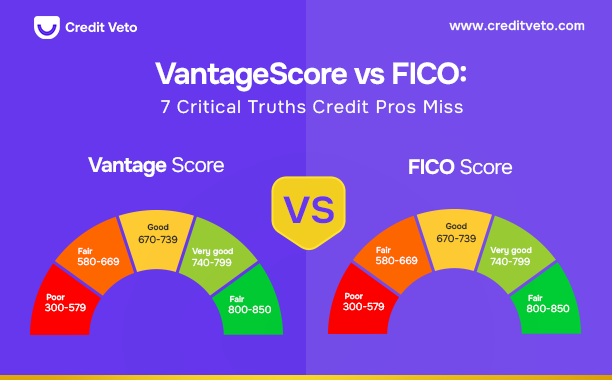

Vantage Score vs FICO: 7 Critical Truths Credit Pros Miss

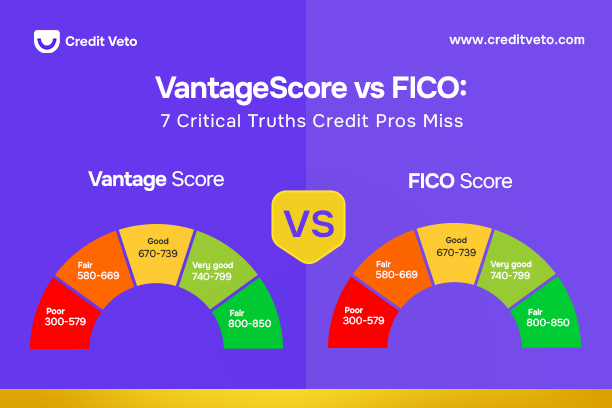

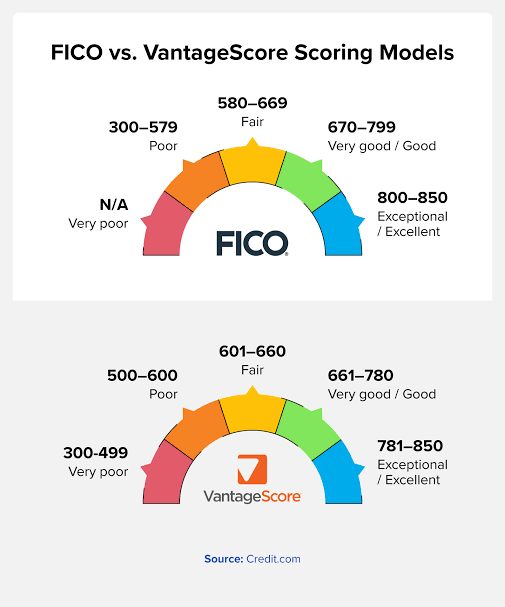

Short Answer: The key difference between vantage score vs FICO is how each model calculates credit risk. FICO is used by about 90 percent of lenders, while Vantage Score is widely used for credit monitoring and by some lenders. Both scores range from 300 to 850, but they weigh credit factors differently. Credit professionals must understand both to guide clients correctly and improve approval outcomes.

A client tells you their credit score IS 708. They are confident. They expect approval. Then the lender pulls their report and declines them. Suddenly, the client is confused. They ask what went wrong. You check again and see the problem. Their Vantage score was 708, but their FICO score was much lower.

This situation happens every day in credit repair. It creates frustration for clients and damages trust if you cannot explain it clearly. Many professionals focus on improving one score without realizing lenders may use another. This is why understanding vantage score vs FICO is critical for anyone helping clients prepare for funding, approvals, or financial growth. These scores look similar, but they are calculated differently, and lenders do not treat them the same.

Once you understand the real difference between vantage score vs FICO, everything changes. You can prepare clients properly. You can prevent surprises. You can help them move from denied to approved with confidence. In this guide, you will learn how both scores work, why lenders rely more on FICO, and how to use this knowledge to improve client outcomes and grow your credit repair business.

Why Understanding Vantage Score vs FICO Matters for Credit Repair Professionals

Many credit repair professionals work hard to improve a client’s credit score, but they often do not check which scoring model lenders are actually using. This creates confusion and missed expectations.

For example, a client may see a 720 Vantage score in a credit app and feel confident about applying for funding. But when the lender pulls their report, the FICO score vs Vantage score comparison tells a different story. Their FICO score may be 660, which falls into a higher risk category. The result is a denial, a lower approval amount, or higher interest rates.

This is why understanding vantage score vs FICO is not just technical knowledge. It directly affects your results as a credit repair professional.

When you clearly understand the difference, you can:

• Predict approval outcomes more accurately

You can review both scores and identify possible approval risks before your client applies. This reduces surprises and improves planning.

• Set correct expectations from the beginning

Clients trust you more when you explain why their Vantage score looks strong but their FICO score still needs improvement.

• Increase funding success rates

When you focus on improving the score lenders actually use, your clients get approved faster and with better terms.

• Build stronger authority and trust

Professionals who understand vantage score 3 vs FICO score 8 differences stand out as true experts, not just dispute processors.

• Improve client retention and conversion rates

Clients stay longer and refer others when your guidance leads to real approvals, not just higher numbers on monitoring apps.

In simple terms, mastering vantage score vs FICO helps you move from fixing credit reports to helping clients achieve real financial outcomes. And that shift is what separates average operators from high-earning credit repair businesses.

What Is a Vantage score

Vantage score is a credit scoring model created jointly by the three major credit bureaus:

• Experian

• Equifax

It was introduced as an alternative to FICO to make credit scoring more accessible and faster, especially for people with limited credit history. When comparing vantage score vs FICO, one of the biggest differences is how quickly a score can be generated.

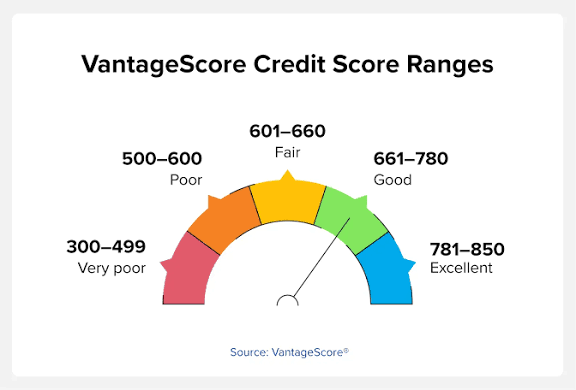

Like FICO, the Vantage score range is 300 to 850, and higher scores indicate lower risk. However, Vantage score can produce a score with as little as one month of credit activity, while FICO usually requires a longer history. This is why many consumers see a Vantage score first when using credit monitoring apps such as Credit Karma or bank dashboards.

Vantage score evaluates several key factors, including:

• Payment history

• Credit utilization

• Account balances

• Total debt levels

• Recent credit behavior and trends

Another key point in the vantage score vs FICO comparison is that Vantage score places strong emphasis on recent activity and trends, not just static balances. This means a client who starts improving their habits may see their Vantage score increase faster than their FICO score.

For credit repair professionals, understanding how Vantage score works is important because it often reflects what clients see themselves as. It shapes their expectations, even though lenders may rely more heavily on FICO for final approval decisions.

Read Also: How to become a credit repair specialist (Even If You’re Starting From Scratch)

What Is a FICO Score

A FICO score is a credit score created by the Fair Isaac Corporation. It is the most widely used scoring model in lending today. When comparing Vantage score vs FICO, the FICO score is the one most lenders rely on to make final approval decisions.

FICO scores are used in major financial products, including:

• Mortgage lending

• Auto loans

• Credit cards

• Personal loans

• Business lending decisions

Like Vantage score, the FICO score also ranges from 300 to 850, and higher scores mean lower risk to lenders. However, FICO has been in use longer and is trusted because of its proven track record in predicting repayment behavior.

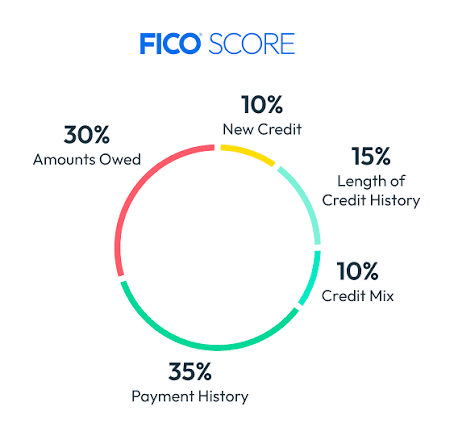

FICO calculates scores using five main factors:

• Payment history 35 percent

• Credit utilization 30 percent

• Length of credit history 15 percent

• Credit mix 10 percent

• New credit inquiries 10 percent

The biggest driver is payment history. This means late payments, collections, and charge-offs can lower the score quickly. On the positive side, consistent on-time payments can steadily increase it.

Another key difference in the Vantage score vs FICO comparison is that FICO places strong value on long-term credit behavior. Older accounts help build trust with lenders and improve the score over time.

For credit repair professionals, this matters because a client may see a strong Vantage score but still get denied if their FICO score tells a different story. Understanding this difference helps you guide clients correctly and improve approval outcomes.

See Also: 6 Best Steps to Remove Paid Collections from Your Credit Report

Vantage score vs FICO: 7 Critical Truths Credit Professionals Miss

Most clients and even some credit repair professionals assume a credit score is just a single number. This is where mistakes happen. The reality is that Vantage score vs FICO is not just a technical difference. It directly affects approvals, funding timelines, and client expectations.

When you understand how both scoring models work, you can predict outcomes more accurately, guide clients better, and position yourself as a trusted authority. Here are the seven truths that matter most.

1. Most Lenders Still Use FICO

This is the most important truth.

According to FICO, over 90 percent of top lenders use FICO scores in lending decisions.

This includes:

• Mortgage lenders

• Major banks

• Auto lenders

Vantage score is less commonly used for final approvals.

What this means for your business:

Your client’s FICO score carries more weight than their Vantage score in most funding decisions. If you focus only on Vantage score, you may misjudge approval readiness.

2. Clients Often Monitor the Wrong Score

Most consumer credit apps show Vantage score, not FICO.

This includes:

• Credit Karma

• Credit Sesame

• NerdWallet credit monitoring

Many clients believe this is the exact score lenders see. Often, it is not.

This creates confusion, false expectations, and approval surprises.

This is also why platforms like Credit Veto are important. Credit Veto helps professionals and clients go beyond basic credit monitoring by reviewing the full credit profile, identifying approval risks, and helping determine true funding readiness, not just the visible score.

Credit professionals who clearly explain vantage score vs FICO build stronger trust and close more clients.

3. Vantage score Reacts Faster to Changes

Vantage score updates faster when:

• Balances decrease

• Collections are paid

• Credit utilization improves

FICO may take longer to reflect these changes.

This means Vantage score often shows progress sooner.

However, FICO remains the score most lenders use when making final decisions. Vantage score shows progress. FICO confirms approval readiness.

4. FICO Is More Sensitive to Negative History

Late payments and collections affect FICO scores more strongly. Even one late payment can cause a noticeable drop.

Vantage score may be slightly more forgiving in comparison. This explains why clients sometimes see a high Vantage score but a lower FICO score.

Understanding this difference helps prevent approval surprises.

5. Credit Age Impacts FICO More

FICO gives strong importance to credit age.

Older accounts help increase FICO scores.

Closing accounts can reduce FICO scores.

Vantage score is less sensitive to account age.

This is critical when advising clients on which accounts to keep open.

Incorrect advice can unintentionally reduce approval chances.

6. Different Versions Are Used by Different Lenders

There is no single FICO score.

Common versions include:

• FICO Score 8

• FICO Score 9

• Mortgage-specific FICO scores

Vantage score also has versions such as:

• Vantage score 3.0

• Vantage score 4.0

Each version may produce slightly different numbers.

This is why understanding the vantage score vs FICO helps professionals explain score differences clearly.

7. Approval Decisions Go Beyond the Score

This is one of the biggest mistakes many professionals miss.

Lenders do not approve based on score alone.

They also evaluate:

• Payment history

• Collections

• Credit utilization

• Account stability

• Debt levels

Two clients with the same score can receive different decisions.

This is why full credit profile analysis matters.

This is also where Credit Veto helps professionals identify approval readiness, organize credit data, and guide clients toward stronger funding outcomes with more clarity and structure.

Which Score Should Credit Repair Professionals Focus On?

Credit repair professionals should prioritize the FICO score while using Vantage score as a progress indicator. FICO is still the score most lenders use to approve or deny applications.

Understanding this part of vantage score vs FICO can completely change how you guide clients.

Many clients come to you feeling confident because their Vantage score looks good. They see a 700 or higher in their credit app and expect approvals. Then they get denied. This damages trust and creates frustration.

This happens because the lender is looking at FICO, not Vantage score.

Here is how to approach it correctly:

1. Use Vantage score to Track Early Progress

Vantage score updates faster when:

• Credit card balances decrease

• Negative accounts are resolved

• Utilization improves

This makes it useful for showing clients early improvement.

It helps maintain motivation.

It shows that your work is moving in the right direction.

But it should not be used to predict approvals.

2. Use FICO to Measure Approval Readiness

FICO is the score most lenders use when making decisions.

This includes:

• Auto loans

• Credit cards

• Personal loans

• Mortgages

• Business funding

This makes FICO the real approval score.

Before applying for funding, your client’s FICO profile should be the main focus.

This reduces denials.

It improves approval odds.

It protects your professional credibility.

3. Focus on the Full Credit Profile, Not Just the Score

This is where most credit repair professionals gain a major advantage.

The score alone does not determine approval.

Lenders also look at:

• Recent late payments

• Collections

• Credit utilization

• Account stability

• Total debt

This is why two clients with the same score can have different outcomes.

Credit Veto helps professionals analyze these approval factors in one place. Instead of guessing based on a score, you can see what is helping or hurting approval readiness and guide clients with confidence.

This makes your service more valuable and more predictable.

4. Set Correct Expectations From Day One

When you explain vantage score vs FICO clearly, clients understand the process better.

They stop relying only on credit app scores.

They trust your guidance more.

They stay longer.

They refer others.

Trust increases conversions.

Clarity increases revenue.

When Should Clients Apply Based on FICO vs Vantage score?

Here is a simple rule credit professionals use:

• Rising Vantage score shows improvement

• Strong FICO score shows readiness

This prevents premature applications.

It improves approval success rates.

It protects your client relationships.

When to Focus on Vantage score vs FICO

Focus on Vantage score when:

• Monitoring progress

• Tracking early improvements

Focus on FICO when:

• Preparing for funding

• Applying for credit

• Predicting approval outcomes

Understanding both gives you full control.

Vantage score 3.0 Score vs FICO Score 8

These are the most common models.

Here is how they compare:

| Factor | Vantage score 3.0 | FICO Score 8 |

| Score Range | 300 to 850 | 300 to 850 |

| Used by lenders | Some | Most |

| Reaction speed | Faster | Moderate |

| Credit history requirement | Less | More |

| Approval importance | Moderate | Highest |

For funding success, FICO Score 8 carries more weight.

Why This Difference Matters for Your Credit Repair Business

Understanding Vantage score vs FICO helps you:

Improve Client Results

You guide clients using the score lenders actually use. This increases approval success.

Increase Client Retention

Clients trust professionals who explain why approvals succeed or fail. Trust leads to referrals.

Increase Revenue Per Client

When approvals improve, clients move faster into funding. This increases your business income.

How CreditVeto Helps Credit Professionals Use Both Scores Correctly

Many credit repair businesses rely on guesswork.

This leads to:

• Failed funding applications

• Lost clients

• Lower revenue

CreditVeto helps by giving professionals:

Clear Credit Profile Analysis

Understand what lenders see.

Not just the score number.

Structured Client Tracking

Track credit progress and funding readiness.

Identify Approval Barriers Early

Know what needs fixing before applying.

This improves approval success.

Credit professionals who use structured systems increase both approvals and income.

Conclusion

Understanding vantage score vs FICO is no longer optional for credit professionals. It directly affects approval outcomes, client satisfaction, and business growth.

Credit specialists who rely on only one score often misguide clients. Those who understand both models guide clients correctly and increase approvals.

Credit Veto helps credit professionals move beyond guesswork by providing structure, clarity, and tools to manage credit profiles more effectively.

If you want to improve client approvals, increase trust, and grow your credit repair business, Credit Veto gives you the system to make that happen. Sign up to get started and be ten steps ahead of your competitors.

FAQs About VantageScore vs FICO

Is VantageScore higher than FICO?

Often yes. VantageScore may show higher numbers, but lenders still rely mainly on FICO.

Which score do lenders use more?

FICO is used by the majority of lenders.

Can you improve both scores at the same time?

Yes. Improving payment history and lowering balances helps both and with structured credit monitoring platforms like Credit Veto, it becomes even more easier.

Why are my VantageScore and FICO different?

They use different formulas and scoring methods.

How Fast Will a Car Loan Raise My Credit Score? 2026 Real Timeline

How Fast Will a Car Loan Raise My Credit Score? 2026 Real Timeline  What Credit Score Is Needed to Buy a UTV? (Real Limits)

What Credit Score Is Needed to Buy a UTV? (Real Limits)  Does a DUI Affect Your Credit Score? 5 Ways to Protect It

Does a DUI Affect Your Credit Score? 5 Ways to Protect It  How to Remove a Closed Account from Your Credit Report: 3 Best Steps

How to Remove a Closed Account from Your Credit Report: 3 Best Steps  650 Credit Score: Good or Bad? The Honest Answer

650 Credit Score: Good or Bad? The Honest Answer  How Midland Credit Management Can Affect Your Credit Score

How Midland Credit Management Can Affect Your Credit Score  Vantage Score vs FICO: 7 Critical Truths Credit Pros Miss

Vantage Score vs FICO: 7 Critical Truths Credit Pros Miss  How to Read a Business Credit Report: 5 Key Tips for Success

How to Read a Business Credit Report: 5 Key Tips for Success  How to Read a TransUnion Credit Report (Your Complete Guide)

How to Read a TransUnion Credit Report (Your Complete Guide)