualifying for a car loan, or to give a young professional the fresh start they deserve.

Beyond the emotional rewards, this business offers a real pathway to financial freedom. With the right tools, strategies, and support, you can begin earning a steady income within your first few weeks. As more people look for reliable ways to fix their credit, your services can become not just helpful but truly life-changing.

The best part? You don’t need to be a financial guru to get started. You simplyd the passion to help others, the willingness to learn, and a trusted platform to support your journey. That’s where Credit Veto Pro comes in, giving you the training, automation, and compliance tools needed to launch your credit repair business with confidence.

Read Also: How to scale credit repair the right way

The Emotional Drive Behind Starting a Credit Repair Business

Many credit repair specialists and entrepreneurs didn’t start out chasing profits. Their journey began with a loved one in crisis or a personal battle with bad credit. They saw firsthand how a poor credit score can lock doors: denied rentals, high-interest loans, and rejection from job opportunities.

By helping someone close to them dispute inaccuracies or build new smart credit habits, they witnessed a transformation that went beyond numbers. That first success story often ignites a bigger mission: helping more people experience the same freedom.

- Transforming Communities One Score at a Time

In many underserved communities, financial literacy is scarce and credit issues are widespread. People feel invisible to the system and stuck in cycles of debt.

When you start a credit repair business, you’re not just offering a service; you’re offering hope. You help people qualify for mortgages, auto loans, and better insurance premiums simply by giving them the tools to repair and rebuild their credit reports.

Credit repair is often misunderstood. It’s not a scam or a shortcut. It’s a legitimate process that helps individuals correct errors in their credit reports and improve their overall credit profile.

Many people are unaware that their credit reports can contain errors, from outdated information to accounts that don’t belong to them, and these inaccuracies can severely impact their credit scores. A properly run credit repair business helps identify these issues and take the necessary steps to fix them.

Contrary to common myths, you cannot legally remove accurate and verified information from a credit report before its expiration. However, you can challenge items that are incorrect, unverifiable, or misreported.

Whether it’s a wrongly marked late rent payment or a duplicated collection account, credit repair involves sending targeted disputes to credit bureaus and creditors, asking them to investigate and resolve the issue. At the same time, clients are coached on how to establish healthy credit behaviors like reducing credit utilization, paying on time, and diversifying their credit mix to improve their scores over time.

How a Credit Repair Business Operates

A well-structured credit repair business is more than just filing disputes. It’s a comprehensive service that evaluates, educates, and empowers clients to take control of their financial futures. Here’s how it typically works:

- You onboard clients and gather their case files

Each client comes with a unique credit situation. You begin by collecting authorizations and reviewing their current credit reports from all three major bureaus: Experian, Equifax, and TransUnion.

- You analyze and audit their credit reports

This step involves combing through each line item to detect inaccuracies, outdated entries, duplicate accounts, or unverifiable debts that may be damaging their score.

- You dispute errors and negotiate with credit bureaus or creditors

Using customized dispute letters and legal consumer protection rights such as the Fair Credit Reporting Act (FCRA), you initiate contact with the appropriate agencies to resolve the inaccuracies.

- You coach clients on fast-track credit improvement strategies

Beyond disputes, you help clients adopt smart credit habits: keeping credit utilization low, maintaining a mix of credit types, and never missing a payment. This guidance not only repairs credit but also builds a foundation for long-term financial health.

By offering both dispute management and financial coaching, a credit repair business becomes a trusted partner in a client’s journey toward financial confidence. And when you consistently deliver results, word spreads, making this one of the most powerful, purpose-driven business models in today’s economy.

Step-by-Step Blueprint to Start a Credit Repair Business

Here are five (5) crucial steps you shouldn’t trivialize when starting a credit repair business.

Step 1: Learn the Tools of the Trade

- Understand the Fair Credit Reporting Act (FCRA).

- Learn dispute letter formats and required documentation.

- Use credit monitoring platforms and credit bureau portals.

Step 2: Validate Your Market

- Identify individuals searching for terms like “fix credit fast,” “credit repair for beginners,” or “help me fix my credit.”

- Use Google Keyword Planner or low-competition tools like Ubersuggest to refine phrasing: “start a credit repair business,” “credit repair for dummies,” and “credit fix cost.”

Step 3: Legal Setup

- Register your business (LLC recommended).

- Draft service agreements and disclosures.

- Create transparent pricing and privacy policies.

Step 4: Build Trust and Authority

- Host live Q&As about credit myths and repair.

- Publish case studies: before-and-after stories with anonymized credit changes.

- Use testimonials that highlight emotional relief from clients.

Step 5: Launch Smart—Scaled Growth

- Start with personal referrals and small community ads.

- Offer low-fee pilot programs or sliding-scale services.

- As results build, reinvest into paid ads and social media promotion.

How People See Results in 6 weeks

Realistic Timeline of Impact

Why Credit Veto Pro Is the Smart Launchpad for Your Credit Repair Business

If you’re going to start a credit repair business, starting with Credit Veto Pro supercharges your capabilities:

- Automated Dispute Engine: AI-generated dispute letters, automated tracking, and validation.

- Tri-Bureau Monitoring: Constant access to client credit updates for accurate intervention timing.

- White-Label Options: Launch your business under your own branding with backend automation.

- Client Dashboard and Reporting: Real-time transparency builds trust and recurring subscriptions.

Your business can focus on coaching and client acquisition while Credit Veto Pro handles the heavy lifting.

Conclusion: Your Journey Awaits

Launching a credit repair business isn’t just a financial opportunity; it’s a chance to make real change in people’s lives while defining your own destiny. With focused strategy and emotional purpose, you can help clients improve their credit and create a business that thrives in as little as six weeks.

Start now with Credit Veto Pro, your AI-powered partner in dispute automation, monitoring, and scalable client delivery. Together, you can fix credit—and build futures. Book a call with us today to begin your journey not just to financial freedom but real impact.

FAQs About Starting a Credit Repair Business

Q: Is starting a credit repair business legal?

A: Yes, as long as you follow the FCRA and provide proper disclosures. Credit Veto Pro includes compliant documentation tools.

Q: How much should I expert platforms like Credit Veto Pro to discover How Regular People Are Launching $30K/month Credit Repair & Funding Businesses in Just 14 Days Without Prior Experience

Q: Do I need capital to start?

A: Not necessarily; bootstrap tools like Credit Veto Pro remove technology barriers, so you can begin with minimal investment.

Q: How do I attract my first clients?

A: Start with personal networks and local community groups, or offer educational workshops on credit rebuilding.

How a Credit Repair Course Can Improve Your Credit Score and Business Faster

How a Credit Repair Course Can Improve Your Credit Score and Business Faster  How Fast Will a Car Loan Raise My Credit Score? 2026 Real Timeline

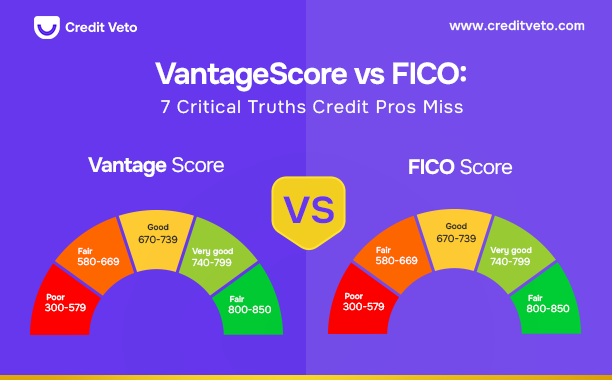

How Fast Will a Car Loan Raise My Credit Score? 2026 Real Timeline  Vantage Score vs FICO: 7 Critical Truths Credit Pros Miss

Vantage Score vs FICO: 7 Critical Truths Credit Pros Miss  What Credit Score Is Needed to Buy a UTV? (Real Limits)

What Credit Score Is Needed to Buy a UTV? (Real Limits)  Does a DUI Affect Your Credit Score? 5 Ways to Protect It

Does a DUI Affect Your Credit Score? 5 Ways to Protect It  How to Remove a Closed Account from Your Credit Report: 3 Best Steps

How to Remove a Closed Account from Your Credit Report: 3 Best Steps  How Long Do Late Payments Stay on Your Credit Report? 2026 Update

How Long Do Late Payments Stay on Your Credit Report? 2026 Update  How Many Credit Cards Should I Have? Avoid These 4 Mistakes

How Many Credit Cards Should I Have? Avoid These 4 Mistakes  How to Check Personal Credit Report: 7 Easy Steps

How to Check Personal Credit Report: 7 Easy Steps